- Finland

- /

- Healthcare Services

- /

- HLSE:TTALO

European Value Stocks Trading At Estimated Discounts

Reviewed by Simply Wall St

As European markets experience a positive shift, with the STOXX Europe 600 Index rising by 2.77% amid easing trade tensions and stable economic indicators, investors are increasingly on the lookout for opportunities in value stocks. In this environment, identifying undervalued stocks—those trading below their intrinsic value due to market inefficiencies—can offer potential long-term benefits as these companies may be poised for recovery or growth once broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Andritz (WBAG:ANDR) | €57.05 | €112.70 | 49.4% |

| Pluxee (ENXTPA:PLX) | €18.90 | €36.97 | 48.9% |

| TF Bank (OM:TFBANK) | SEK347.00 | SEK682.14 | 49.1% |

| Terveystalo Oyj (HLSE:TTALO) | €12.00 | €23.56 | 49.1% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.20 | €42.13 | 49.7% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €22.87 | 49.5% |

| Komplett (OB:KOMPL) | NOK11.15 | NOK22.14 | 49.6% |

| Expert.ai (BIT:EXAI) | €1.32 | €2.59 | 49% |

| FACC (WBAG:FACC) | €7.34 | €14.32 | 48.7% |

| Longino & Cardenal (BIT:LON) | €1.35 | €2.67 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Terveystalo Oyj (HLSE:TTALO)

Overview: Terveystalo Oyj operates as a provider of occupational healthcare services in Finland, Sweden, and Estonia with a market cap of €1.52 billion.

Operations: The company generates revenue from various segments, including €79.40 million from Sweden, €1.06 billion from Healthcare Services, and €224.40 million from Portfolio Businesses.

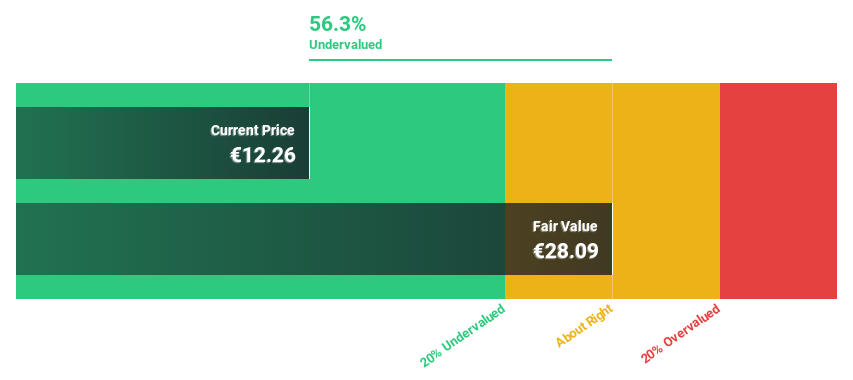

Estimated Discount To Fair Value: 49.1%

Terveystalo Oyj is trading significantly below its estimated fair value, suggesting potential undervaluation based on cash flows. Despite a high debt level, the company's earnings are projected to grow faster than the Finnish market at 16.9% annually. Recent Q1 2025 results show an increase in net income to €33.4 million from €23.6 million year-over-year, reflecting improved profitability and supporting its growth outlook amid stable revenue forecasts for 2025.

- Our earnings growth report unveils the potential for significant increases in Terveystalo Oyj's future results.

- Navigate through the intricacies of Terveystalo Oyj with our comprehensive financial health report here.

Invisio (OM:IVSO)

Overview: Invisio AB (publ) develops and sells communication and hearing protection systems for defense, law enforcement, and security professionals globally, with a market cap of SEK16.96 billion.

Operations: The company generates revenue of SEK1.81 billion from its wireless communications equipment segment, serving professionals in defense, law enforcement, and security sectors worldwide.

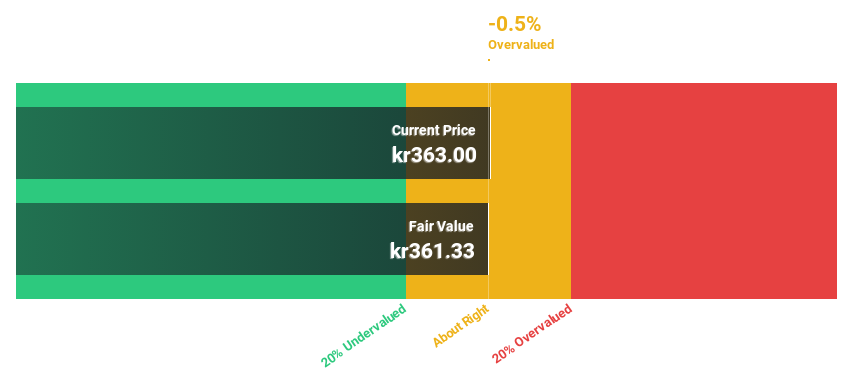

Estimated Discount To Fair Value: 12%

Invisio AB is trading at approximately 12% below its estimated fair value of SEK 427.65, indicating a potential undervaluation based on cash flows. The company reported strong earnings growth, with net income rising to SEK 306.4 million for the year ending December 2024, up from SEK 178.4 million previously. Invisio's earnings are expected to grow significantly over the next three years at an annual rate of over 20%, surpassing the Swedish market average.

- Upon reviewing our latest growth report, Invisio's projected financial performance appears quite optimistic.

- Take a closer look at Invisio's balance sheet health here in our report.

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., along with its subsidiaries, develops and manufactures electronic components, devices, and systems globally, with a market cap of CHF452.85 million.

Operations: The company's revenue is primarily derived from its Electronic Manufacturing Services (EMS) Division at CHF347.90 million and its Advanced Substrates (AS) Division at CHF43 million.

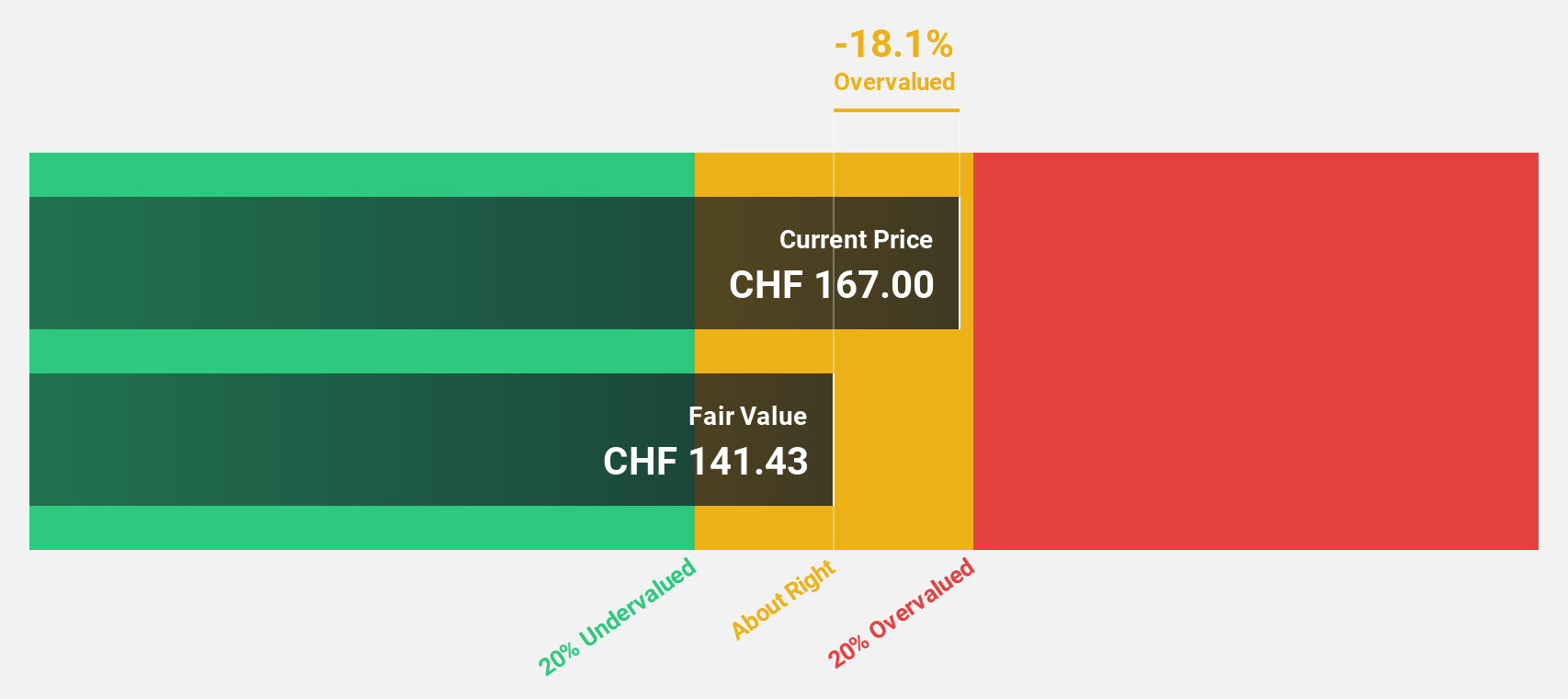

Estimated Discount To Fair Value: 25.7%

Cicor Technologies, trading at CHF104, is undervalued by 25.7% compared to its fair value of CHF139.9. The company anticipates significant earnings growth of 21.4% annually over the next three years, outpacing the Swiss market's growth rate. Despite high debt levels and recent shareholder dilution, Cicor's strategic expansion in aerospace and defense through agreements with Mercury Mission Systems positions it well for future revenue enhancement in this sector.

- Insights from our recent growth report point to a promising forecast for Cicor Technologies' business outlook.

- Dive into the specifics of Cicor Technologies here with our thorough financial health report.

Make It Happen

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 177 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Terveystalo Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Terveystalo Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TTALO

Terveystalo Oyj

Provides occupational healthcare services in Finland, Sweden, and Estonia.

Undervalued with moderate growth potential.

Market Insights

Community Narratives