- Sweden

- /

- Electrical

- /

- OM:FAG

Fagerhult Group (OM:FAG) Profit Margin Hit by SEK90.8m One-Off Loss, Testing Bullish Growth Narratives

Reviewed by Simply Wall St

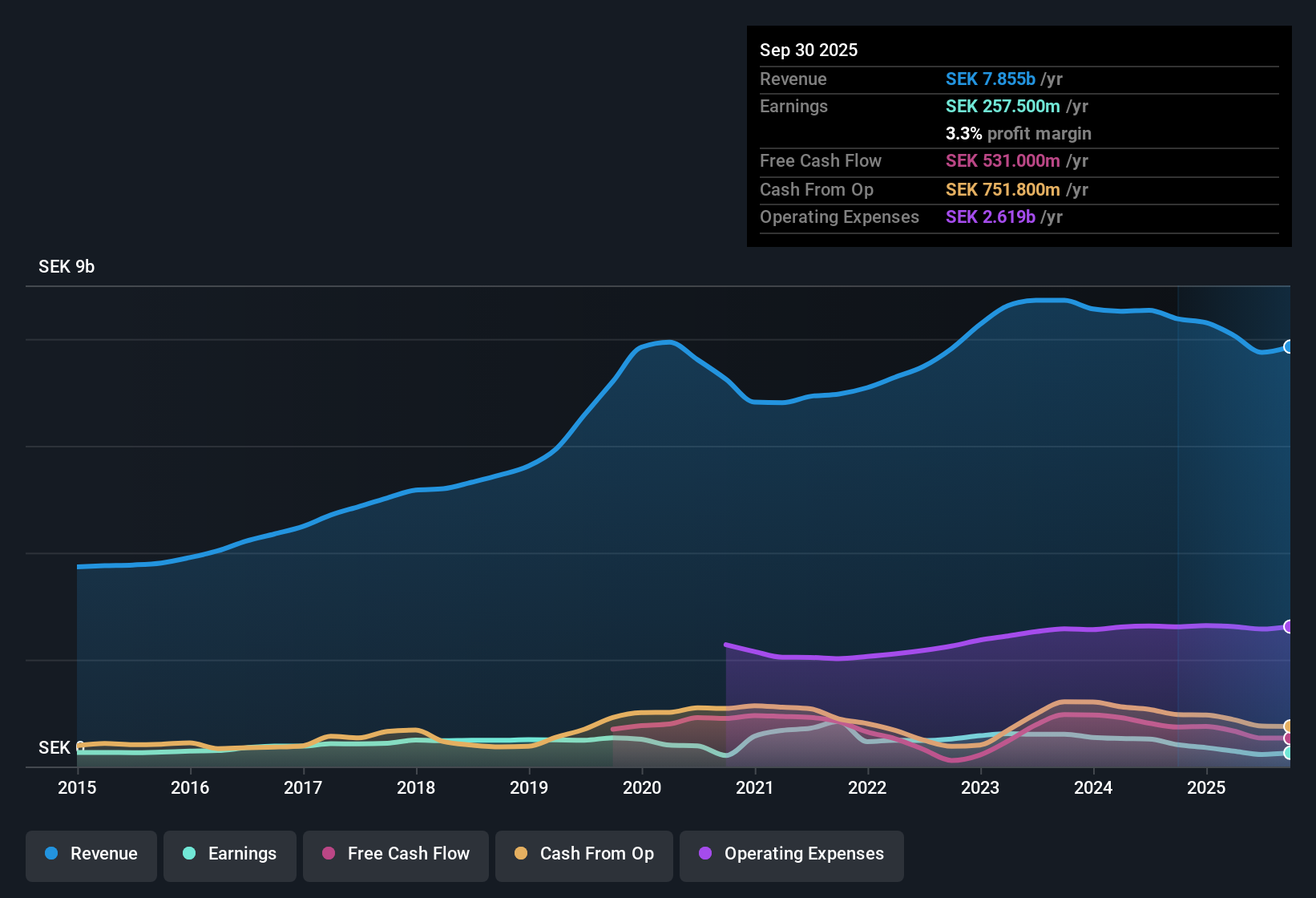

Fagerhult Group (OM:FAG) posted a net profit margin of 2.9% for the period ending September 30, 2025, down from 6% a year earlier. The company’s earnings have contracted at an average rate of 8.8% annually over the past five years, with a notable SEK90.8 million one-off loss weighing on the most recent results. Looking ahead, forecasts point to robust annual earnings growth of 27.4% over the next three years, well ahead of the Swedish market’s 13.2% projection. Meanwhile, revenue is slated to rise by 4.9% per year.

See our full analysis for Fagerhult Group.Now that we’ve seen the headline numbers, it's time to see how they stack up against the narratives the market follows most closely. Some might get confirmed, but a few surprises could challenge conventional wisdom.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Loss Drives Profit Margin Dip

- The company recorded a one-off loss of SEK90.8 million in the most recent twelve months, which played a key role in reducing the net profit margin to 2.9% from 6% last year.

- Positive momentum for future growth contrasts sharply with this setback. Forecasts for earnings to grow 27.4% annually challenge skeptics who may view recent losses as an ongoing trend.

- Bears may point to the recent one-off loss as a signal of operational risk. However, the outsized growth projection stands as a counterpoint and suggests upside if management can prevent similar charges going forward.

- A profit margin still in positive territory, even after the loss, supports the idea that underlying business fundamentals have not collapsed despite headline pressures.

Peer Discount But Industry Premium

- Fagerhult’s price-to-earnings ratio of 35.3x is slightly below the average for direct peers (36.9x), but remains higher than the broader European electrical industry, where the P/E averages 23.8x.

- While shares appear relatively attractively priced compared to close competitors, some narrative claims about undervaluation are less clear-cut when viewed against a wider industry lens.

- It is surprising that despite trading at a discount to peers, investors are still paying a premium versus the overall sector. This raises questions about whether growth prospects justify this higher price.

- Bulls might argue the revenue growth outlook (4.9% per year) warrants a premium, but industry watchers will want to see sustained execution before rewarding the company with a higher valuation multiple.

DCF Fair Value Gap Remains Wide

- The share price of SEK45.2 is well below its DCF fair value estimate of SEK64.47, suggesting a gap that may attract value-focused investors.

- The prevailing market view emphasizes that strong projected earnings growth could help close this valuation gap if future results align with expectations.

- The projected 27.4% annual earnings growth rate is a key figure backing up the case for upside, especially given the current discount to intrinsic value.

- However, investors may remain hesitant until the company’s margins show consistent improvement and unusual losses are put firmly in the past.

See what the community is saying about Fagerhult Group See what the community is saying about Fagerhult Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fagerhult Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite promising growth forecasts, Fagerhult’s recent one-off losses, shrinking profit margins, and premium valuation compared to the sector highlight vulnerability and uncertainty in its near-term outlook.

If steady results are a priority for you, use stable growth stocks screener (2117 results) to focus on companies consistently delivering reliable revenue and earnings, even when conditions change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives