- Sweden

- /

- Electrical

- /

- OM:FAG

Undervalued Small Caps With Insider Action In Global For July 2025

Reviewed by Simply Wall St

As global markets reach new highs, buoyed by favorable trade deals and robust business activity in the U.S., small-cap stocks have also seen a lift, with indices like the S&P MidCap 400 and Russell 2000 posting gains. In this environment of optimism and strategic international agreements, identifying small-cap companies with strong fundamentals and insider action can present intriguing opportunities for investors seeking value amidst broader market momentum.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.5x | 6.5x | 47.25% | ★★★★★☆ |

| Lion Rock Group | 5.1x | 0.4x | 49.78% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.9x | 3.0x | 14.15% | ★★★★☆☆ |

| Sagicor Financial | 9.9x | 0.4x | -98.48% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 19.66% | ★★★★☆☆ |

| Absolent Air Care Group | 33.4x | 2.2x | 47.72% | ★★★☆☆☆ |

| A.G. BARR | 19.1x | 1.8x | 47.40% | ★★★☆☆☆ |

| Saturn Oil & Gas | 3.0x | 0.5x | -152.77% | ★★★☆☆☆ |

| Chinasoft International | 24.6x | 0.7x | 10.19% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.2x | 0.7x | 6.24% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

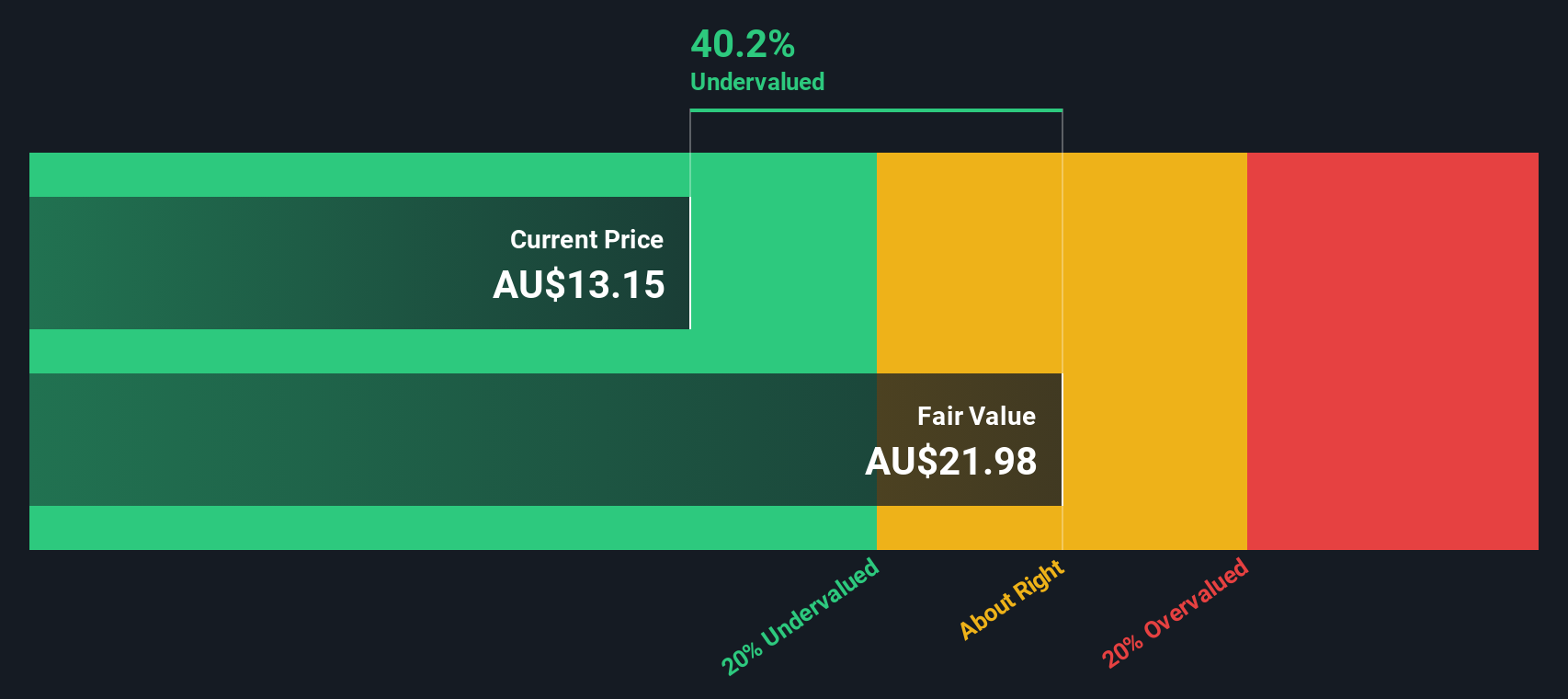

Credit Corp Group (ASX:CCP)

Simply Wall St Value Rating: ★★★★★★

Overview: Credit Corp Group is a financial services company specializing in debt ledger purchasing and consumer lending across Australia, New Zealand, and the United States, with a market cap of A$2.44 billion.

Operations: The company's revenue is primarily derived from Debt Ledger Purchasing in the United States and Australia/New Zealand, alongside consumer lending across these regions. Operating expenses are significant, with general and administrative expenses consistently forming a large portion of costs. The net income margin has shown variability over time, with a notable decrease to 13.36% as of June 2024 before rebounding to 23.28% by December 2024.

PE: 9.8x

Credit Corp Group, a smaller company in its sector, recently participated in the Macquarie Emerging Leaders Conference on June 18, 2025. Despite its size and some funding risks due to reliance on external borrowing, the stock may be overlooked by investors. Insider confidence is evident with recent share purchases over the past year. However, earnings are projected to decline by an average of 0.7% annually for three years, suggesting cautious optimism is warranted for future prospects.

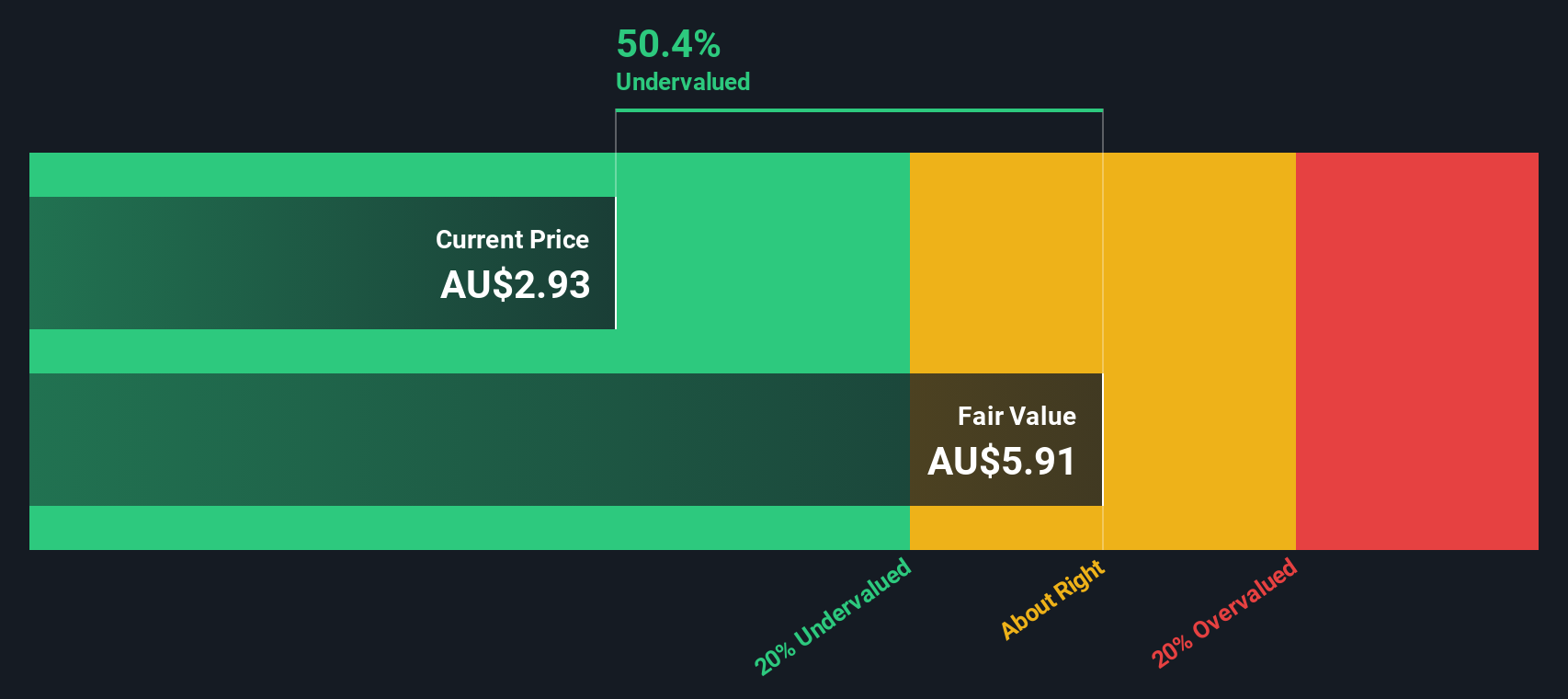

Ridley (ASX:RIC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ridley is a company that specializes in the production of bulk stockfeeds and packaged ingredients, with a market capitalization of A$0.92 billion.

Operations: Ridley generates revenue primarily from Bulk Stockfeeds and Packaged/Ingredients segments, with significant contributions of A$894.26 million and A$389.70 million respectively. The company has experienced fluctuations in its gross profit margin, which reached 9.22% by December 2024, reflecting changes in cost management and pricing strategies over time. Operating expenses have been a notable component of the cost structure, impacting net income margins consistently across periods analyzed.

PE: 26.9x

Ridley, a smaller player in its sector, is currently navigating significant changes. Recent executive transitions signal strategic shifts as they prepare to integrate the Incitec Pivot Fertilisers business. Despite past shareholder dilution from an A$125.68 million equity offering and reliance on external borrowing, insider confidence remains evident through their stock purchases. Earnings are projected to grow annually by 16.64%, suggesting potential for future value appreciation amidst these corporate developments and market positioning strategies.

- Unlock comprehensive insights into our analysis of Ridley stock in this valuation report.

Gain insights into Ridley's past trends and performance with our Past report.

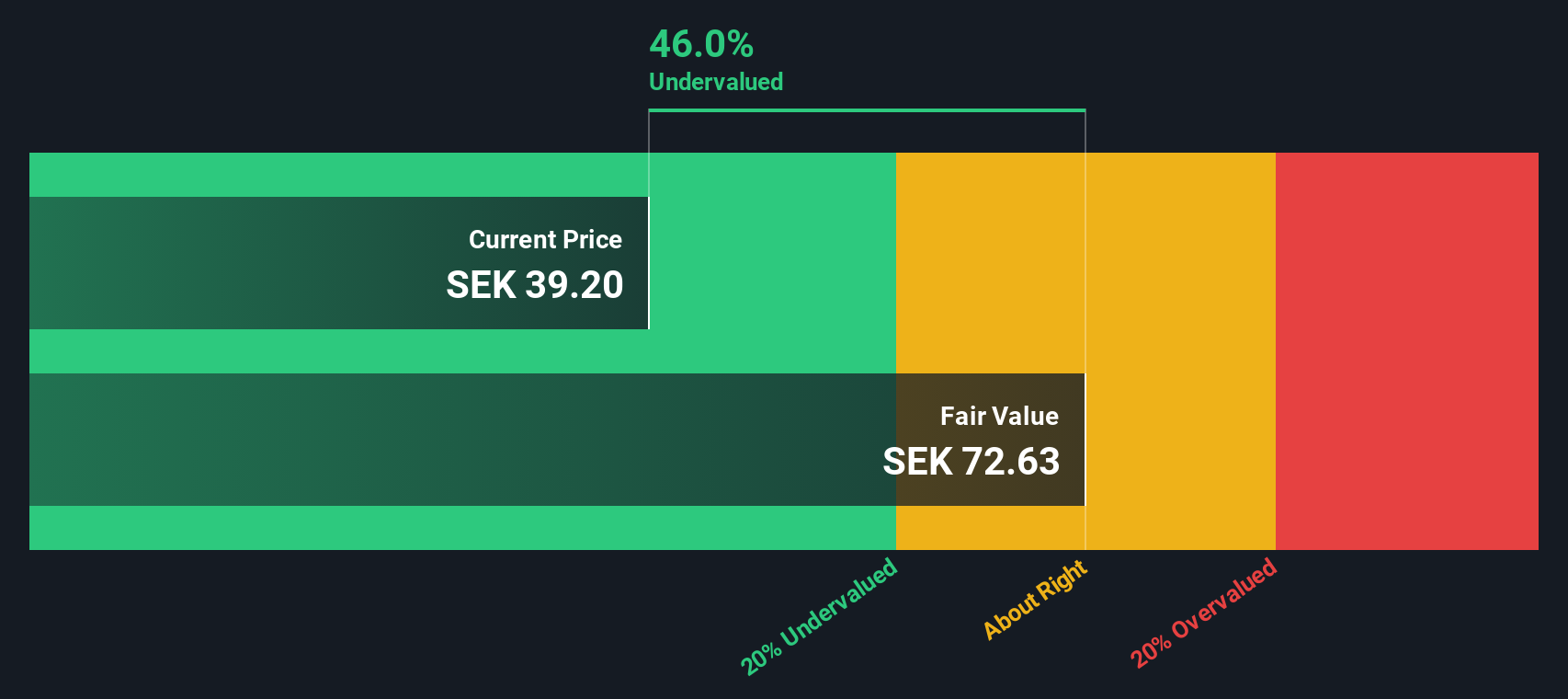

Fagerhult Group (OM:FAG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fagerhult Group is a company specializing in lighting solutions, providing products and services across various segments including premium, collection, professional, infrastructure, and smart solutions.

Operations: The company generates revenue primarily from its Collection and Premium segments, with additional contributions from Professional and Infrastructure. Over recent periods, the gross profit margin has shown a trend of increasing stability, reaching 39.92% by mid-2025. Operating expenses are largely driven by sales and marketing activities, followed by general and administrative costs.

PE: 29.7x

Fagerhult Group, a smaller company in the lighting industry, faces challenges with declining profit margins—2.9% compared to last year's 6%—and sales dropping to SEK 1.8 billion from SEK 2.2 billion year-over-year for Q2 2025. Despite this, earnings are projected to grow annually by nearly 35%. The recent appointment of Oscar Wallstén as CFO brings expertise that could aid financial transformation amidst reliance on external borrowing for funding. Additionally, insider confidence is evident with increased share purchases throughout June and July 2025, suggesting optimism about future prospects despite current hurdles.

- Click to explore a detailed breakdown of our findings in Fagerhult Group's valuation report.

Assess Fagerhult Group's past performance with our detailed historical performance reports.

Where To Now?

- Discover the full array of 109 Undervalued Global Small Caps With Insider Buying right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives