- Sweden

- /

- Hospitality

- /

- OM:BETS B

Betsson And 2 Other Swedish Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets face challenges from rising U.S. Treasury yields and cautious monetary policy expectations in Europe, investors are increasingly looking to stable dividend stocks for reliable income streams. In the context of Sweden's market, where economic fundamentals remain a focal point amid broader European trends, understanding what makes a good dividend stock—such as consistent payout history and strong financial health—can help investors navigate these uncertain times.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.64% | ★★★★★★ |

| Zinzino (OM:ZZ B) | 3.21% | ★★★★★☆ |

| Softronic (OM:SOF B) | 5.66% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.11% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.82% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.53% | ★★★★★☆ |

| Bilia (OM:BILI A) | 5.23% | ★★★★☆☆ |

| Loomis (OM:LOOMIS) | 3.89% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.47% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.66% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Betsson AB (publ) operates and manages an online gaming business across various regions including the Nordic countries, Latin America, and Europe, with a market cap of SEK38.52 billion.

Operations: Betsson AB's revenue primarily comes from its Casinos & Resorts segment, which generated €1.05 billion.

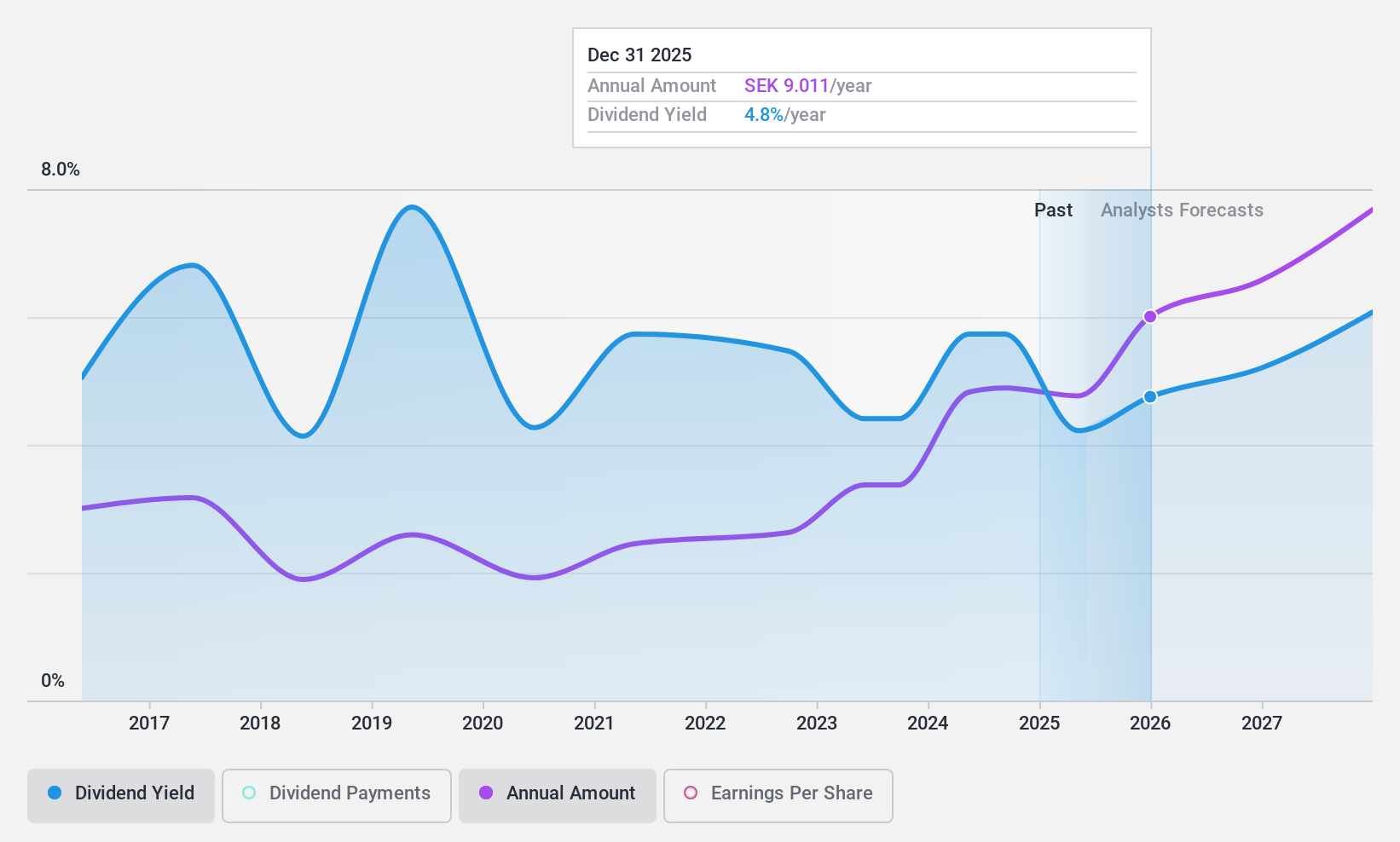

Dividend Yield: 5.3%

Betsson's recent financial performance shows increased sales but a slight decline in net income, impacting its dividend reliability. The company's dividend yield of 5.33% is attractive, ranking in the top 25% of Swedish stocks, yet it's not well covered by free cash flow due to a high cash payout ratio of 92.9%. Despite past volatility and unreliability in dividends, Betsson has managed to increase payouts over the last decade while maintaining a reasonable earnings payout ratio of 51.9%.

- Click here and access our complete dividend analysis report to understand the dynamics of Betsson.

- Upon reviewing our latest valuation report, Betsson's share price might be too pessimistic.

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related services for various industries, including automotive and consumer electronics, across multiple countries such as Sweden, Germany, the United States, and China, with a market cap of SEK1.46 billion.

Operations: Bulten AB (publ) generates revenue of SEK5.98 billion from its fasteners and related services across various industries and international markets.

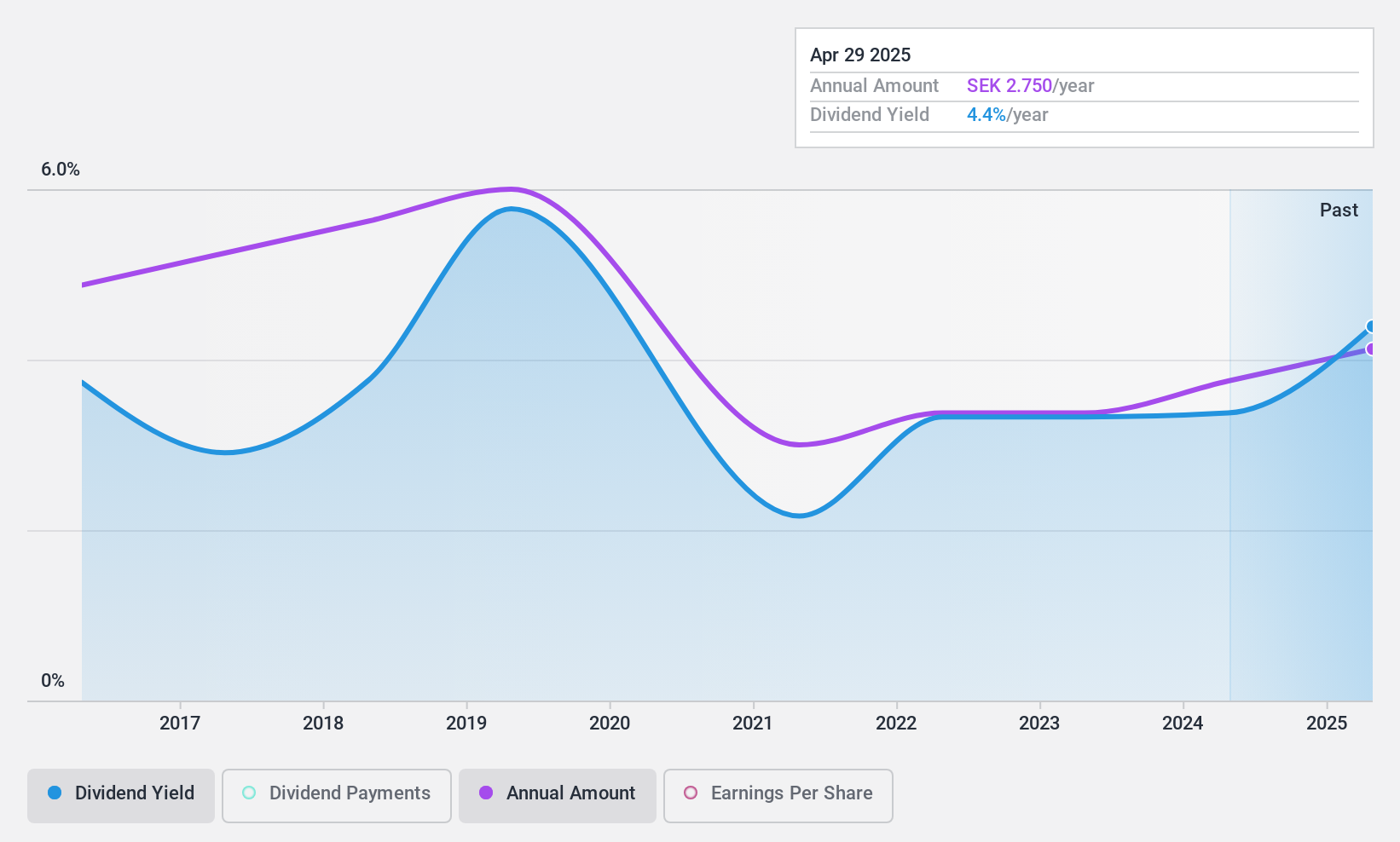

Dividend Yield: 3.6%

Bulten's recent earnings report indicates a return to profitability with a net income of SEK 33 million for Q3, contrasting last year's loss. Despite an unstable dividend history, the current payout ratio of 33.6% suggests dividends are well covered by earnings. However, the cash payout ratio at 68.1% raises concerns about cash flow sustainability. The dividend yield of 3.59% is below top-tier Swedish stocks and past volatility makes it less reliable despite some growth over ten years.

- Navigate through the intricacies of Bulten with our comprehensive dividend report here.

- Our expertly prepared valuation report Bulten implies its share price may be too high.

Fagerhult Group (OM:FAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fagerhult Group AB, along with its subsidiaries, manufactures and sells professional lighting solutions globally and has a market cap of SEK10.32 billion.

Operations: Fagerhult Group AB generates revenue through its global operations in the manufacture and sale of professional lighting solutions.

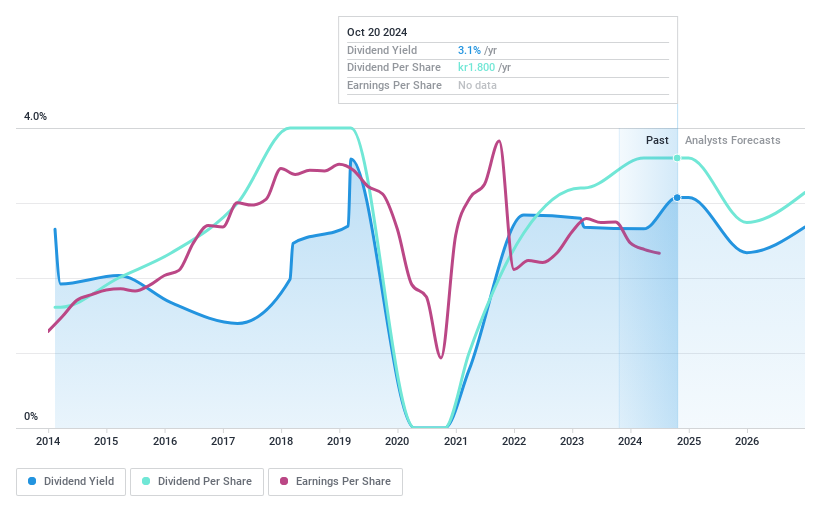

Dividend Yield: 3.1%

Fagerhult Group's recent earnings reveal a decline in both sales and net income for Q3 2024, impacting its dividend stability. While the dividend yield of 3.08% is modest compared to top-tier Swedish stocks, dividends are covered by earnings with a payout ratio of 77.7% and cash flows with a cash payout ratio of 43%. Despite past volatility in payments, dividends have grown over the last decade. The company is actively pursuing M&A opportunities amid challenging market conditions.

- Dive into the specifics of Fagerhult Group here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Fagerhult Group shares in the market.

Seize The Opportunity

- Unlock more gems! Our Top Swedish Dividend Stocks screener has unearthed 17 more companies for you to explore.Click here to unveil our expertly curated list of 20 Top Swedish Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business primarily in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.