- Sweden

- /

- Industrials

- /

- OM:NOLA B

Nolato (OM:NOLA B) Earnings Surge 38% Reinforces Positive Growth Narratives

Reviewed by Simply Wall St

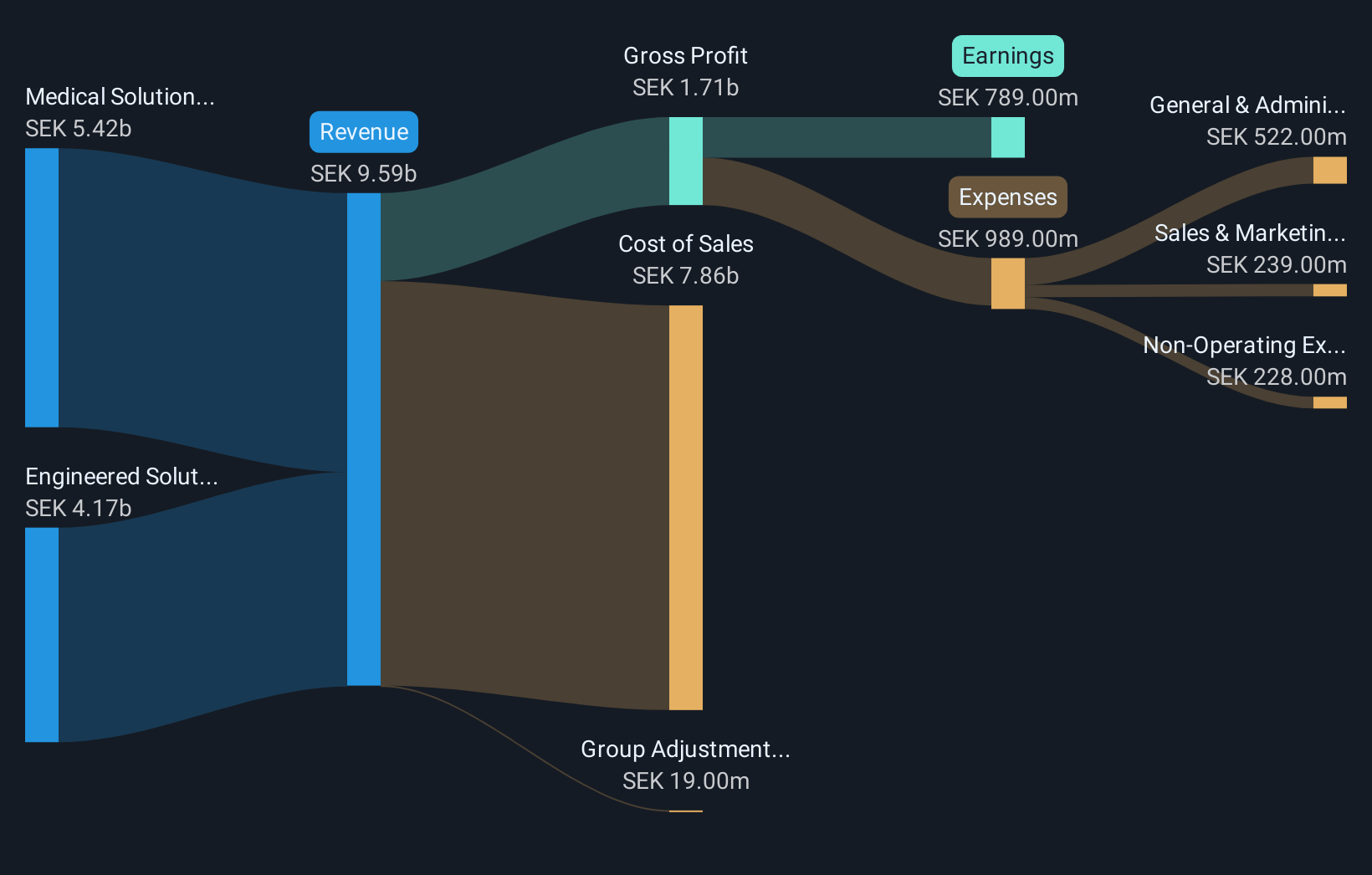

Nolato (OM:NOLA B) delivered a standout year, with earnings surging 38.4% and net profit margins climbing to 8.2% from last year's 6.0%. Looking ahead, the company forecasts annual earnings growth of 12.75% and revenue gains of 5.9% per year. Both figures outpace the Swedish market average of 3.8%. The combination of improved profitability and strong growth projections provides a notably positive backdrop for investors this quarter.

See our full analysis for Nolato.Next, we will see how these headline numbers compare with the most widely followed narratives about Nolato and what they might mean for investors going forward.

See what the community is saying about Nolato

DCF Fair Value Stands Out at SEK106.54

- Nolato's share price of SEK62.35 is trading at a 41% discount to its DCF fair value of SEK106.54. Its Price-To-Earnings ratio is 21.3x compared to the peer average of 41.3x and industry average of 23.2x.

- Analysts' consensus view highlights that the current valuation appeals to investors seeking upside, given improving margins alongside solid growth rates.

- Consensus narrative notes that a 5.5% annual revenue growth and rising profit margins to 9.4% by 2028 support the case for Nolato trading closer to its fair value.

- However, the analyst price target of SEK67.33 is far lower than fair value, suggesting some analysts remain cautious on achieving all forecasted improvements.

Profit Margins Climb Amid Medical and Electronics Growth

- Net profit margins have increased to 8.2%, up from 6.0% last year, reflecting the impact of higher-margin medical and electronics divisions and ongoing investments in automation and cost-outs.

- Analysts' consensus view credits expanding medical and electronics markets, capacity growth in Asian facilities, and efficiency gains as driving this margin strength.

- Accelerating healthcare demand, sustainable materials offerings, and global site expansions are expected to bolster both revenue and operating margins over the coming years.

- Consensus narrative also contends that these factors provide the foundation for stronger earnings quality, with sequential margin improvement anticipated.

High CapEx and Flat Sales Growth Pose Risks

- While profit margins and earnings are improving, consensus risk points to heavy capital expenditure on new capacity (Hungary, Malaysia, Poland) and the risk that only 4-5% underlying sales growth might not absorb the added costs if demand slows.

- Analysts' consensus view flags that future margin expansion could become harder, with low organic sales growth and overcapacity, especially from the U.S. GW Plastics acquisition, placing pressure on group EBIT margins.

- Bears argue that dependence on a few cyclical markets and risk of underutilized facilities may cap near-term upside, even as headline numbers look strong now.

- Consensus narrative emphasizes the balancing act between investing for growth and protecting margins if end-markets weaken or major contracts are lost.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nolato on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Shape your interpretation into a fresh narrative with just a few clicks: Do it your way

A great starting point for your Nolato research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Nolato's heavy capital spending and reliance on just 4 to 5% underlying sales growth mean future margin expansion could stall if demand softens or facilities are underutilized.

If you want businesses with more consistent sales and profit trends across cycles, find stronger picks through our stable growth stocks screener (2124 results) and sidestep this uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products in Europe, Asia, North America, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives