- Sweden

- /

- Electrical

- /

- OM:FAG

European Small Caps With Insider Buying To Consider

Reviewed by Simply Wall St

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.68% and major stock indexes across Germany, Italy, France, and the UK also experiencing gains. Amidst this positive backdrop, small-cap stocks in Europe are gaining attention as potential opportunities for investors seeking to capitalize on insider buying trends and favorable economic indicators such as improved consumer confidence and robust business activity. Identifying stocks that align with these market dynamics can be crucial for those looking to explore investment opportunities within this segment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.1x | 1.5x | 30.70% | ★★★★★★ |

| Bytes Technology Group | 16.6x | 4.0x | 20.29% | ★★★★★☆ |

| Boozt | 18.0x | 0.8x | 48.72% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 30.44% | ★★★★★☆ |

| Eastnine | 12.2x | 7.7x | 48.68% | ★★★★☆☆ |

| J D Wetherspoon | 10.6x | 0.3x | 2.54% | ★★★★☆☆ |

| Senior | 24.9x | 0.8x | 25.68% | ★★★★☆☆ |

| Renold | 10.8x | 0.7x | -0.38% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.0x | 34.86% | ★★★☆☆☆ |

| Fastighets AB Trianon | 14.2x | 4.6x | -221.76% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

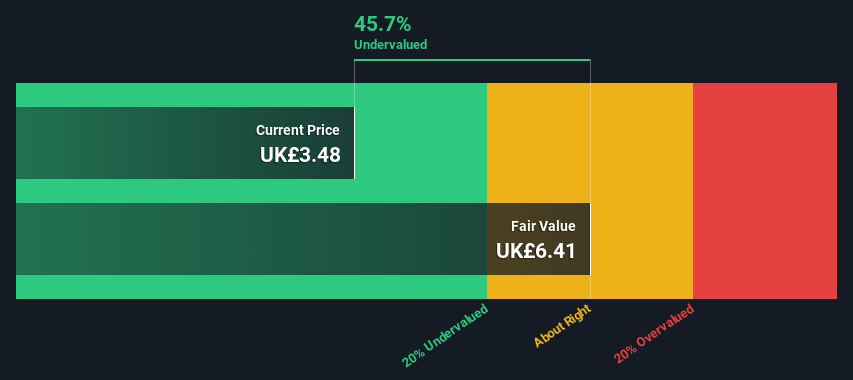

Forterra (LSE:FORT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Forterra is a UK-based manufacturer specializing in the production of building products, including bricks and blocks, with a market capitalization of £0.55 billion.

Operations: The company's revenue primarily comes from its Bricks and Blocks segment (£300.70 million) and Bespoke Products (£80 million). The gross profit margin has shown variability, with a recent figure of 28.73% as of June 2025. Operating expenses are a significant cost component, including sales and marketing expenses which were £51.4 million in the latest period reported.

PE: 24.9x

Forterra, a smaller European company, has caught attention with its recent financial performance and strategic plans. In H1 2025, sales rose to £195.1 million from £162.1 million the previous year, although net income dipped slightly to £7.2 million from £9 million. Insider confidence is evident with recent share purchases in July 2025, indicating potential optimism about future prospects. The company aims for growth through bolt-on acquisitions in complementary markets while offering increased dividends of 1.9 pence per share compared to last year's 1 pence per share, suggesting a commitment to shareholder returns amidst forecasted earnings growth of over 28% annually.

- Dive into the specifics of Forterra here with our thorough valuation report.

Gain insights into Forterra's past trends and performance with our Past report.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Wilmington is a company that provides information, education, and networking services across sectors such as legal, financial services, and health, safety and environment (HSE), with a market cap of £0.30 billion.

Operations: Wilmington generates revenue primarily from Financial Services (£67.96 million), Legal (£15.14 million), and Health, Safety and Environment (HSE) (£16.43 million) segments. The company experienced fluctuations in its gross profit margin, reaching 23.50% by June 2025, indicating changes in cost management or pricing strategies over time.

PE: 25.6x

Wilmington's recent decision to market its U.S. events business, FRA, for sale marks a strategic shift towards digital-first operations. This move aligns with their focus on improving earnings quality amidst a challenging financial year ending June 2025, where net income dropped to £11.56 million from £41.21 million the previous year. Despite this decline, they announced an increased dividend of 11.5 pence per share and are in talks for a potentially significant acquisition of Professional Group Conversia S.L.U., indicating proactive growth strategies in place.

- Unlock comprehensive insights into our analysis of Wilmington stock in this valuation report.

Evaluate Wilmington's historical performance by accessing our past performance report.

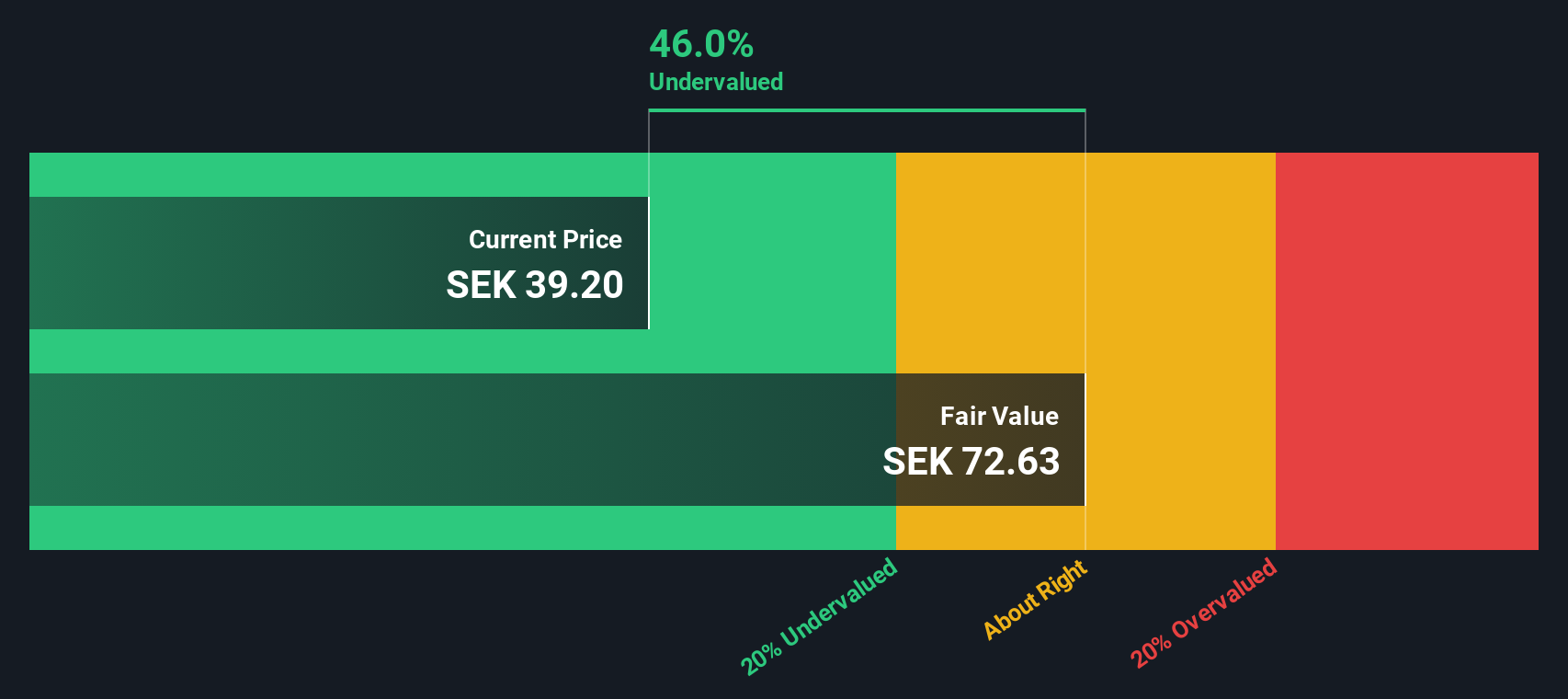

Fagerhult Group (OM:FAG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Fagerhult Group is a lighting solutions company that designs, manufactures, and markets professional lighting systems across various segments, with a market capitalization of SEK 9.2 billion.

Operations: The Group generates revenue primarily from the Collection and Premium segments, with additional contributions from Professional and Infrastructure. Operating expenses are largely driven by Sales & Marketing, followed by General & Administrative costs. The gross profit margin has shown a notable trend, reaching 39.92% in the latest period ending June 2025.

PE: 32.6x

Fagerhult Group, a notable player in the European lighting industry, presents an intriguing opportunity among smaller companies. Despite a dip in profit margins to 2.9% from last year's 6%, insider confidence is evident with recent share purchases over the past quarter. The company faces challenges with its higher-risk external borrowing but is poised for growth, with earnings expected to increase by 34% annually. This growth potential could attract attention in the coming years.

- Delve into the full analysis valuation report here for a deeper understanding of Fagerhult Group.

Examine Fagerhult Group's past performance report to understand how it has performed in the past.

Summing It All Up

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 55 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives