- Sweden

- /

- Electrical

- /

- OM:FERRO

A Piece Of The Puzzle Missing From Ferroamp AB (publ)'s (STO:FERRO) 65% Share Price Climb

The Ferroamp AB (publ) (STO:FERRO) share price has done very well over the last month, posting an excellent gain of 65%. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 72% share price drop in the last twelve months.

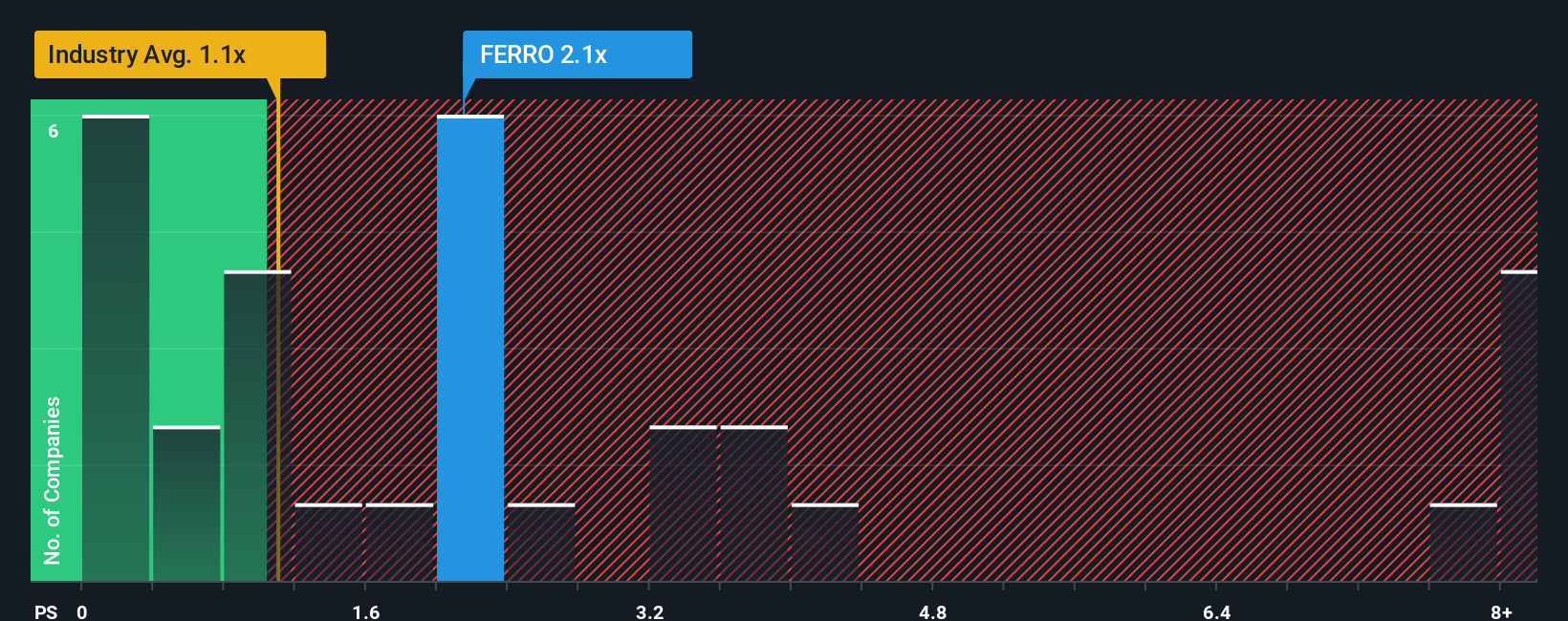

In spite of the firm bounce in price, there still wouldn't be many who think Ferroamp's price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S in Sweden's Electrical industry is similar at about 2.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Ferroamp

What Does Ferroamp's Recent Performance Look Like?

With revenue that's retreating more than the industry's average of late, Ferroamp has been very sluggish. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Ferroamp's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Ferroamp?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ferroamp's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 55% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 39% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 300% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this information, we find it interesting that Ferroamp is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Ferroamp's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Ferroamp currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Ferroamp (at least 3 which are potentially serious), and understanding them should be part of your investment process.

If you're unsure about the strength of Ferroamp's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FERRO

Ferroamp

Provides energy and power optimization solutions for homeowners, tenant owner associations, and property owners in Sweden.

High growth potential with slight risk.

Market Insights

Community Narratives