- Italy

- /

- Auto Components

- /

- BIT:SGF

3 Undiscovered European Gems To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

In recent weeks, European markets have faced challenges with the pan-European STOXX Europe 600 Index declining by 2.21% amid concerns about inflated AI stock valuations and diminishing expectations for a U.S. interest rate cut. Despite these hurdles, steady business activity growth in the eurozone offers a glimmer of stability for investors seeking opportunities within the region's small-cap stocks. In such an environment, identifying promising companies that demonstrate resilience and potential for growth can be key to enhancing one's investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sogefi (BIT:SGF)

Simply Wall St Value Rating: ★★★★★★

Overview: Sogefi S.p.A. specializes in designing, developing, and producing filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry across Europe, South America, North America, China, and other international markets with a market capitalization of approximately €385.92 million.

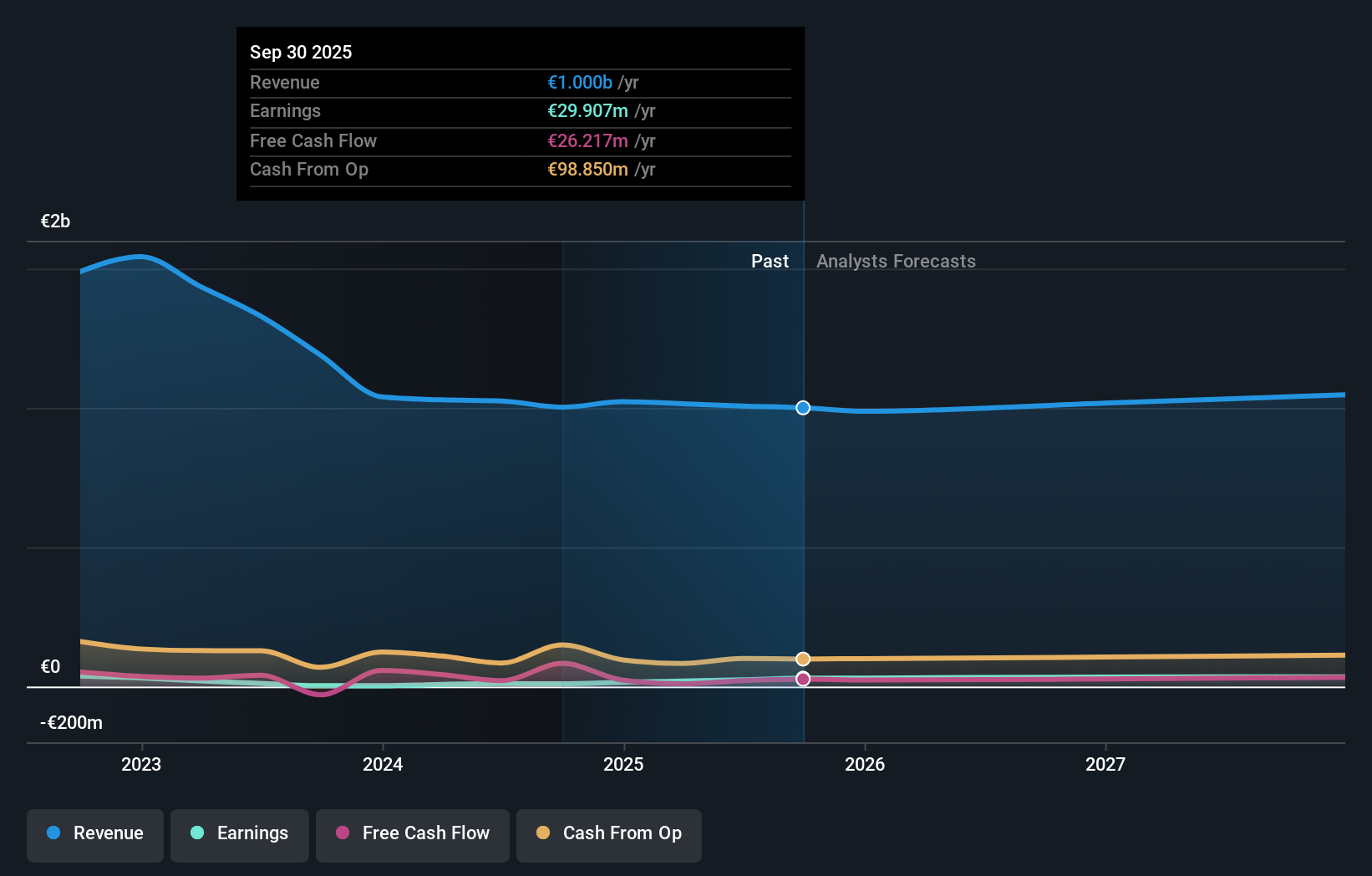

Operations: Sogefi generates revenue primarily from its suspensions segment, contributing €544.91 million, and air and cooling segment with €454.30 million.

Sogefi, a player in the auto components sector, has shown impressive earnings growth of 190.2% over the past year, significantly outpacing the industry average. The company's net debt to equity ratio stands at a satisfactory 7.3%, reflecting prudent financial management. Despite challenges like pricing pressures from OEM customers and rising capital investments, Sogefi's operational restructuring and local production strategy are likely enhancing efficiency and profit margins, which increased from 2.4% to 3.1%. Trading slightly below its fair value estimate by 4.3%, Sogefi appears fairly valued with potential for stable long-term growth despite market uncertainties.

Funkwerk (DB:FEW0)

Simply Wall St Value Rating: ★★★★★☆

Overview: Funkwerk AG is a company specializing in communication, information, and security systems with operations in Germany, the European Union, the European Free Trade Association, and internationally; it has a market capitalization of €254.69 million.

Operations: Funkwerk generates revenue primarily from its communication, information, and security systems across various regions. The company has a market capitalization of €254.69 million.

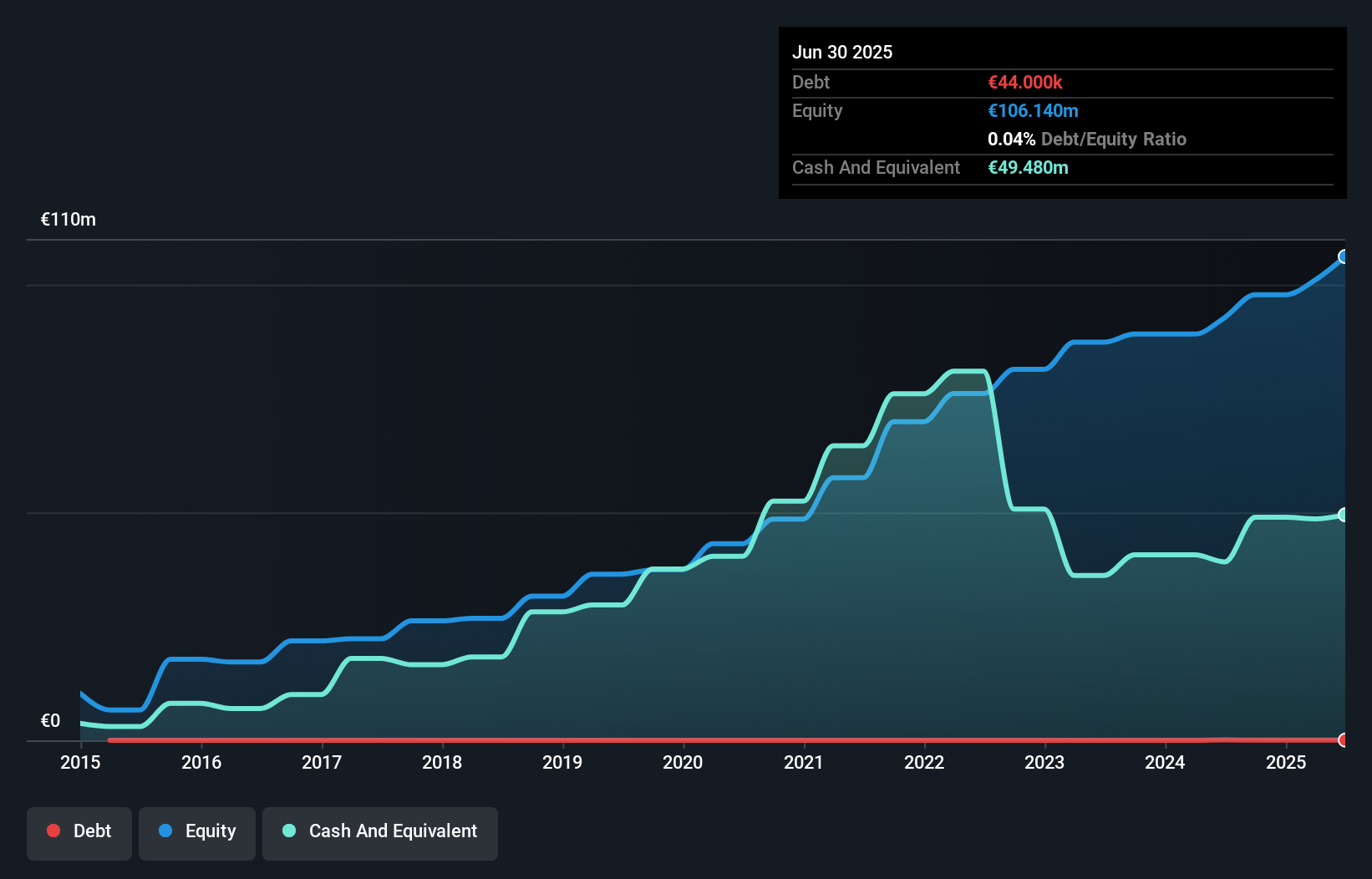

Funkwerk, a nimble player in the European market, has shown impressive earnings growth of 16.9% over the past year, outpacing its industry peers by a significant margin. Its price-to-earnings ratio of 13.8x is attractive compared to the broader German market's 17.7x, indicating potential undervaluation. The company's financial health is bolstered by having more cash than total debt and maintaining positive free cash flow. Funkwerk's debt-to-equity ratio has slightly increased to 0.04% over five years, suggesting prudent financial management while growing its operations efficiently within the communications sector.

- Dive into the specifics of Funkwerk here with our thorough health report.

Review our historical performance report to gain insights into Funkwerk's's past performance.

Karnell Group (OM:KARNEL B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Karnell Group AB (publ) is a private equity firm focused on investments in add-on acquisitions, expansion, and small to medium-sized companies, with a market cap of SEK3.77 billion.

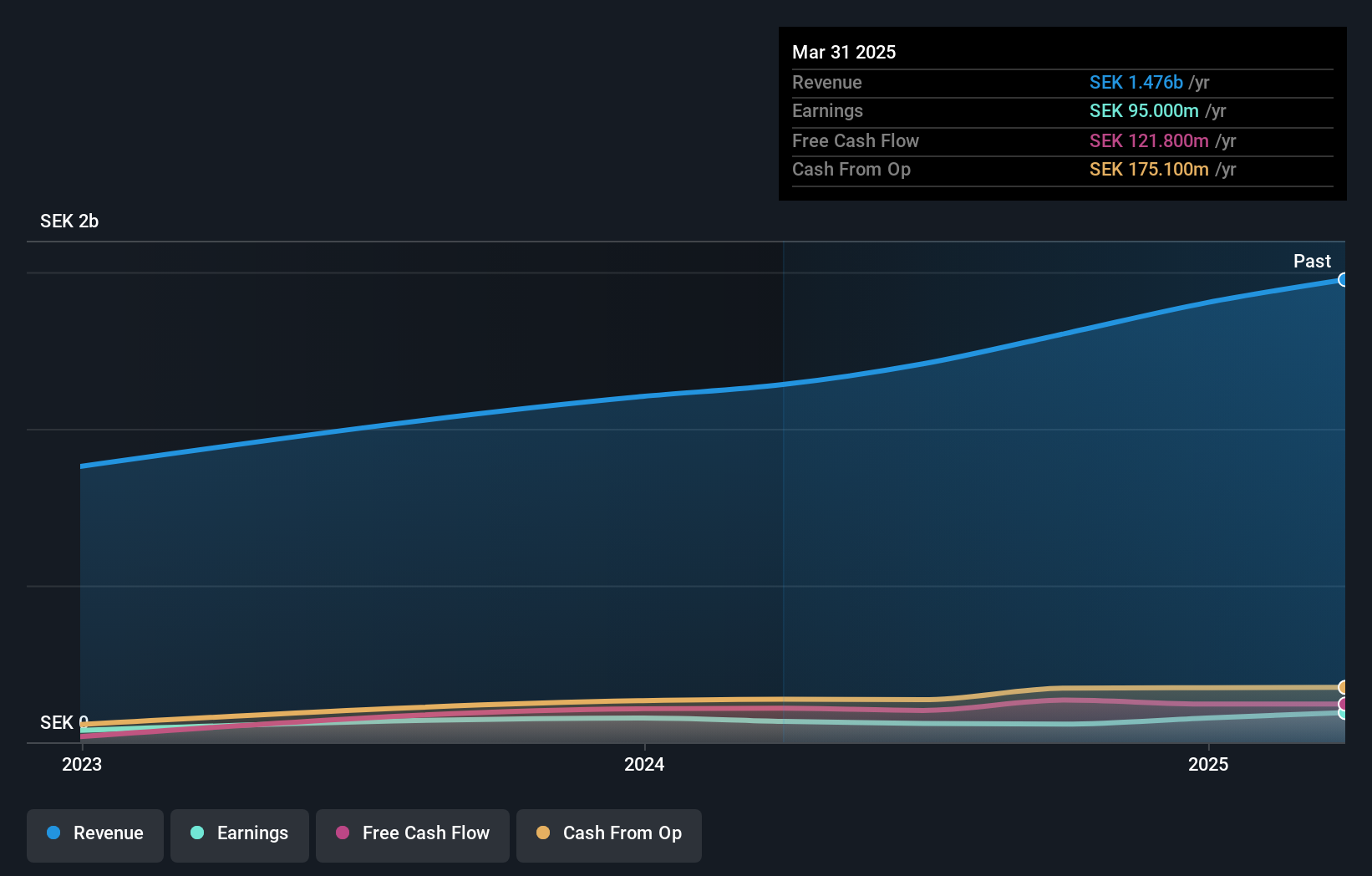

Operations: Karnell Group generates revenue primarily from its Niche Production and Product Companies segments, contributing SEK778.40 million and SEK850.90 million, respectively.

Karnell Group, a promising player in the European industrial sector, has demonstrated impressive financial resilience. With earnings surging by 130% over the past year, Karnell outpaced its industry peers significantly. The company's net debt to equity ratio stands at a satisfactory 33.9%, reflecting prudent financial management. Its interest payments are well-covered by EBIT at 6.8 times, suggesting robust operational efficiency. Recent quarterly results showed sales climbing to SEK 436 million from SEK 357 million year-on-year, while net income reached SEK 46 million compared to SEK 29 million previously. The appointment of Niklas Svensson as CFO signals strategic leadership for continued growth across Northern Europe’s industrial landscape.

- Navigate through the intricacies of Karnell Group with our comprehensive health report here.

Explore historical data to track Karnell Group's performance over time in our Past section.

Taking Advantage

- Access the full spectrum of 313 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SGF

Sogefi

Designs, develops, and produces filtration systems, suspension components, air intake products, and engine cooling systems for the automotive industry in Europe, South America, North America, China, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success