European Stocks Estimated To Be Trading Below Their Intrinsic Value In April 2025

Reviewed by Simply Wall St

Amid escalating global trade tensions, European markets have experienced volatility, with major indices like the STOXX Europe 600 Index seeing declines as central banks heighten their vigilance. In such an environment, identifying stocks that are potentially trading below their intrinsic value can offer opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Cenergy Holdings (ENXTBR:CENER) | €8.19 | €16.34 | 49.9% |

| Mips (OM:MIPS) | SEK351.00 | SEK686.53 | 48.9% |

| LPP (WSE:LPP) | PLN15785.00 | PLN30693.52 | 48.6% |

| Lindab International (OM:LIAB) | SEK185.90 | SEK370.29 | 49.8% |

| Net Insight (OM:NETI B) | SEK4.61 | SEK9.05 | 49.1% |

| TF Bank (OM:TFBANK) | SEK344.50 | SEK668.98 | 48.5% |

| Schaeffler (XTRA:SHA0) | €3.558 | €7.06 | 49.6% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.59 | €7.00 | 48.7% |

| Komplett (OB:KOMPL) | NOK11.50 | NOK22.68 | 49.3% |

| 3U Holding (XTRA:UUU) | €1.435 | €2.77 | 48.2% |

Let's uncover some gems from our specialized screener.

RENK Group (DB:R3NK)

Overview: RENK Group AG specializes in designing, engineering, producing, testing, and servicing customized drive systems globally and has a market cap of €4.78 billion.

Operations: The company's revenue is derived from three main segments: Slide Bearings (€124.82 million), Marine & Industry (€329.82 million), and Vehicle Mobility Solutions (€699.00 million).

Estimated Discount To Fair Value: 44.4%

RENK Group is trading at €47.81, significantly below its estimated fair value of €85.9, indicating potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to €53.32 million from €32.31 million year-over-year and is expected to see significant annual profit growth over the next three years, outpacing the German market average. However, it carries a high level of debt and has experienced share price volatility recently.

- According our earnings growth report, there's an indication that RENK Group might be ready to expand.

- Dive into the specifics of RENK Group here with our thorough financial health report.

NIBE Industrier (OM:NIBE B)

Overview: NIBE Industrier AB (publ) is a company that develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components across the Nordic countries, Europe, North America, and internationally with a market capitalization of approximately SEK71.53 billion.

Operations: NIBE Industrier's revenue segments include Climate Solutions at SEK26.04 billion, Element at SEK11.09 billion, and Stoves at SEK3.86 billion.

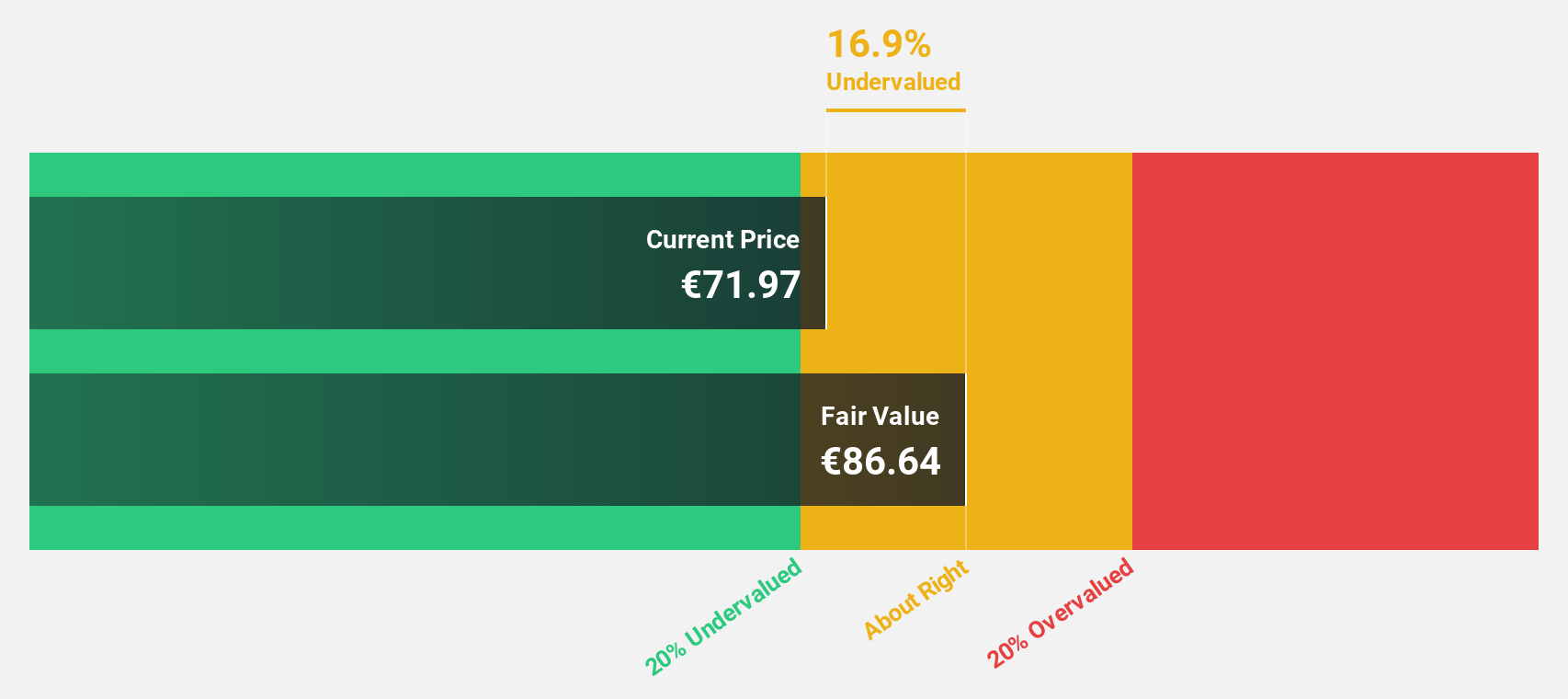

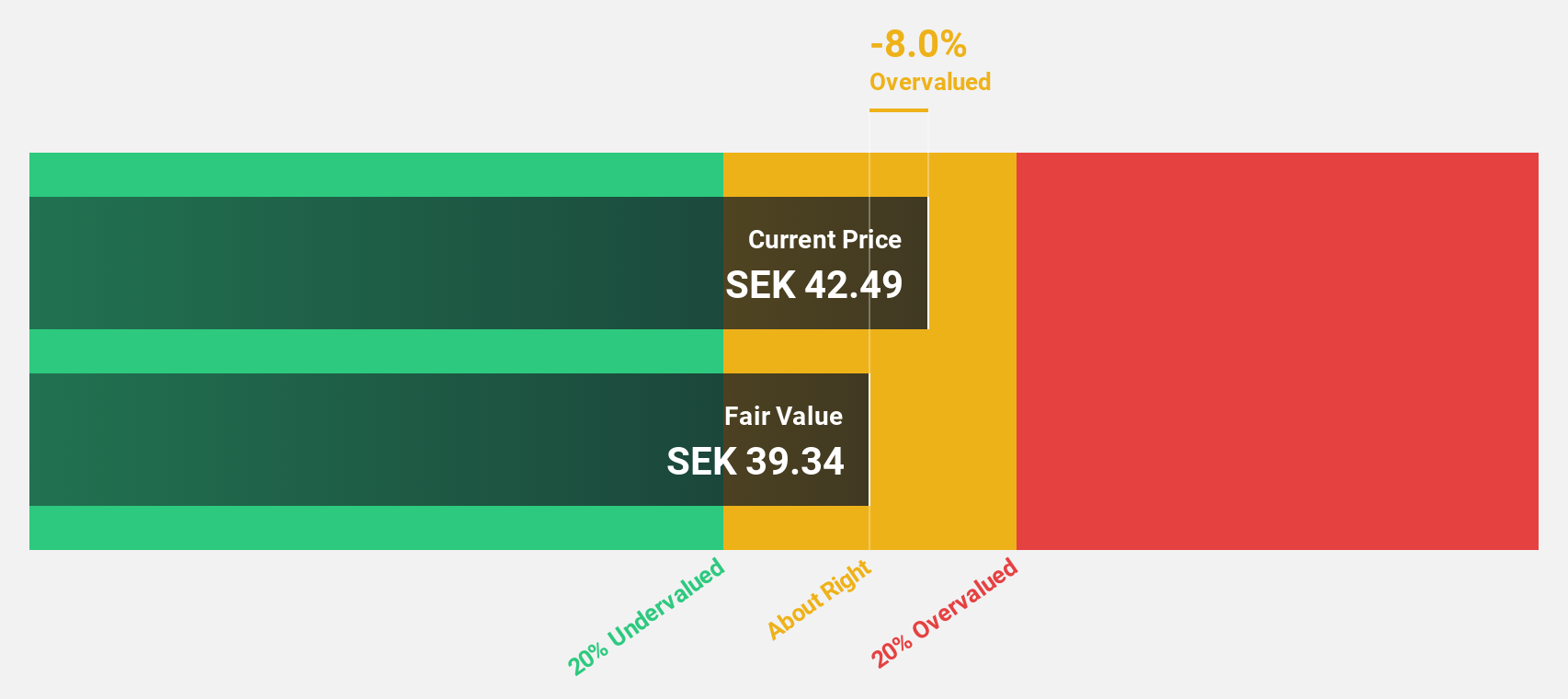

Estimated Discount To Fair Value: 10.6%

NIBE Industrier, trading at SEK 35.48, is slightly undervalued compared to its fair value estimate of SEK 39.7. Despite a drop in net income to SEK 1.17 billion from SEK 4.79 billion year-over-year, earnings are projected to grow significantly at 27.38% annually over the next three years, surpassing the Swedish market average growth rate of 13.4%. However, profit margins have decreased from last year's figures and interest payments remain poorly covered by earnings.

- Our earnings growth report unveils the potential for significant increases in NIBE Industrier's future results.

- Unlock comprehensive insights into our analysis of NIBE Industrier stock in this financial health report.

Knorr-Bremse (XTRA:KBX)

Overview: Knorr-Bremse AG, with a market cap of €12.66 billion, develops, produces, and markets braking and other systems for rail and commercial vehicles globally.

Operations: The company's revenue is primarily derived from its Rail Vehicle Systems segment, generating €4.13 billion, and its Commercial Vehicle Systems segment, contributing €3.91 billion.

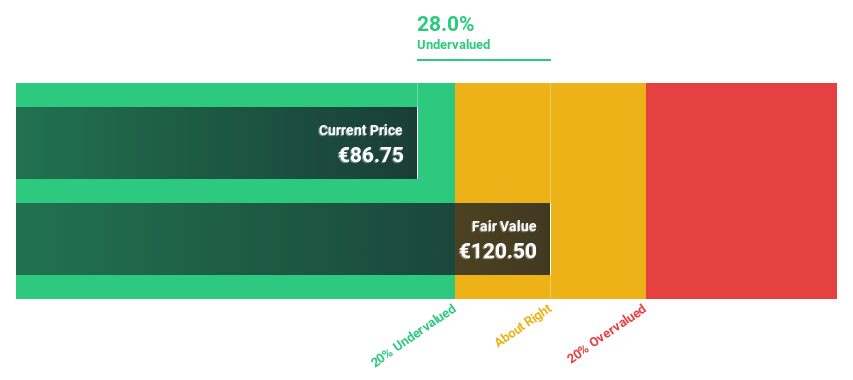

Estimated Discount To Fair Value: 36.4%

Knorr-Bremse, trading at €78.55, is significantly undervalued with a fair value estimate of €123.48. Earnings are forecast to grow at 20.5% annually, outpacing the German market's growth rate of 15.8%. Despite stable revenue projections of €8.1 billion to €8.4 billion for 2025 and an EBIT margin between 12.5% and 13.5%, net income has declined from the previous year, and its dividend track record remains unstable despite recent increases.

- Our expertly prepared growth report on Knorr-Bremse implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Knorr-Bremse.

Summing It All Up

- Reveal the 182 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KBX

Knorr-Bremse

Develops, produces, and markets brake systems for rail and commercial vehicles and other safety-critical systems worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives