- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

GomSpace Group AB (publ) (STO:GOMX) Shares Slammed 31% But Getting In Cheap Might Be Difficult Regardless

GomSpace Group AB (publ) (STO:GOMX) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 128% in the last twelve months.

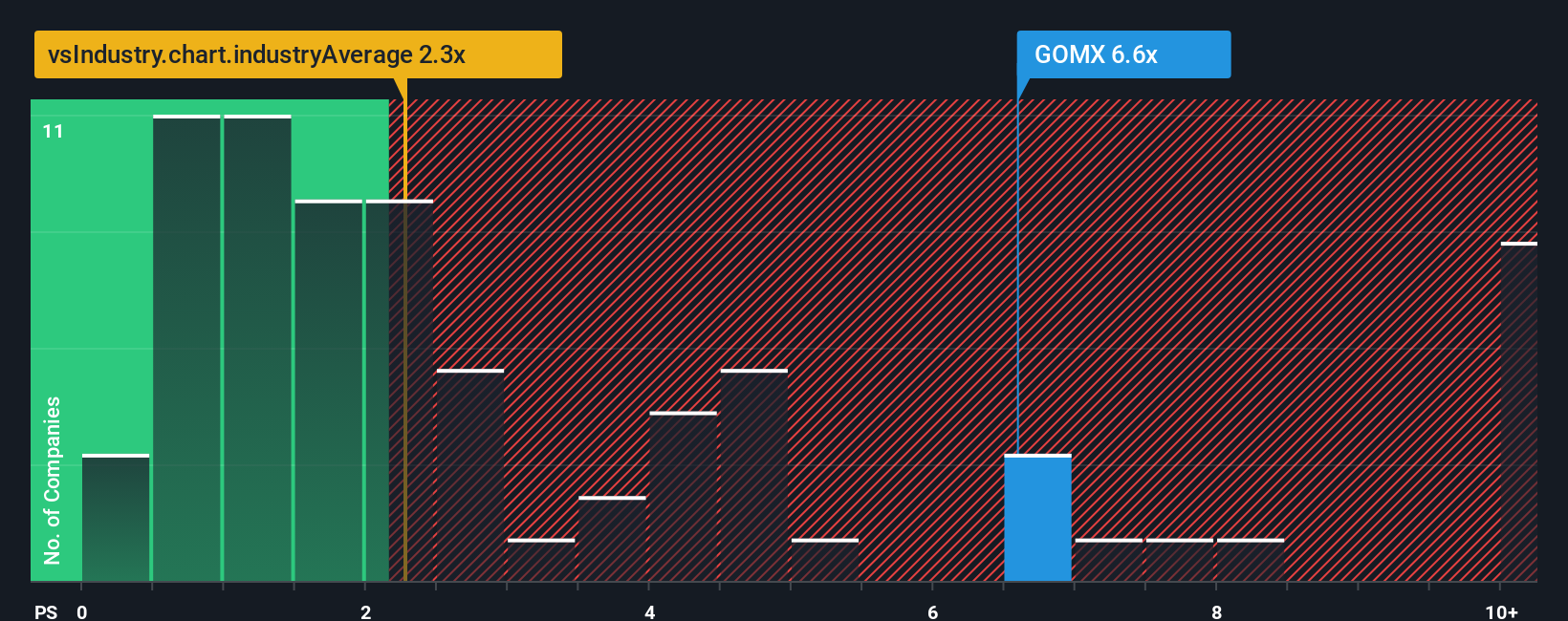

Even after such a large drop in price, GomSpace Group may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6.6x, since almost half of all companies in the Aerospace & Defense in Sweden have P/S ratios under 5.2x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for GomSpace Group

What Does GomSpace Group's Recent Performance Look Like?

Recent times haven't been great for GomSpace Group as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on GomSpace Group will help you uncover what's on the horizon.How Is GomSpace Group's Revenue Growth Trending?

GomSpace Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.1% last year. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 41% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 19%, which is noticeably less attractive.

With this information, we can see why GomSpace Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From GomSpace Group's P/S?

GomSpace Group's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that GomSpace Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - GomSpace Group has 2 warning signs (and 1 which is significant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GOMX

GomSpace Group

Through its subsidiaries, manufactures and sells nanosatellites and components, and turnkey solutions for satellites in Denmark, Sweden, France, rest of Europe, the United States, Asia, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.