- Sweden

- /

- Industrials

- /

- OM:LATO B

Latour (OM:LATO B) Profit Margin Miss Challenges Defensive-Narrative as Dividend Sustainability Questioned

Reviewed by Simply Wall St

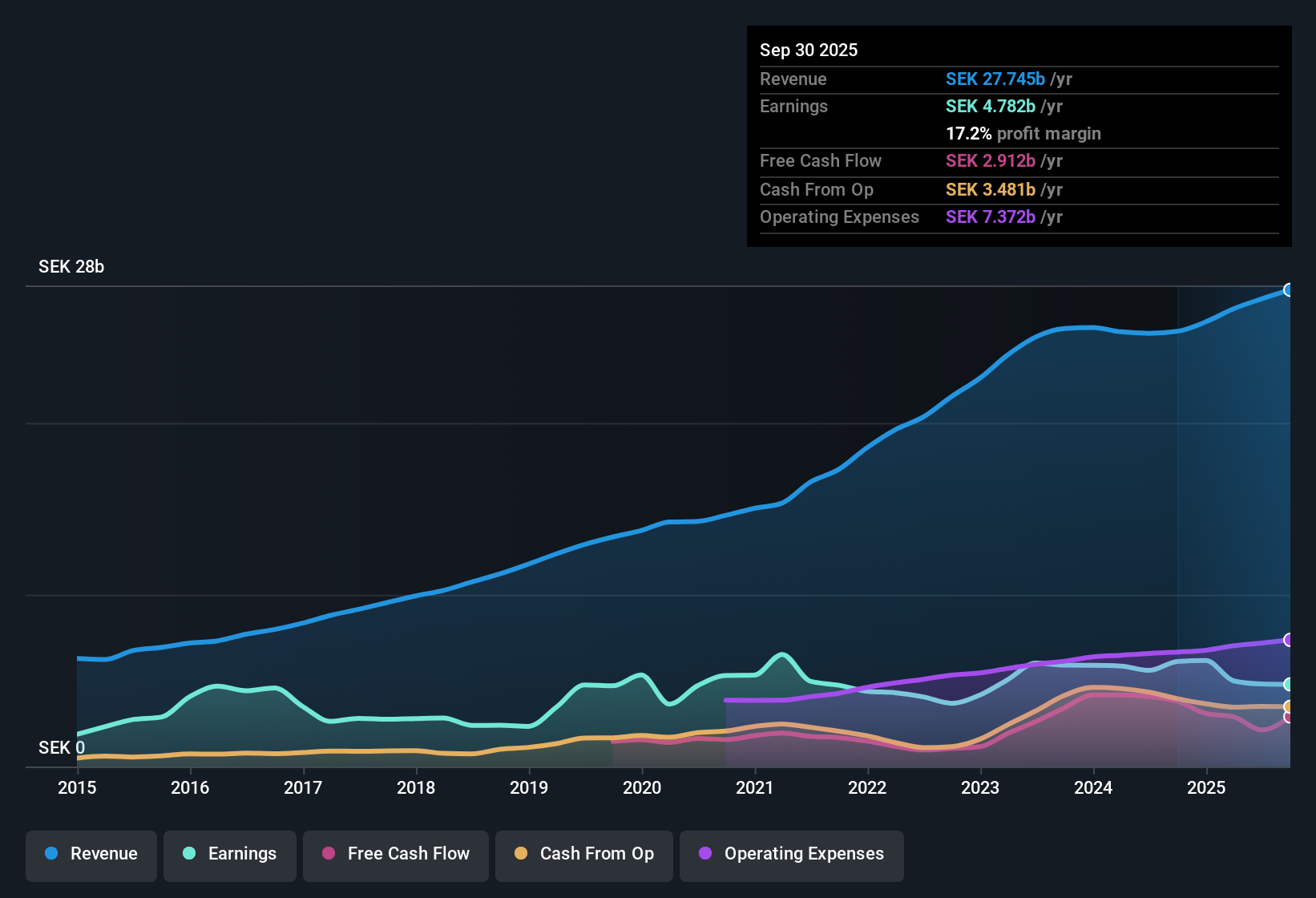

Investment AB Latour (OM:LATO B) reported revenue growth that continues to outpace the Swedish market, with forecasts of 3.94% annual growth compared to the country’s 3.7%. Over the past five years, Latour’s annualized earnings growth sat at 2.6%. While the company maintains high-quality earnings with a net profit margin of 17.7%, this figure is down from last year’s 22.2%. Investors are weighing the sustained trajectory of profit and revenue growth against questions about dividend sustainability, especially as the stock currently trades at SEK225.5, significantly above its SEK128.54 estimated fair value.

See our full analysis for Investment AB Latour.Next, we will set these headline numbers against the prevailing narratives to see where the data backs up market sentiment and where surprises might challenge consensus expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Dip but Remain Above Industry

- Net profit margin stands at 17.7%, still robust despite falling from last year’s 22.2% and ahead of the typical margin seen across the European Industrials sector.

- One of the biggest claims in the prevailing market view is that Latour’s earnings quality allows it to ride out macroeconomic stress. The latest dip in profitability below the prior period makes that stability less certain.

- While management points to sustained high-quality earnings, this sharp margin drop introduces fresh scrutiny on how much of that “defensive” reputation is deserved.

- Investors who prize steady margins may expect Latour to bounce back, but the numbers highlight that even best-in-class operators face compressed profitability when market conditions shift.

Dividend Staying Power Draws Questions

- The most material risk flagged is that dividend sustainability is unconfirmed, leaving income-focused shareholders unsure if past payout levels will continue unchanged.

- Prevailing market commentary describes Latour as a safe haven for long-term income. However, the lack of clarity on dividends puts a spotlight on whether the current profit and cash flow mix can actually support stable distributions.

- Investors relying on dividends are forced to weigh the value of historical stability against the reality that no sustainability confirmation has been given for the payout.

- The evidence challenges the idea that Latour is unconditionally reliable for income, pointing to a risk that could shape sentiment until future payouts are confirmed.

Valuation Premium Looms Over Peers and Fair Value

- Shares are trading at 30x earnings, a clear premium to the broader European Industrials sector average of 21.4x and roughly in line with Swedish peers at 30.5x. The current price (SEK225.5) is also far above the DCF fair value estimate of SEK128.54.

- This situation, where investors pay up for perceived safety and quality, fits the narrative that diversified, defensively postured companies like Latour can command higher-than-average multiples during periods of sector-wide caution.

- The considerable gap between share price and DCF fair value, however, is hard to ignore. Even bullish arguments about portfolio stability must grapple with the risk of mean reversion if sector momentum stalls.

- With the premium valuation stacking up against both local and regional benchmarks, only strong operational resilience will justify this level of investor optimism going forward.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Investment AB Latour's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Latour’s premium valuation, recent profit margin decline, and uncertainty around dividend reliability point to risks compared to stocks with more attractive pricing and stability.

If you’re concerned about paying too much for perceived safety, consider these 840 undervalued stocks based on cash flows to focus on companies trading at more reasonable valuations with stronger upside prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LATO B

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives