- Sweden

- /

- Electrical

- /

- OM:PCELL

Market Participants Recognise PowerCell Sweden AB (publ)'s (STO:PCELL) Revenues Pushing Shares 32% Higher

PowerCell Sweden AB (publ) (STO:PCELL) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

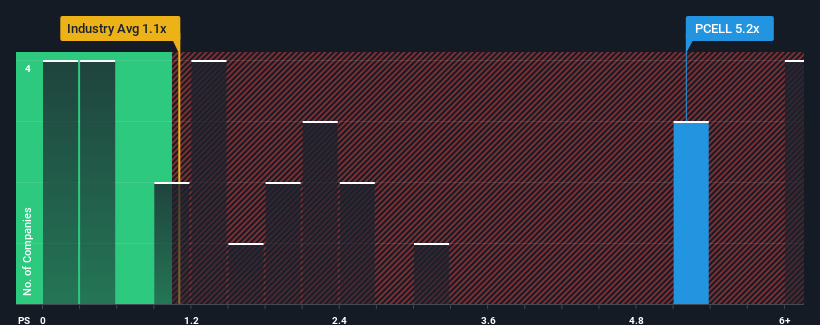

Following the firm bounce in price, you could be forgiven for thinking PowerCell Sweden is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.2x, considering almost half the companies in Sweden's Electrical industry have P/S ratios below 1.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for PowerCell Sweden

How PowerCell Sweden Has Been Performing

PowerCell Sweden certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PowerCell Sweden.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like PowerCell Sweden's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 17% last year. The latest three year period has also seen an excellent 180% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 26% per year over the next three years. With the industry only predicted to deliver 20% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that PowerCell Sweden's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On PowerCell Sweden's P/S

PowerCell Sweden's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into PowerCell Sweden shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for PowerCell Sweden that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PCELL

PowerCell Sweden

Develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives