- United Kingdom

- /

- Retail REITs

- /

- LSE:SUPR

Undervalued European Small Caps With Insider Buying In December 2025

Reviewed by Simply Wall St

As European markets continue to rally, with the STOXX Europe 600 Index climbing 2.35% and major indices in Germany, Italy, France, and the UK all posting gains, small-cap stocks are garnering attention for their potential amid a backdrop of subdued inflation and fiscal policy changes. In this context of economic shifts and market enthusiasm, identifying promising small-cap stocks involves looking at factors such as strong financial fundamentals and insider buying activities that may signal confidence in future growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.3x | 0.7x | 44.14% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 33.20% | ★★★★★☆ |

| Senior | 23.9x | 0.8x | 30.09% | ★★★★★☆ |

| Eurocell | 16.2x | 0.3x | 40.75% | ★★★★☆☆ |

| Nyab | 17.6x | 0.7x | 37.88% | ★★★★☆☆ |

| Eastnine | 11.9x | 7.5x | 48.25% | ★★★★☆☆ |

| Fastighets AB Trianon | 9.4x | 4.6x | -56.05% | ★★★★☆☆ |

| Kendrion | 29.6x | 0.7x | 40.24% | ★★★☆☆☆ |

| J D Wetherspoon | 11.1x | 0.4x | -3.55% | ★★★☆☆☆ |

| CVS Group | 46.2x | 1.3x | 26.00% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

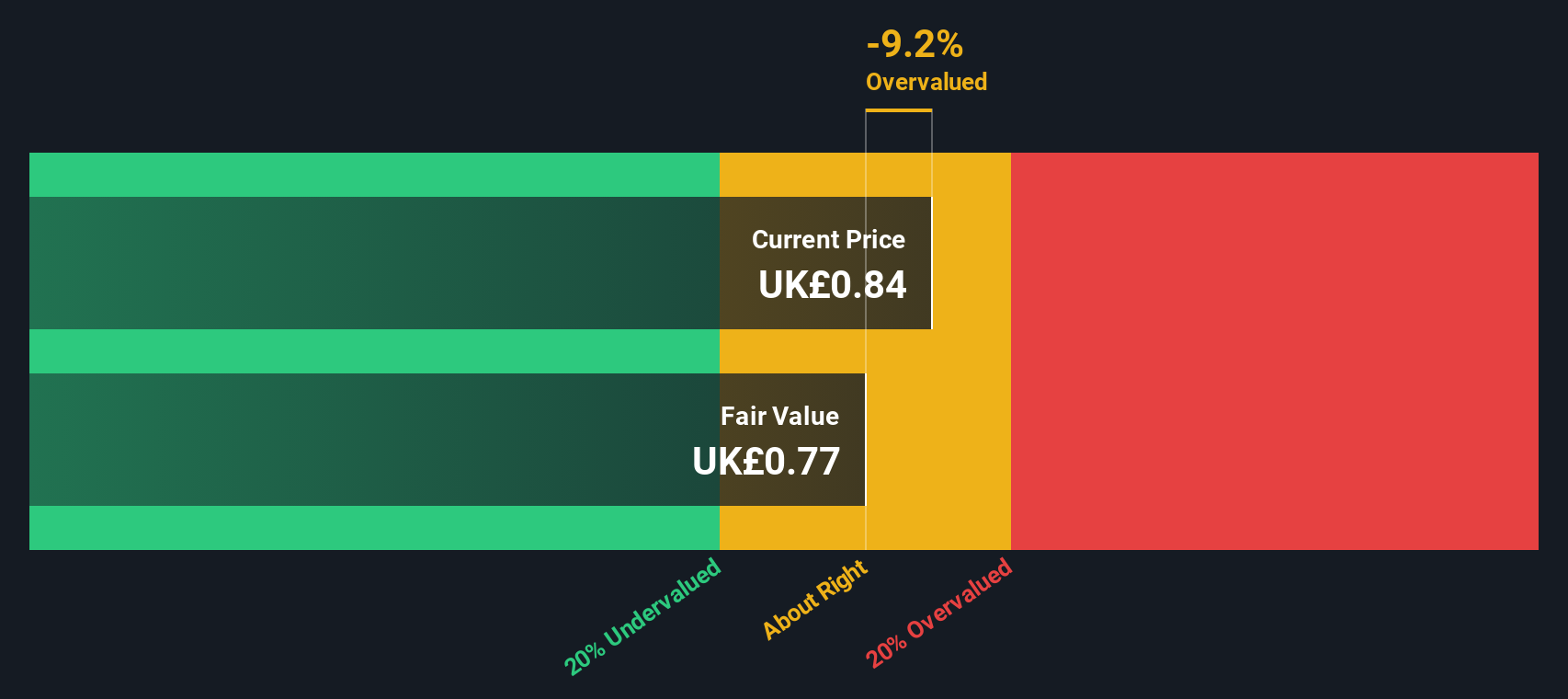

Supermarket Income REIT (LSE:SUPR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Supermarket Income REIT focuses on investing in supermarket property assets and has a market capitalization of approximately £1.06 billion.

Operations: The company's revenue primarily originates from investments in supermarket property assets, with a gross profit margin consistently at 100%. Operating expenses have shown variability, reaching £28.17 million in recent periods. The net income margin has experienced fluctuations, with recent figures indicating a positive trend after previous negative margins.

PE: 16.6x

Supermarket Income REIT, a smaller European stock, is making strategic moves with its joint venture alongside Blue Owl Capital. Recently, they acquired 10 Asda supermarkets for £196 million and plan to transfer five assets into the JV valued at £232 million by December 31. These transactions align with their strategy of capital recycling into high-yield assets. Insider confidence is evident from share purchases this year, while earnings grew to £61.53 million from a prior loss, signaling improved financial health despite debt concerns.

- Click to explore a detailed breakdown of our findings in Supermarket Income REIT's valuation report.

Gain insights into Supermarket Income REIT's past trends and performance with our Past report.

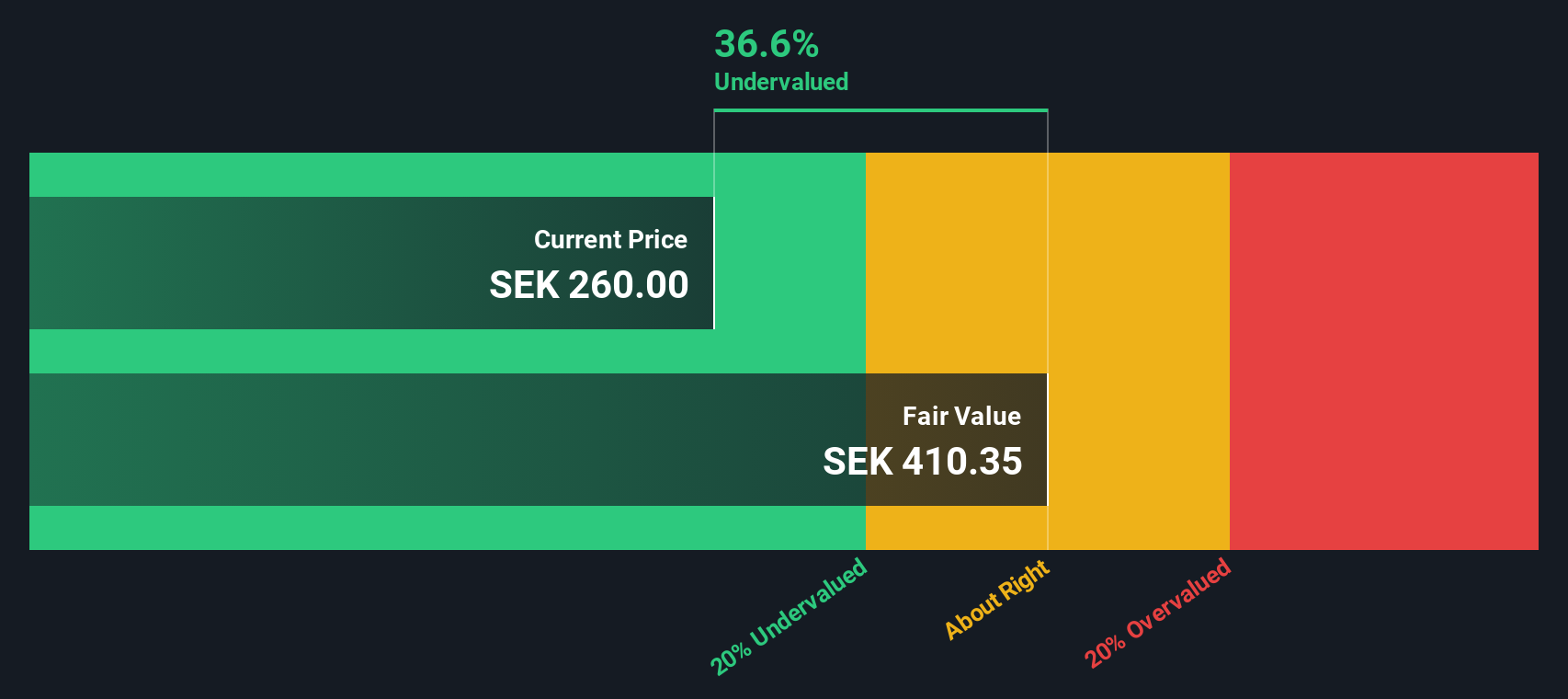

Invisio (OM:IVSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Invisio specializes in advanced communication systems for defense and public safety markets, with a focus on enhancing auditory protection and situational awareness, and has a market cap of approximately SEK 12.34 billion.

Operations: The company's primary revenue stream is from the Aerospace & Defense sector, with recent quarterly revenues reaching SEK 1.65 billion. Gross profit margin has shown variability, peaking at 60.98% in June 2023 before declining to 58.48% by September 2025. Operating expenses are significant, driven largely by sales and marketing as well as R&D expenditures, which have impacted net income margins over time.

PE: 57.3x

Invisio, a company known for its advanced communication solutions, has been attracting attention with insider confidence shown through share purchases over the past year. Despite recent financial challenges, including a Q3 net loss of SEK 4.2 million compared to last year's profit, Invisio's growth potential remains strong with earnings forecasted to grow at 45.92% annually. Recent significant orders from European and US defense sectors underscore demand for their innovative products like the T30 headset and Intercom systems, highlighting their strategic positioning in tactical communications markets.

- Unlock comprehensive insights into our analysis of Invisio stock in this valuation report.

Examine Invisio's past performance report to understand how it has performed in the past.

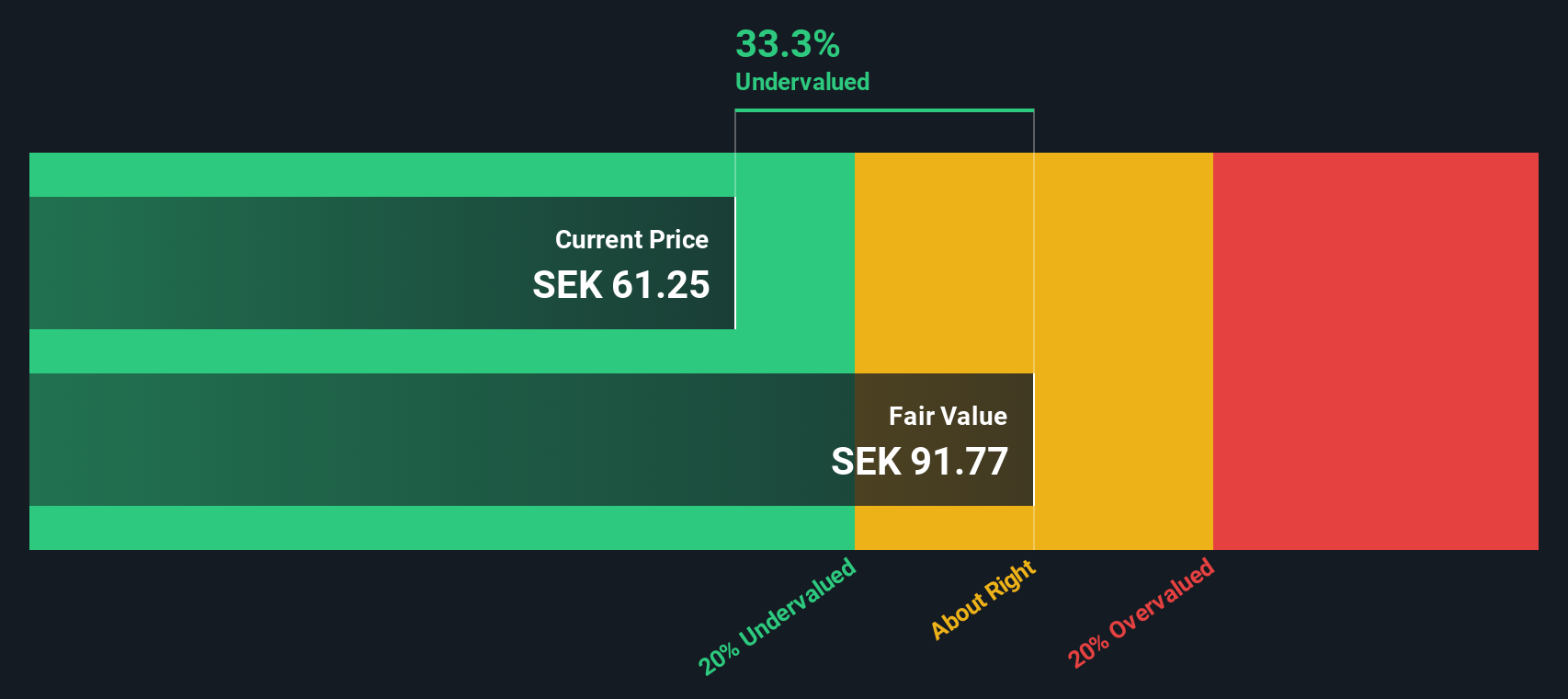

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a technology company that specializes in caller identification, spam blocking, and communication services with a market capitalization of SEK 18.52 billion.

Operations: The company generates revenue primarily from communications software, with a recent gross profit margin of 77.24%. Operating expenses are significant, including general and administrative costs, which were SEK 836.80 million in the latest period. Net income margin has shown variability, reaching 23.73% in the most recent quarter analyzed.

PE: 17.9x

Truecaller, a tech company in Europe, is making strides with its Verified Business Customer Experience Platform and AI-powered adVantage engine. These innovations enhance trust and engagement in business communications across diverse sectors. Despite a slight dip in net income for the third quarter of 2025, sales increased to SEK 476 million. Insider confidence is evident as their CEO purchased 22,500 shares recently worth over SEK 1 million. Earnings are projected to grow annually by over 18%.

- Click here and access our complete valuation analysis report to understand the dynamics of Truecaller.

Understand Truecaller's track record by examining our Past report.

Seize The Opportunity

- Click here to access our complete index of 69 Undervalued European Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SUPR

Supermarket Income REIT

Supermarket Income REIT plc (LSE: SUPR, JSE: SRI) is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the feed the nation infrastructure.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026