- Sweden

- /

- Electrical

- /

- OM:FAG

3 Prominent Stocks Estimated To Be Up To 38.6% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced notable fluctuations, with major indices like the Nasdaq Composite and S&P 500 seeing highs before retreating. Amidst this volatility, growth stocks lagged behind value shares, highlighting the importance of identifying undervalued opportunities in today's market landscape. In such an environment, discerning investors often seek stocks that are trading below their intrinsic value as these may present potential opportunities for appreciation once market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.67 | CN¥76.89 | 49.7% |

| PharmaResearch (KOSDAQ:A214450) | ₩226500.00 | ₩451715.38 | 49.9% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53900.00 | ₩107294.90 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.73 | A$9.45 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| EVERTEC (NYSE:EVTC) | US$33.02 | US$65.79 | 49.8% |

| Laboratorio Reig Jofre (BME:RJF) | €2.90 | €5.77 | 49.7% |

| Open Lending (NasdaqGM:LPRO) | US$6.14 | US$12.21 | 49.7% |

| Hunan TV & Broadcast Intermediary (SZSE:000917) | CN¥10.01 | CN¥20.01 | 50% |

| Energy One (ASX:EOL) | A$5.56 | A$11.06 | 49.7% |

Let's uncover some gems from our specialized screener.

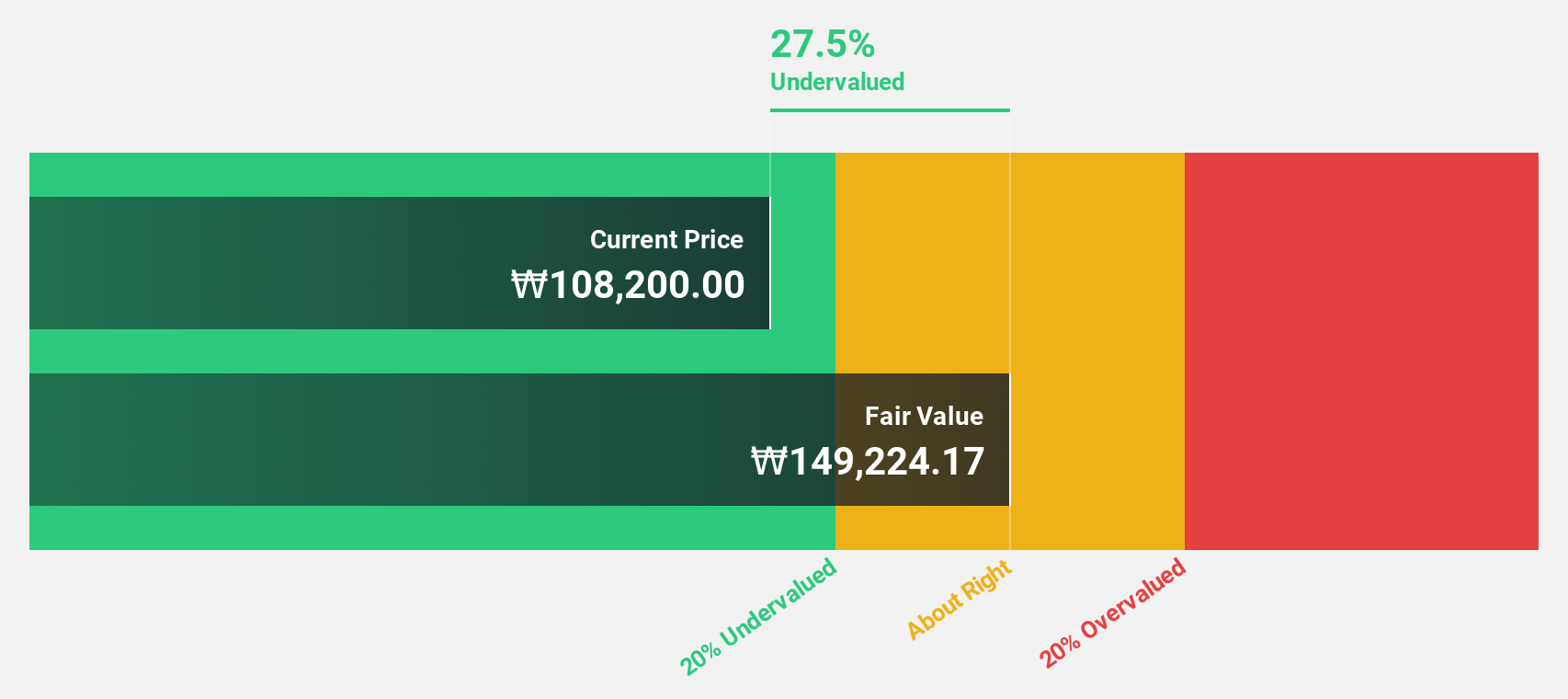

ST PharmLtd (KOSDAQ:A237690)

Overview: ST Pharm Co., Ltd. offers custom manufacturing services for active pharmaceutical ingredients and intermediates both in South Korea and internationally, with a market cap of ₩2.03 trillion.

Operations: The company's revenue segments include Raw Material Manufacturing, generating ₩236.78 billion, and Clinical Trial Site Consignment Research Institute, contributing ₩36.38 billion.

Estimated Discount To Fair Value: 33.4%

ST Pharm Ltd. is trading at ₩100,900, significantly below its estimated fair value of ₩151,524.60, indicating it may be undervalued based on cash flows. Despite recent shareholder dilution and high share price volatility, the company shows promising growth prospects with earnings expected to grow 40.3% annually—outpacing the Korean market's 29.3%. However, large one-off items have impacted financial results and its return on equity is forecasted to remain low at 12.6%.

- Upon reviewing our latest growth report, ST PharmLtd's projected financial performance appears quite optimistic.

- Navigate through the intricacies of ST PharmLtd with our comprehensive financial health report here.

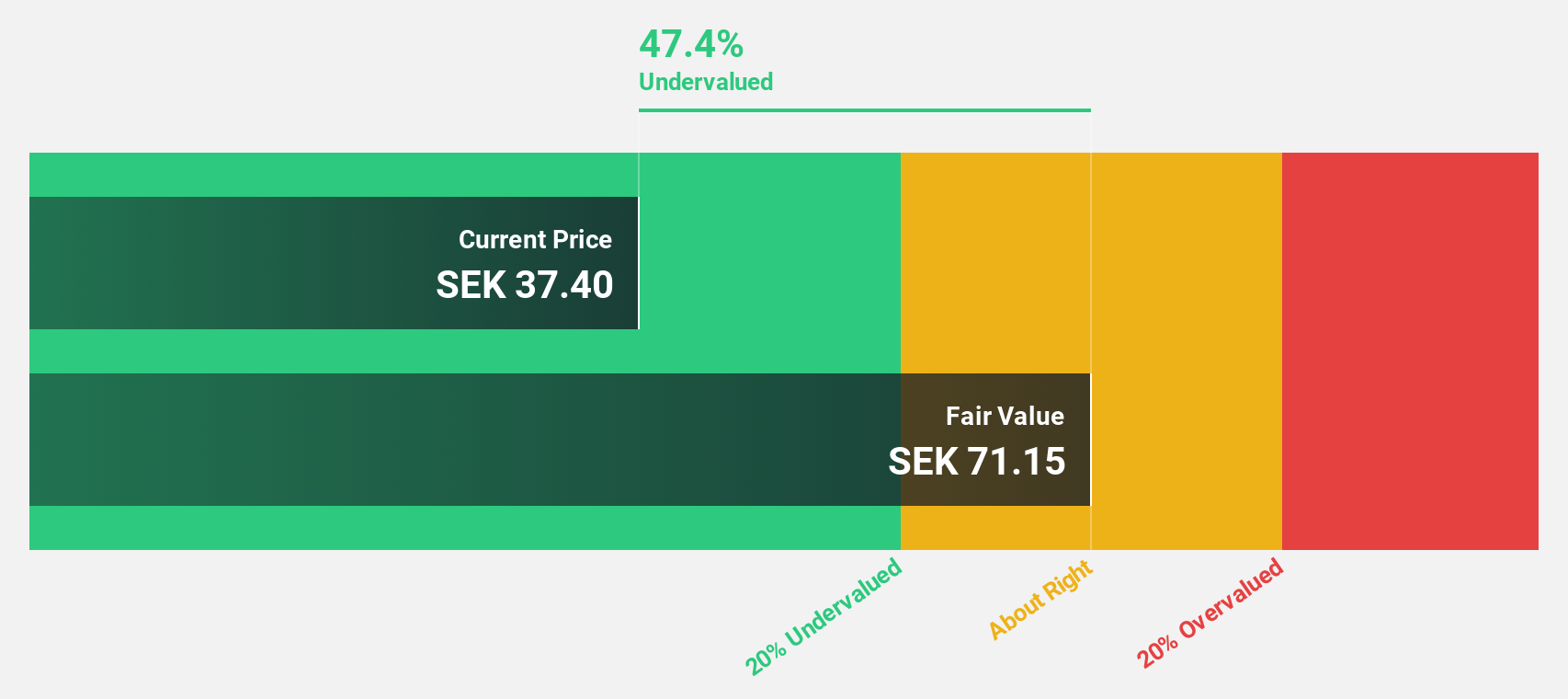

Fagerhult Group (OM:FAG)

Overview: Fagerhult Group AB, along with its subsidiaries, operates in the global market by manufacturing and selling professional lighting solutions, with a market capitalization of SEK11.02 billion.

Operations: The company's revenue segments include Premium at SEK2.87 billion, Collection at SEK3.91 billion, Professional at SEK1.03 billion, and Infrastructure at SEK843.90 million.

Estimated Discount To Fair Value: 38.6%

Fagerhult Group is trading at SEK62.5, well below its estimated fair value of SEK101.85, highlighting potential undervaluation based on cash flows. With expected earnings growth of 24.4% annually, surpassing the Swedish market's 15.7%, it presents a strong growth outlook despite slower revenue growth of 2.1%. Recent earnings show a decline in net income and sales compared to last year but align with strategic initiatives like M&A for future opportunities amidst challenging market conditions.

- Our expertly prepared growth report on Fagerhult Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Fagerhult Group stock in this financial health report.

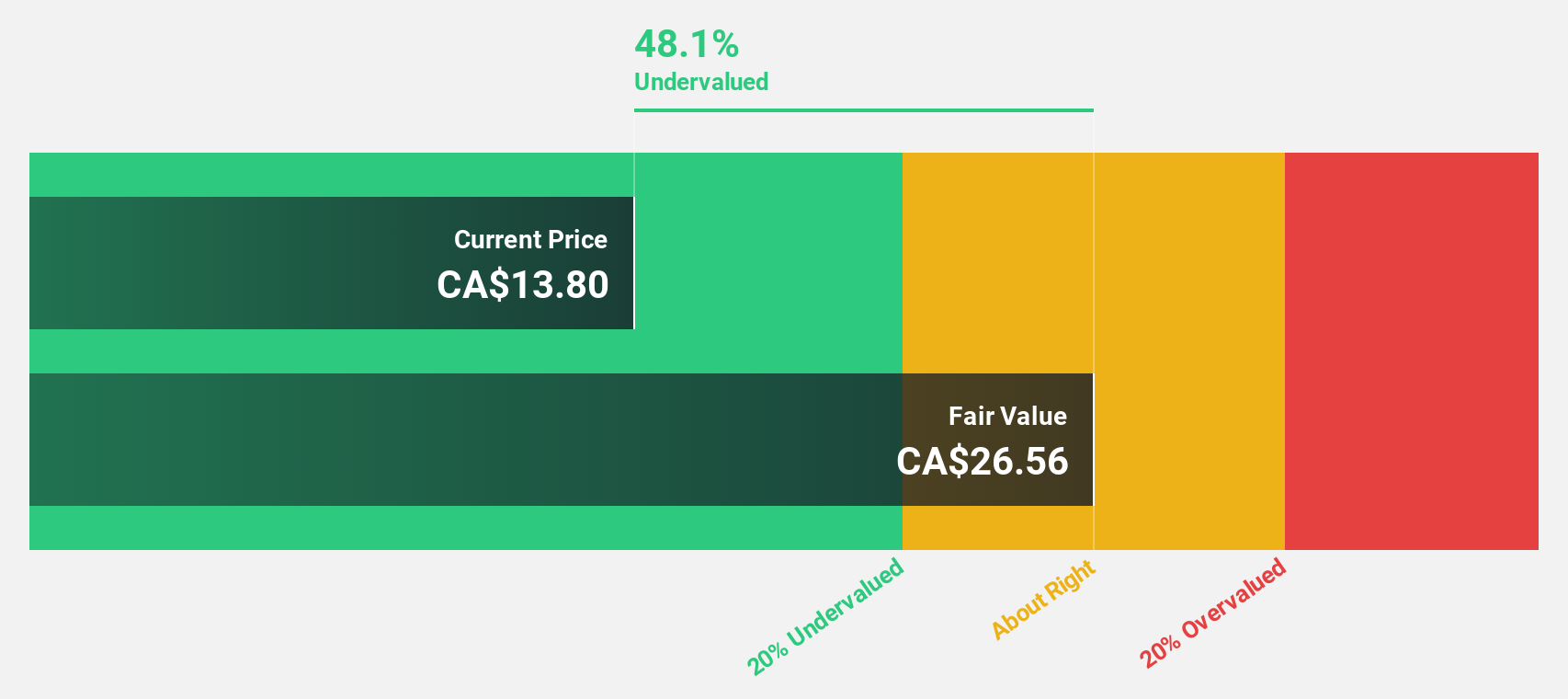

NuVista Energy (TSX:NVA)

Overview: NuVista Energy Ltd. operates in the exploration, development, and production of oil and natural gas reserves in the Western Canadian Sedimentary Basin with a market cap of CA$2.34 billion.

Operations: The company's revenue is primarily derived from its oil and gas exploration and production segment, which generated CA$1.23 billion.

Estimated Discount To Fair Value: 19.4%

NuVista Energy, trading at CA$11.57, is undervalued compared to its estimated fair value of CA$14.36. Despite a recent CEO transition announcement, the company maintains strong fundamentals with earnings expected to grow significantly at 45.1% annually, outpacing the Canadian market's growth rate of 16.2%. Analysts anticipate a 42.1% stock price increase, supported by robust cash flows and production gains in natural gas and condensate outputs from recent quarters.

- The growth report we've compiled suggests that NuVista Energy's future prospects could be on the up.

- Take a closer look at NuVista Energy's balance sheet health here in our report.

Key Takeaways

- Click here to access our complete index of 960 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FAG

Fagerhult Group

Engages in the manufacture and sale of professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.