- Sweden

- /

- Electrical

- /

- OM:GARO

Optimistic Investors Push Garo Aktiebolag (publ) (STO:GARO) Shares Up 26% But Growth Is Lacking

Garo Aktiebolag (publ) (STO:GARO) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

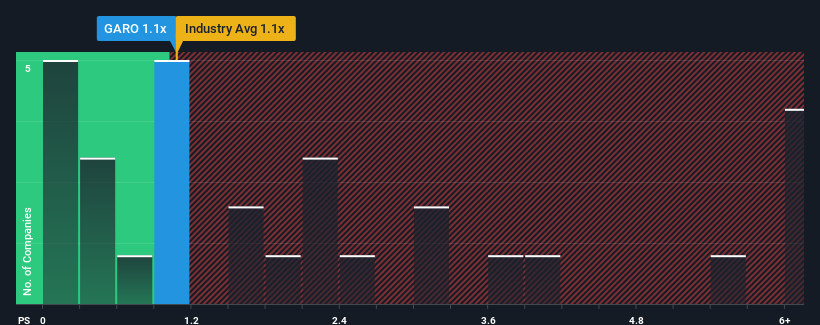

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Garo Aktiebolag's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in Sweden is also close to 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Garo Aktiebolag

How Has Garo Aktiebolag Performed Recently?

Garo Aktiebolag hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Garo Aktiebolag will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Garo Aktiebolag's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. The last three years don't look nice either as the company has shrunk revenue by 4.7% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 6.5% over the next year. With the industry predicted to deliver 22% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Garo Aktiebolag's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Garo Aktiebolag's P/S

Garo Aktiebolag's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Garo Aktiebolag's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Having said that, be aware Garo Aktiebolag is showing 1 warning sign in our investment analysis, you should know about.

If you're unsure about the strength of Garo Aktiebolag's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Garo Aktiebolag, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GARO

Garo Aktiebolag

Develops, manufactures, and markets electrical installation materials in Sweden, Norway, Ireland, the United Kingdom, Finland, Denmark, Austria, Poland, Belgium, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives