Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Nolato AB (publ) (STO:NOLA B) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Nolato

What Is Nolato's Net Debt?

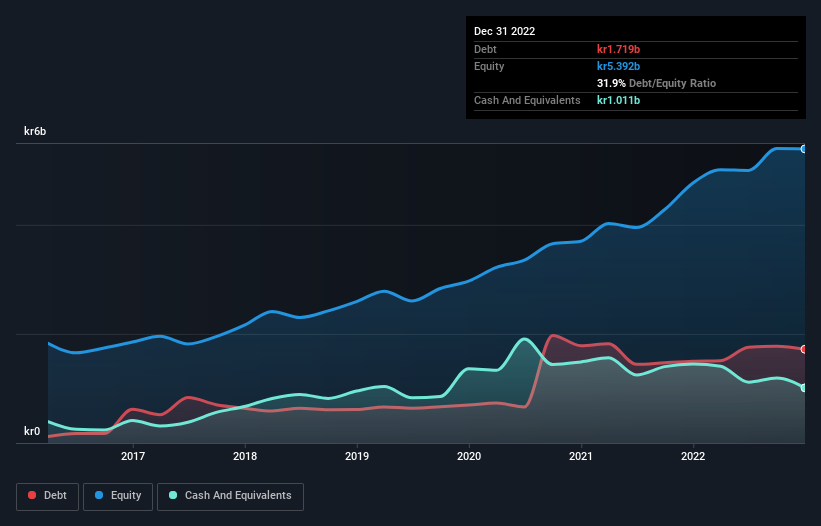

The image below, which you can click on for greater detail, shows that at December 2022 Nolato had debt of kr1.72b, up from kr1.50b in one year. However, it does have kr1.01b in cash offsetting this, leading to net debt of about kr708.0m.

How Healthy Is Nolato's Balance Sheet?

We can see from the most recent balance sheet that Nolato had liabilities of kr2.38b falling due within a year, and liabilities of kr2.24b due beyond that. Offsetting these obligations, it had cash of kr1.01b as well as receivables valued at kr1.52b due within 12 months. So it has liabilities totalling kr2.08b more than its cash and near-term receivables, combined.

Of course, Nolato has a market capitalization of kr13.8b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Nolato's net debt is only 0.50 times its EBITDA. And its EBIT covers its interest expense a whopping 26.3 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The modesty of its debt load may become crucial for Nolato if management cannot prevent a repeat of the 33% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Nolato can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Nolato recorded free cash flow of 37% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Based on what we've seen Nolato is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its interest cover. Looking at all this data makes us feel a little cautious about Nolato's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Nolato you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Nolato might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOLA B

Nolato

Develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products in Europe, Asia, North America, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives