- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

Even after rising 10% this past week, GomSpace Group (STO:GOMX) shareholders are still down 46% over the past five years

This week we saw the GomSpace Group AB (publ) (STO:GOMX) share price climb by 10%. But if you look at the last five years the returns have not been good. In fact, the share price is down 59%, which falls well short of the return you could get by buying an index fund.

While the last five years has been tough for GomSpace Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for GomSpace Group

GomSpace Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, GomSpace Group grew its revenue at 10.0% per year. That's a fairly respectable growth rate. The share price, meanwhile, has fallen 10% compounded, over five years. That suggests the market is disappointed with the current growth rate. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

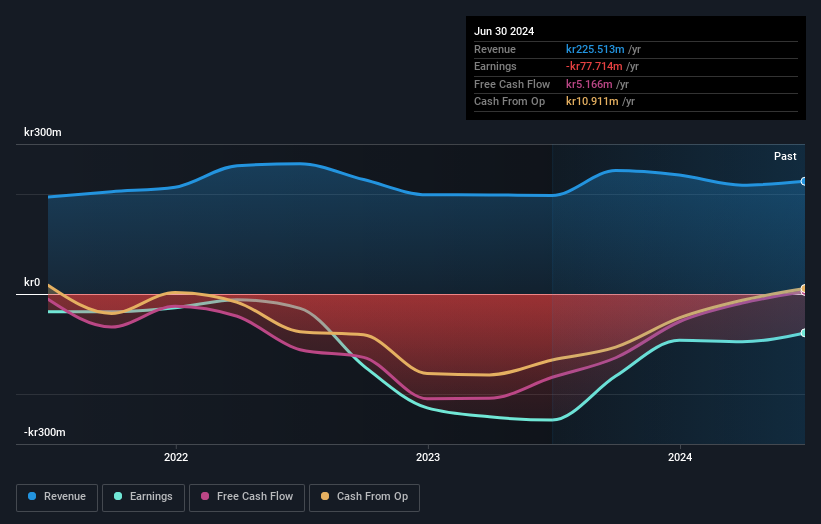

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at GomSpace Group's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered GomSpace Group's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. GomSpace Group hasn't been paying dividends, but its TSR of -46% exceeds its share price return of -59%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 15% in the last year, GomSpace Group shareholders lost 4.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 8% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for GomSpace Group (of which 1 shouldn't be ignored!) you should know about.

Of course GomSpace Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GOMX

GomSpace Group

Through its subsidiaries, engages in the manufacturing of nanosatellites and components, and turnkey solutions for satellites.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives