- Sweden

- /

- Electrical

- /

- OM:GARO

Some Confidence Is Lacking In Garo Aktiebolag (publ) (STO:GARO) As Shares Slide 26%

Garo Aktiebolag (publ) (STO:GARO) shares have had a horrible month, losing 26% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 73% share price decline.

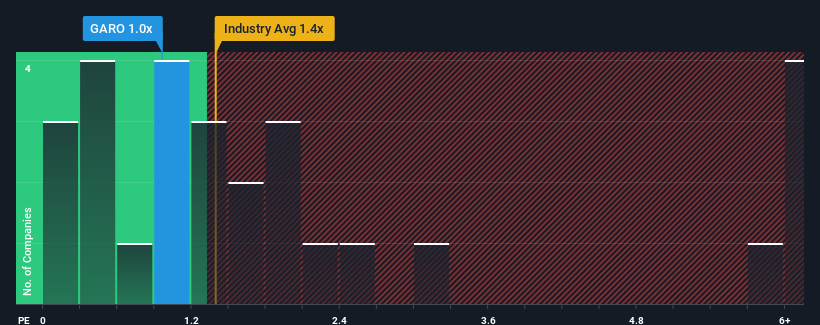

In spite of the heavy fall in price, there still wouldn't be many who think Garo Aktiebolag's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Sweden's Electrical industry is similar at about 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Garo Aktiebolag

What Does Garo Aktiebolag's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Garo Aktiebolag's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Garo Aktiebolag.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Garo Aktiebolag would need to produce growth that's similar to the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 38% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.3% as estimated by the dual analysts watching the company. Meanwhile, the broader industry is forecast to expand by 103%, which paints a poor picture.

With this information, we find it concerning that Garo Aktiebolag is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Following Garo Aktiebolag's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Garo Aktiebolag's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Having said that, be aware Garo Aktiebolag is showing 3 warning signs in our investment analysis, and 2 of those are significant.

If you're unsure about the strength of Garo Aktiebolag's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GARO

Garo Aktiebolag

Develops, manufactures, and markets electrical installation materials in Sweden, Norway, Ireland, the United Kingdom, Finland, Denmark, Austria, Poland, Belgium, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives