- Sweden

- /

- Trade Distributors

- /

- OM:MMGR B

Novabase S.G.P.S And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As European markets navigate the complexities of geopolitical tensions and economic shifts, smaller-cap stocks have shown resilience amid broader market fluctuations. In this environment, identifying potential opportunities requires a keen eye for companies that demonstrate strong fundamentals and adaptability to changing conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Novabase S.G.P.S (DB:NVQ)

Simply Wall St Value Rating: ★★★★★☆

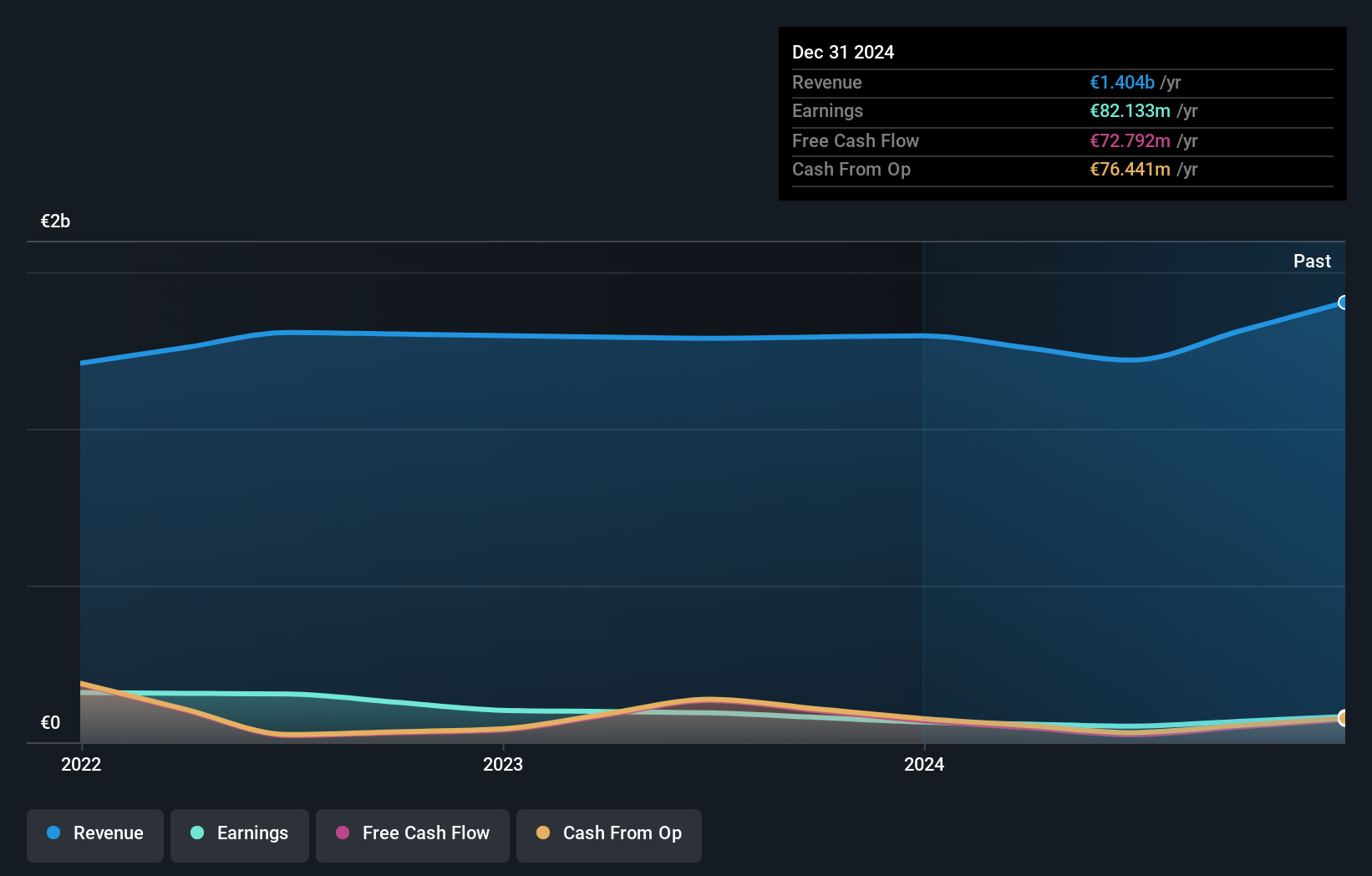

Overview: Novabase S.G.P.S., S.A. operates as an IT consulting and services provider across Portugal, Europe, Africa, the Middle East, and internationally, with a market capitalization of approximately €273.81 million.

Operations: The company's revenue is primarily driven by its Next-Gen segment, contributing €134.13 million, while the Value Portfolio adds €1.29 million.

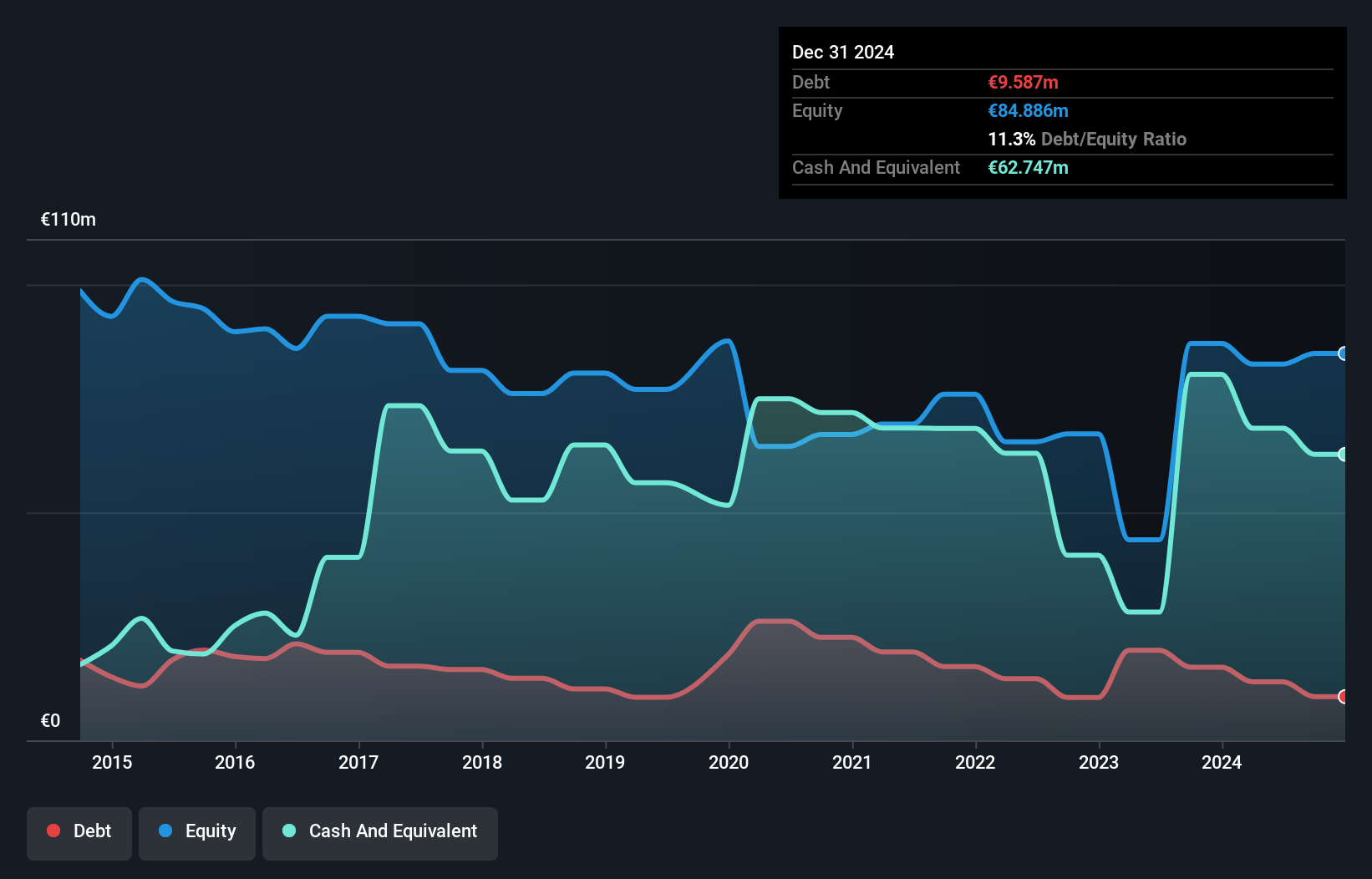

Novabase, a small player in the tech sector, has shown impressive earnings growth of 77.1% over the past year, outpacing the IT industry's -7.7%. Despite this positive trend, its earnings have decreased by 10.6% annually over five years. The company trades at a significant discount of 46.2% below its estimated fair value and has reduced its debt to equity ratio from 21.4% to 11.3% in five years, indicating improved financial health. However, shareholders faced substantial dilution recently and free cash flow is negative, presenting some challenges for investors to consider moving forward.

BASSAC Société anonyme (ENXTPA:BASS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BASSAC Société anonyme is a real estate development company with operations in France, Belgium, Germany, and Spain, and has a market cap of approximately €980.68 million.

Operations: The company generates revenue primarily from real estate development in France (€1.05 billion) and foreign markets (€275.47 million).

With a price-to-earnings ratio of 11.9x, BASSAC Société anonyme offers value below the French market average of 16x. Despite a notable increase in its debt to equity ratio from 58.9% to 79.5% over five years, the company maintains satisfactory net debt levels at 33.8%. Earnings surged by 26.7% last year, outpacing the real estate industry's growth rate of 3.3%, although they have decreased by an average of 6.9% annually over five years. The company's interest payments are well covered with EBIT at a comfortable multiple of 4.8 times interest repayments, highlighting its robust financial health amidst industry challenges.

- Get an in-depth perspective on BASSAC Société anonyme's performance by reading our health report here.

Understand BASSAC Société anonyme's track record by examining our Past report.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★★

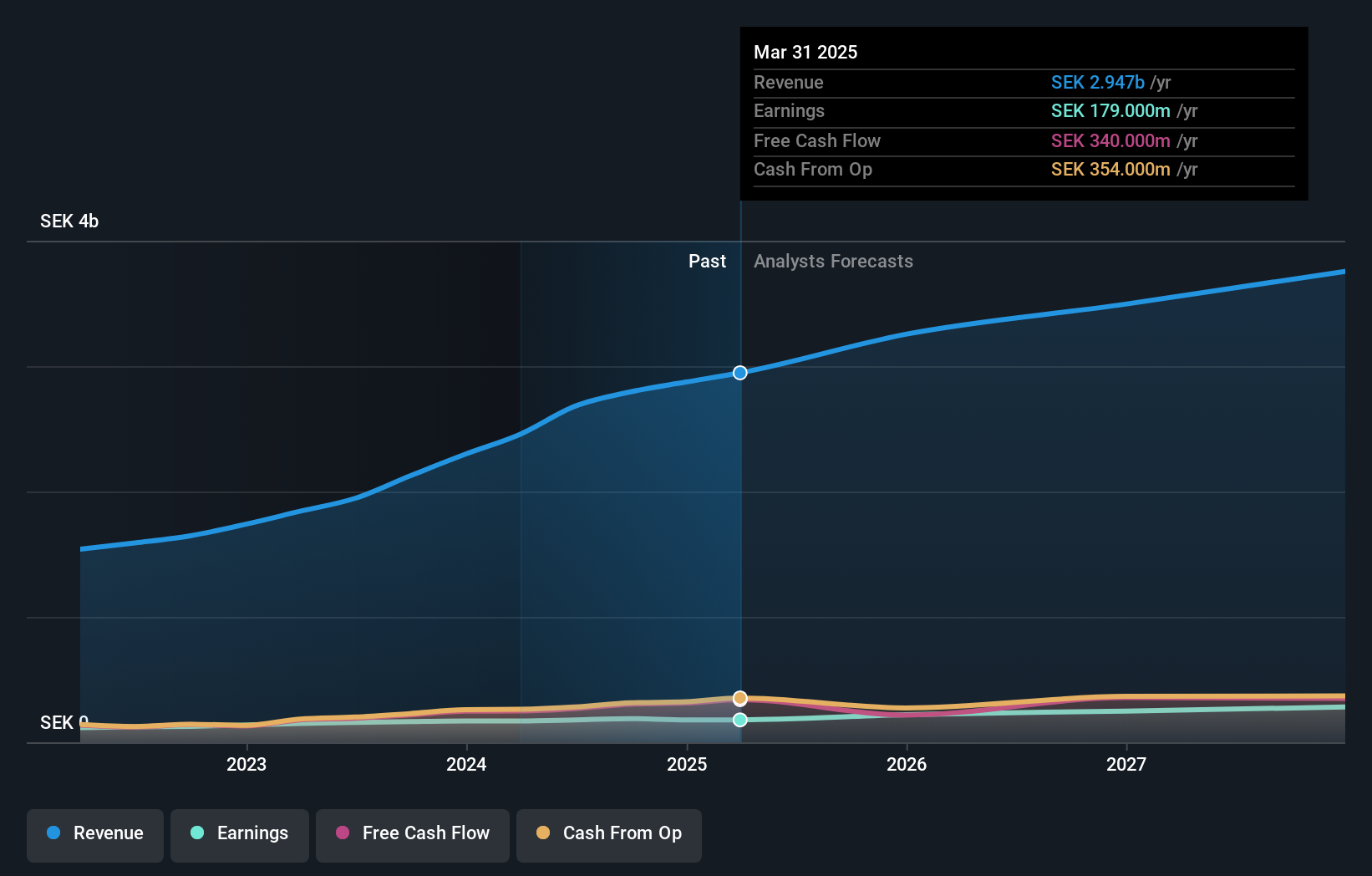

Overview: Momentum Group AB (publ) is a company that provides industrial components and services to the industrial sector, with a market capitalization of approximately SEK8.12 billion.

Operations: Momentum Group AB (publ) generates revenue primarily from its Industry and Infrastructure segments, contributing SEK1.73 billion and SEK1.24 billion respectively. The company's net profit margin shows an interesting trend with fluctuations observed over recent periods, reflecting the varying cost structures and efficiencies within its operational segments.

Momentum Group's recent performance highlights its robust financial health and growth potential. The company reported a net income of SEK 42 million for Q1 2025, slightly up from SEK 41 million the previous year, with sales climbing to SEK 735 million from SEK 661 million. Its debt management is commendable with a net debt to equity ratio of 39.3%, deemed satisfactory, and interest payments well-covered by EBIT at an impressive coverage ratio of 11 times. Additionally, earnings outpaced the industry average with a growth rate of 5.3% last year, signaling strong market positioning in trade distribution.

- Take a closer look at Momentum Group's potential here in our health report.

Gain insights into Momentum Group's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Reveal the 336 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MMGR B

Momentum Group

Supplies industrial components, industrial services, and related services to the industrial sector.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives