How Investors Are Reacting To Indutrade (OM:INDT) Reporting Lower Sales and Earnings in Q3

Reviewed by Sasha Jovanovic

- Indutrade AB recently reported its third quarter and nine-month earnings for 2025, showing sales of SEK7.85 billion and net income of SEK674 million for the quarter, both slightly lower than the previous year.

- This development highlights a modest decline in financial performance that may prompt stakeholders to reassess short-term operational trends and sector resilience.

- To explore how this recent dip in quarterly sales and earnings may influence Indutrade's investment outlook, we review its broader narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Indutrade Investment Narrative Recap

To be a shareholder in Indutrade, you need to believe in the group's ability to deliver steady growth through its acquisition strategy and robust sector diversification, despite short-term earnings fluctuations. The recent slip in sales and net income appears modest and isn't likely to be a material setback to Indutrade’s most important near-term catalyst, its ongoing acquisition pipeline. However, rising operational costs without matching revenue growth remain a risk to margin stability in the upcoming quarters.

Among recent company announcements, the appointment of Gustav Ruda as Head of Acquisitions and Business Development stands out, given the central role that acquisitions continue to play in Indutrade’s future growth ambitions. Maintaining acquisition momentum may help counteract sluggish regional sales trends and provide a buffer against sector-specific volatility.

In contrast, a deeper look at rising administrative costs could reveal trends that investors should be aware of...

Read the full narrative on Indutrade (it's free!)

Indutrade's outlook anticipates SEK40.0 billion in revenue and SEK3.9 billion in earnings by 2028. This is based on a 7.2% annual revenue growth rate and a SEK1.2 billion increase in earnings from the current SEK2.7 billion.

Uncover how Indutrade's forecasts yield a SEK275.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

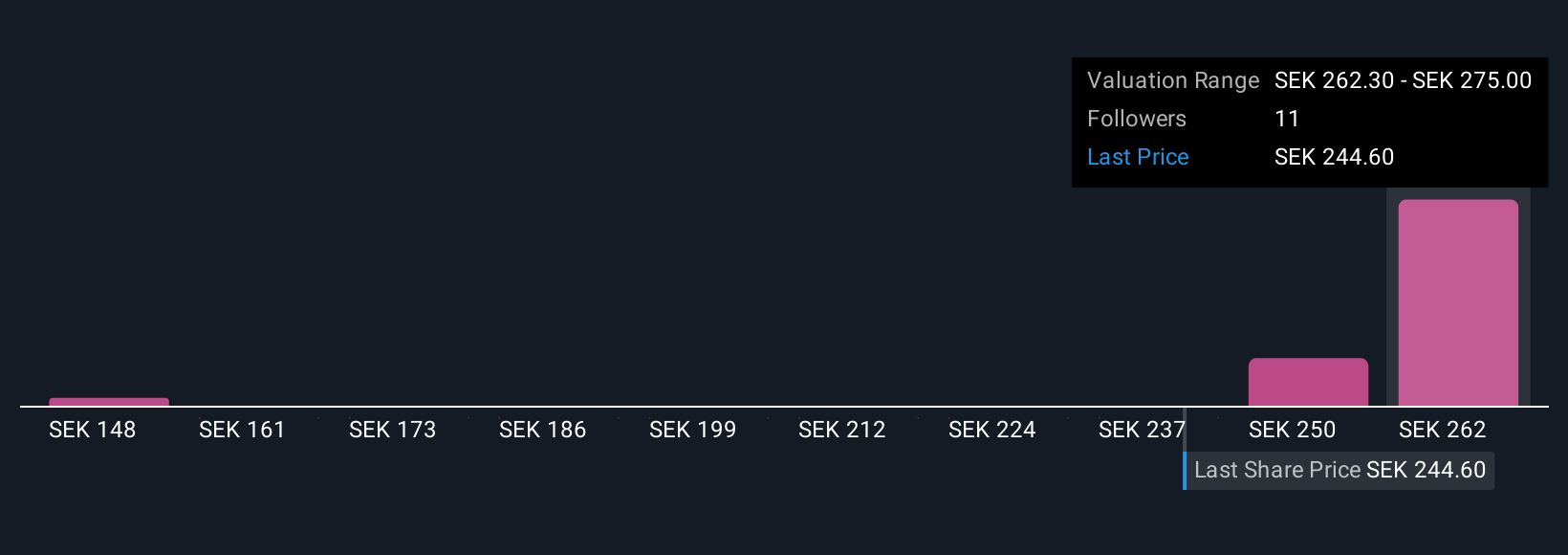

Three Simply Wall St Community members provided fair value estimates for Indutrade, spanning SEK148 to SEK275 per share. This range reflects widely differing outlooks on growth potential, even as ongoing acquisition activity is seen as an important influence on future business strength.

Explore 3 other fair value estimates on Indutrade - why the stock might be worth as much as 6% more than the current price!

Build Your Own Indutrade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Indutrade research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Indutrade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Indutrade's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INDT

Indutrade

Manufactures, develops, and sells components, systems, and services to various industries worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives