Shareholders Will Probably Not Have Any Issues With Nederman Holding AB (publ)'s (STO:NMAN) CEO Compensation

Key Insights

- Nederman Holding to hold its Annual General Meeting on 26th of April

- Total pay for CEO Sven Kristensson includes kr5.56m salary

- The total compensation is similar to the average for the industry

- Nederman Holding's EPS grew by 46% over the past three years while total shareholder return over the past three years was 18%

Performance at Nederman Holding AB (publ) (STO:NMAN) has been reasonably good and CEO Sven Kristensson has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26th of April. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Nederman Holding

Comparing Nederman Holding AB (publ)'s CEO Compensation With The Industry

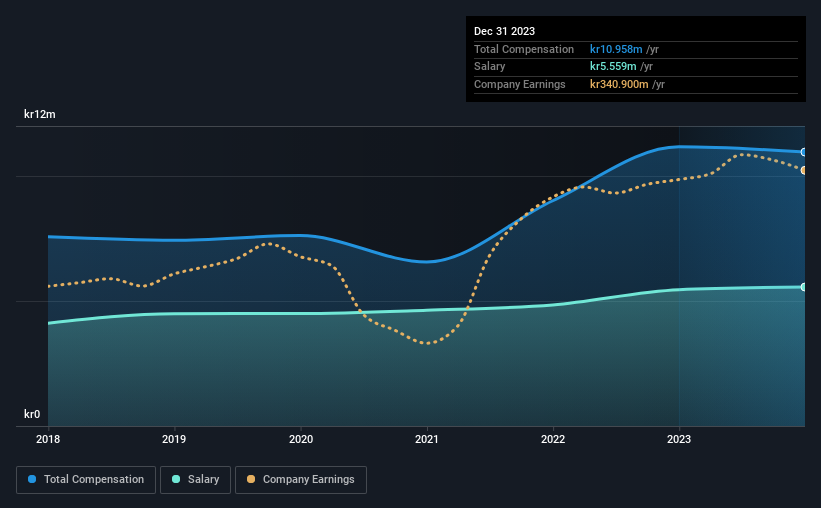

At the time of writing, our data shows that Nederman Holding AB (publ) has a market capitalization of kr6.5b, and reported total annual CEO compensation of kr11m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is kr5.56m, represents a considerable chunk of the total compensation being paid.

On comparing similar companies from the Swedish Building industry with market caps ranging from kr2.2b to kr8.7b, we found that the median CEO total compensation was kr11m. This suggests that Nederman Holding remunerates its CEO largely in line with the industry average. What's more, Sven Kristensson holds kr62m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr5.6m | kr5.5m | 51% |

| Other | kr5.4m | kr5.7m | 49% |

| Total Compensation | kr11m | kr11m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. Although there is a difference in how total compensation is set, Nederman Holding more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Nederman Holding AB (publ)'s Growth Numbers

Nederman Holding AB (publ) has seen its earnings per share (EPS) increase by 46% a year over the past three years. In the last year, its revenue is up 19%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Nederman Holding AB (publ) Been A Good Investment?

Nederman Holding AB (publ) has generated a total shareholder return of 18% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for Nederman Holding that investors should be aware of in a dynamic business environment.

Switching gears from Nederman Holding, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Nederman Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NMAN

Excellent balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026