- Sweden

- /

- Aerospace & Defense

- /

- OM:SAAB B

Can Saab (OM:SAAB B) Leverage New Defense Partnerships to Reinforce Its Global Competitive Edge?

Reviewed by Sasha Jovanovic

- In recent developments, Saab secured a major SEK550 million order for its Giraffe 4A radar from a Latin American client, entered discussions with BAE Systems and Boeing regarding the replacement of Britain's Hawk trainer aircraft, and signed a Memorandum of Understanding with Poland's PGZ Group to support defense modernization efforts. These actions reflect Saab's expanding footprint in global defense markets and its growing role as a collaborator in significant military programs.

- These moves underscore Saab's ability to align with evolving global defense priorities and strengthen its positioning in international markets benefiting from increased defense spending.

- We'll explore how Saab's SEK550 million radar contract and deepening international partnerships could shift its investment narrative outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Saab Investment Narrative Recap

Investing in Saab centers on the belief that global defense spending will continue to rise, creating lasting demand for advanced military solutions and international partnerships. The recent appointment of Saab’s Nomination Committee does not materially alter the near-term outlook or affect the top catalyst, capturing large international defense contracts, nor does it lessen the most pressing risk: dependence on government spending cycles and export regulations.

Among Saab’s recent news, the SEK550 million Giraffe 4A radar order from a Latin American client directly supports the company’s catalysts for growth. Winning export contracts like this not only adds to the current backlog but supports Saab’s efforts to diversify revenue beyond its home market, reducing potential vulnerability to political risks in Sweden and Europe.

However, against the strength of international orders, investors should be aware that tightening global export regulations could still...

Read the full narrative on Saab (it's free!)

Saab's narrative projects SEK112.3 billion in revenue and SEK9.8 billion in earnings by 2028. This requires 17.1% yearly revenue growth and a SEK4.6 billion earnings increase from SEK5.2 billion today.

Uncover how Saab's forecasts yield a SEK473.00 fair value, a 12% downside to its current price.

Exploring Other Perspectives

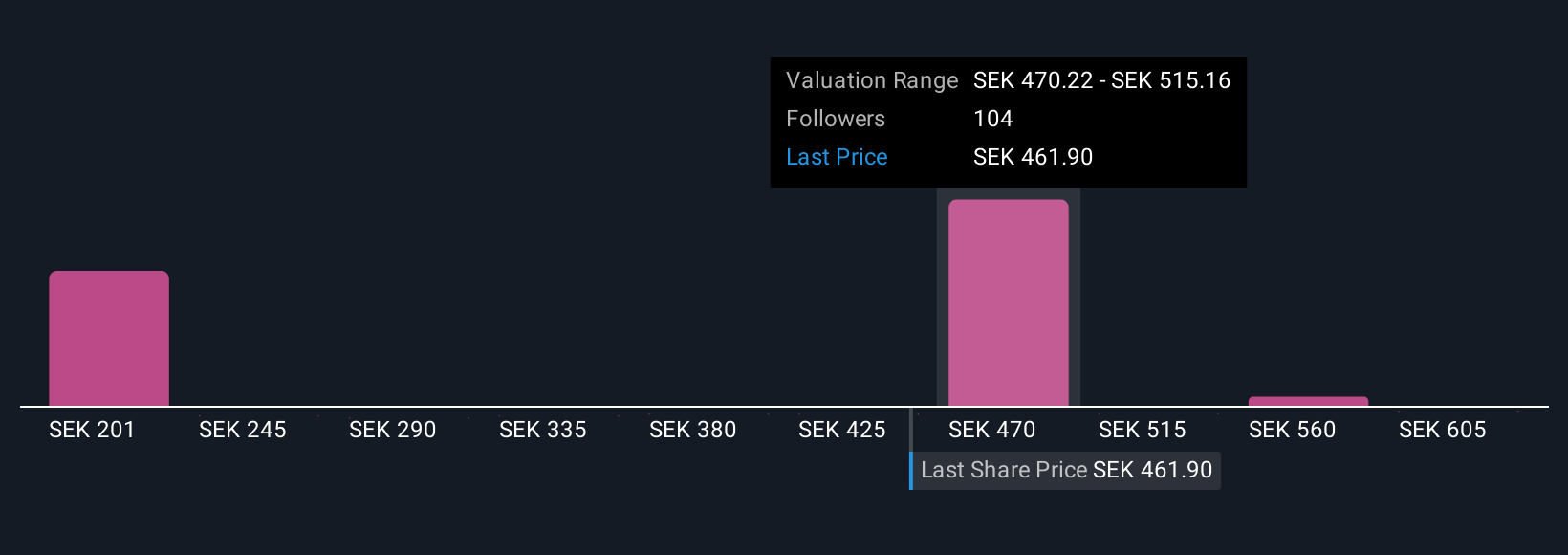

Fifteen members of the Simply Wall St Community estimate Saab’s fair value between SEK202 and SEK641 per share, showing both low and high conviction. With international contracts driving revenue growth, consider how this broad range reflects different expectations for Saab’s global market access.

Explore 15 other fair value estimates on Saab - why the stock might be worth less than half the current price!

Build Your Own Saab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Saab research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Saab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Saab's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAAB B

Saab

Provides products, services, and solutions for military defense, aviation, and civil security markets Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives