- Sweden

- /

- Aerospace & Defense

- /

- OM:IVSO

Invisio (OM:IVSO): Valuation Perspective Following SEK 190m Intercom Systems Order

Reviewed by Simply Wall St

Invisio (OM:IVSO) shares are drawing attention after the company secured a SEK 190 million order from an established European client for its Intercom and Dismounted Soldier systems. This signals ongoing demand for its communication technology.

See our latest analysis for Invisio.

After rallying earlier in the year, Invisio’s share price has softened recently, reflecting some cooling momentum despite that big contract win. Still, the one-year total shareholder return stands at 0.81%, while the three-year total return sits at a robust 70.02%. The stock’s long-term trend suggests growth potential remains, even if the short-term ride has been choppy.

Curious what other companies in defense and aerospace are making moves? Browse the See the full list for free. and see what’s getting attention now.

The question now is whether Invisio’s recent softness leaves its shares trading below fair value, or if strong growth and order wins like these are already baked into the price. Could this be a timely opportunity, or is the market one step ahead?

Most Popular Narrative: 22.5% Undervalued

With Invisio closing at SEK 272 versus a most-followed narrative fair value of SEK 351, there is a sizable gap, suggesting the stock could have considerable upside if forecasts are hit. This disconnect raises the stakes in how key catalysts will play out.

Ongoing soldier modernization and digitization programs are fueling demand for integrated communication and hearing protection systems. Invisio's rapid pace of product innovation (e.g., the X7 in-ear headset, Intercom Link, and recent UltraLYNX acquisition) positions the company to capture a larger share of upcoming multi-year upgrade cycles, supporting future revenue expansion and margin stability. Heightened regulatory and operational focus on hearing protection and occupational safety for military and first responders continues to build long-term, recurring demand for Invisio's solutions, providing a stable foundation for sustained revenue growth, particularly as regulatory mandates tighten.

Want to know what bold financial forecasts back up this bullish fair value? There is a fascinating combination of rapid earnings growth, bigger margins, and high-stakes innovation at play. Uncover the powerful assumptions and surprise drivers behind Invisio’s valuation to see which numbers are building the case for a sharp re-rating.

Result: Fair Value of SEK 351 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Invisio’s dependence on unpredictable government orders and rising costs could undermine earnings visibility. This could challenge the bullish narrative if growth expectations fall short.

Find out about the key risks to this Invisio narrative.

Another View: Multiples Paint a More Cautious Picture

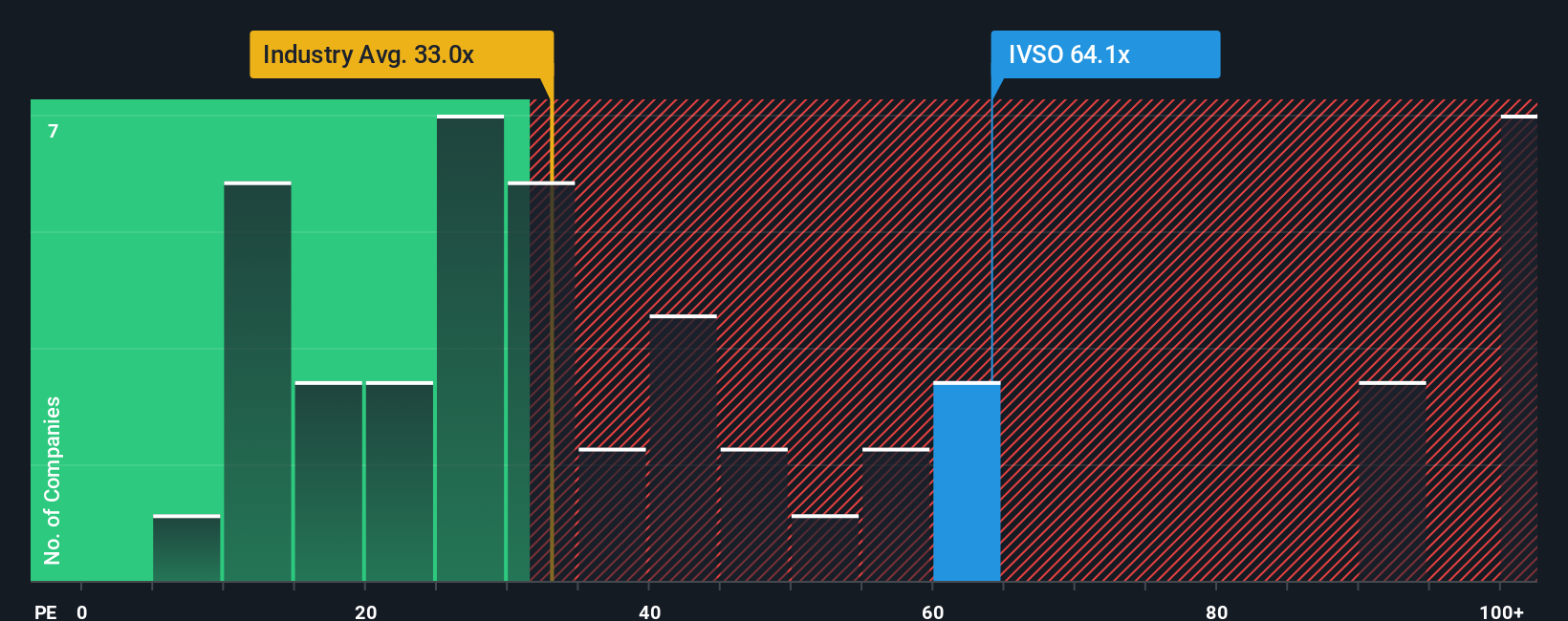

Looking at valuation through the lens of the price-to-earnings ratio tells a different story. Invisio trades at 60x earnings, nearly double the European Aerospace & Defense industry average of 31.7x and well above its fair ratio of 46.1x. This raises the risk that current optimism is already priced in, leaving less room for disappointment or upside surprises.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Invisio Narrative

If you’re not convinced by these perspectives or want to dig deeper into the numbers yourself, you can build your own Invisio narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Invisio.

Looking for More Smart Investment Moves?

Don’t let a unique opportunity slip by. Power up your portfolio with fresh ideas that go beyond Invisio. There are standout companies waiting for your attention.

- Tap into innovative healthcare breakthroughs and see which businesses are disrupting their field by checking out these 31 healthcare AI stocks.

- Catch early-stage gems with strong balance sheets by exploring these 3592 penny stocks with strong financials before the crowd catches on.

- Secure greater value potential during market shifts with these 878 undervalued stocks based on cash flows, which reveals stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IVSO

Invisio

Develops and sells communication and hearing protection systems for professionals in the defense, law enforcement, and security sectors in Sweden, the United Kingdom, Denmark, rest of Europe, the United States, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives