- Sweden

- /

- Electrical

- /

- OM:PCELL

The Price Is Right For PowerCell Sweden AB (publ) (STO:PCELL) Even After Diving 25%

PowerCell Sweden AB (publ) (STO:PCELL) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 8.0% over that longer period.

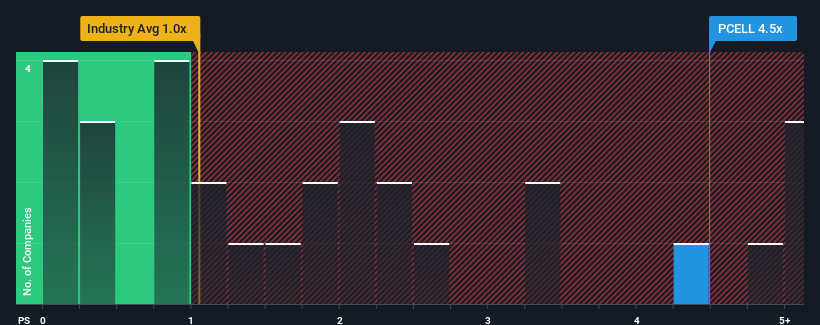

In spite of the heavy fall in price, you could still be forgiven for thinking PowerCell Sweden is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.5x, considering almost half the companies in Sweden's Electrical industry have P/S ratios below 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for PowerCell Sweden

What Does PowerCell Sweden's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, PowerCell Sweden has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PowerCell Sweden.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like PowerCell Sweden's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.7% last year. The latest three year period has also seen an excellent 109% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 26% per year during the coming three years according to the five analysts following the company. With the industry only predicted to deliver 12% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that PowerCell Sweden's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

PowerCell Sweden's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that PowerCell Sweden maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for PowerCell Sweden with six simple checks.

If these risks are making you reconsider your opinion on PowerCell Sweden, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PCELL

PowerCell Sweden

Develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives