- France

- /

- Consumer Durables

- /

- ENXTPA:KOF

European Dividend Stocks To Consider In November 2025

Reviewed by Simply Wall St

As European markets navigate the challenges of inflated AI stock valuations and shifting expectations for U.S. interest rates, investors are keenly observing how these factors influence broader market sentiment. In this environment, dividend stocks can offer a measure of stability and income, making them an attractive option for those seeking to balance risk with reliable returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★☆ |

| Sonae SGPS (ENXTLS:SON) | 3.98% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.13% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.74% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.11% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.54% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.64% | ★★★★★★ |

Click here to see the full list of 215 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

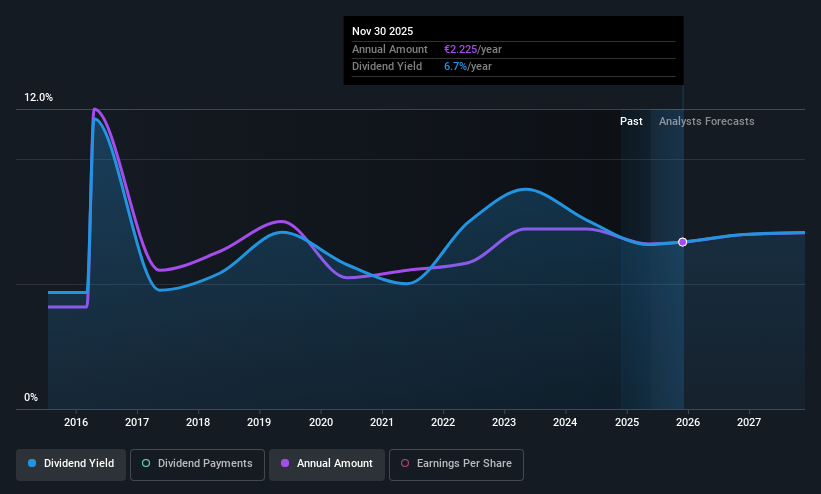

Azimut Holding (BIT:AZM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Azimut Holding S.p.A. operates in the asset management sector and has a market capitalization of €5.06 billion.

Operations: Azimut Holding S.p.A. generates its revenue primarily from the asset management segment, amounting to €1.48 billion.

Dividend Yield: 4.9%

Azimut Holding offers a dividend yield of 4.91%, placing it among the top 25% of Italian dividend payers, though its dividends have been volatile over the past decade. Despite a low payout ratio of 48.1%, dividends aren't covered by free cash flows, raising sustainability concerns. Recent earnings guidance upgrades and share repurchase plans suggest confidence in future performance, but historical volatility and lack of free cash flow coverage warrant careful consideration for dividend-focused investors.

- Take a closer look at Azimut Holding's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Azimut Holding shares in the market.

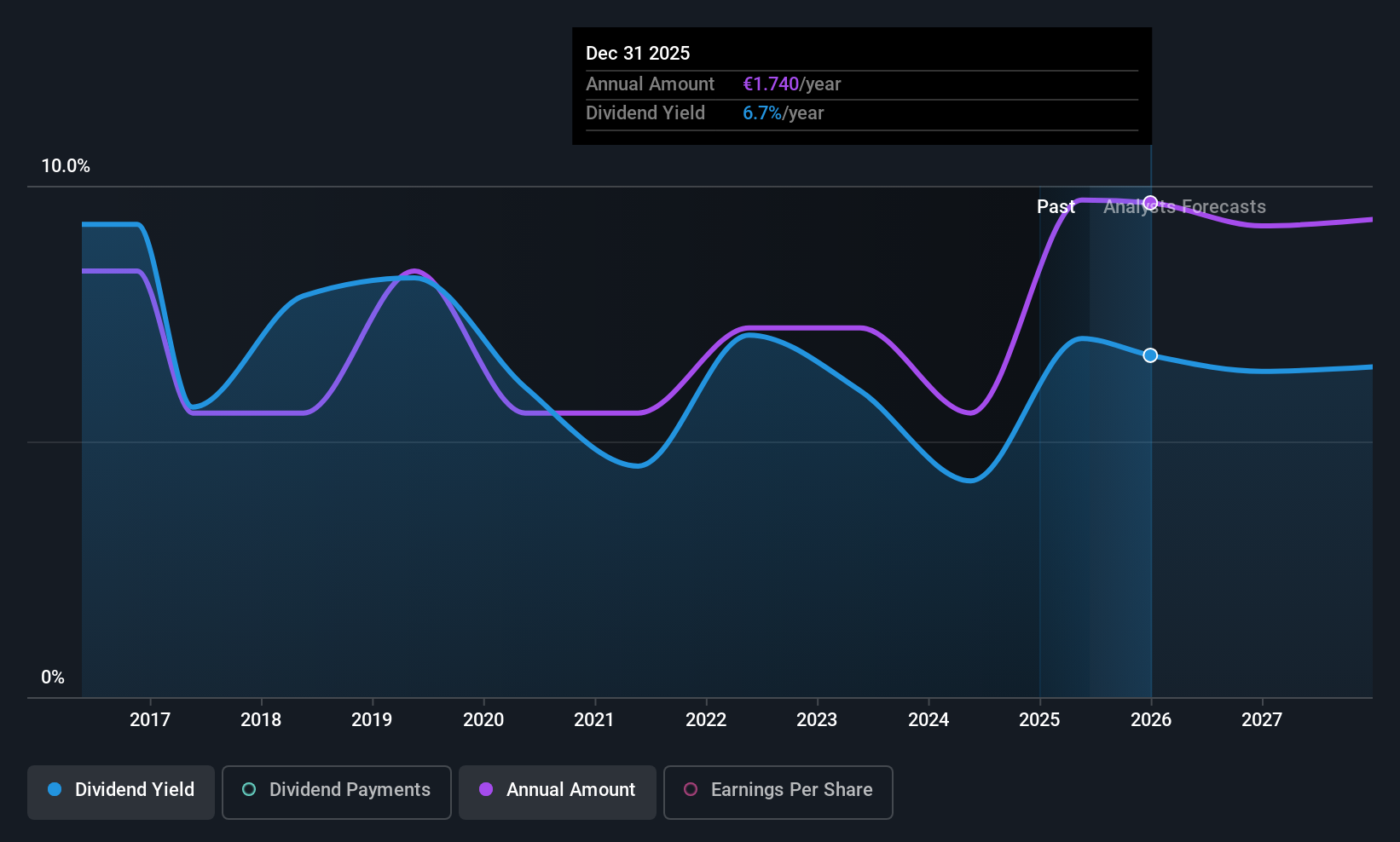

Kaufman & Broad (ENXTPA:KOF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kaufman & Broad S.A. is a property developer and builder operating in France with a market capitalization of €586.40 million.

Operations: Kaufman & Broad S.A. generates revenue primarily through its property development and building activities in France.

Dividend Yield: 7.4%

Kaufman & Broad offers a dividend yield of 7.36%, ranking it in the top 25% of French dividend payers, yet its dividends have been volatile over the past decade. The high payout ratio of 91.2% indicates dividends aren't well covered by earnings, although they are supported by cash flows with a low cash payout ratio of 17.9%. Recent guidance confirmed expected revenue growth of around 5% for 2025, reflecting stability in operations despite inconsistent dividend reliability.

- Click here to discover the nuances of Kaufman & Broad with our detailed analytical dividend report.

- According our valuation report, there's an indication that Kaufman & Broad's share price might be on the cheaper side.

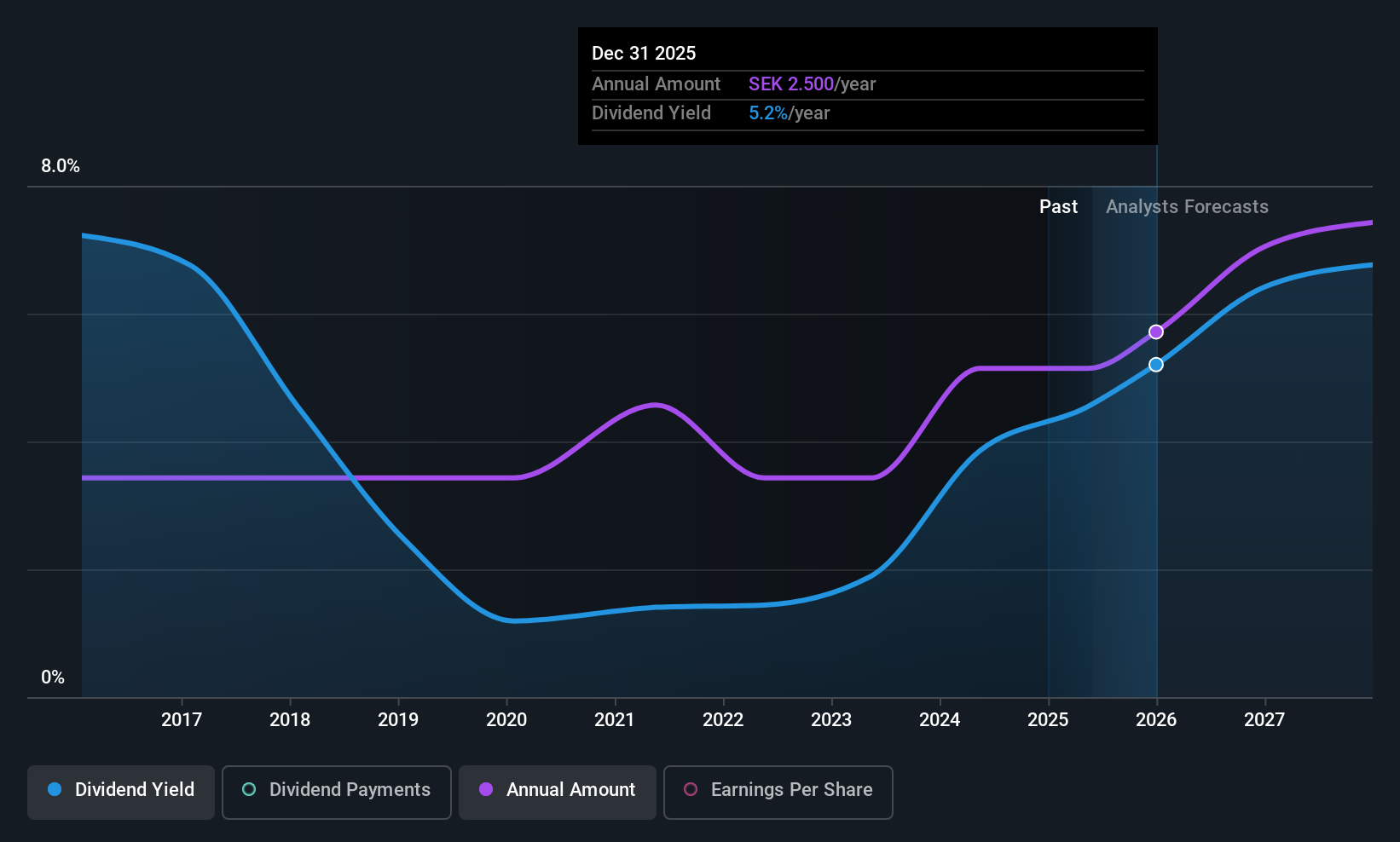

Eolus Aktiebolag (OM:EOLU B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eolus Aktiebolag (publ) is involved in the development, construction, and operation of renewable energy assets across several countries including Sweden, Finland, the United States, Poland, Spain, and the Baltic states with a market cap of approximately SEK1.03 billion.

Operations: Eolus Aktiebolag generates revenue primarily through its Project Development segment, amounting to SEK3.23 billion.

Dividend Yield: 5.4%

Eolus Aktiebolag offers a dividend yield of 5.43%, placing it in the top 25% of Swedish dividend payers, supported by a low payout ratio of 20.5%. Despite this, its dividends have been volatile over the past decade. Recent earnings reports showed substantial revenue growth but continued net losses, indicating financial challenges that may impact future dividend stability and reliability despite current coverage by cash flows and earnings.

- Dive into the specifics of Eolus Aktiebolag here with our thorough dividend report.

- Our expertly prepared valuation report Eolus Aktiebolag implies its share price may be lower than expected.

Next Steps

- Embark on your investment journey to our 215 Top European Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaufman & Broad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KOF

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026