- Japan

- /

- Specialty Stores

- /

- TSE:5889

Discovering 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive sentiment around domestic policy and geopolitical developments, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. In this environment of robust market activity and economic shifts, identifying stocks that are potentially undervalued can offer a unique opportunity for investors seeking to enhance their portfolios amidst prevailing market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HangzhouS MedTech (SHSE:688581) | CN¥62.38 | CN¥124.04 | 49.7% |

| Pan African Resources (AIM:PAF) | £0.3735 | £0.75 | 49.9% |

| Iguatemi (BOVESPA:IGTI3) | R$2.25 | R$4.49 | 49.8% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.33 | US$46.41 | 49.7% |

| Elekta (OM:EKTA B) | SEK61.50 | SEK122.95 | 50% |

| Adtraction Group (OM:ADTR) | SEK38.40 | SEK76.45 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Privia Health Group (NasdaqGS:PRVA) | US$21.66 | US$43.17 | 49.8% |

| Genesis Minerals (ASX:GMD) | A$2.41 | A$4.82 | 50% |

| Akeso (SEHK:9926) | HK$66.50 | HK$132.56 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

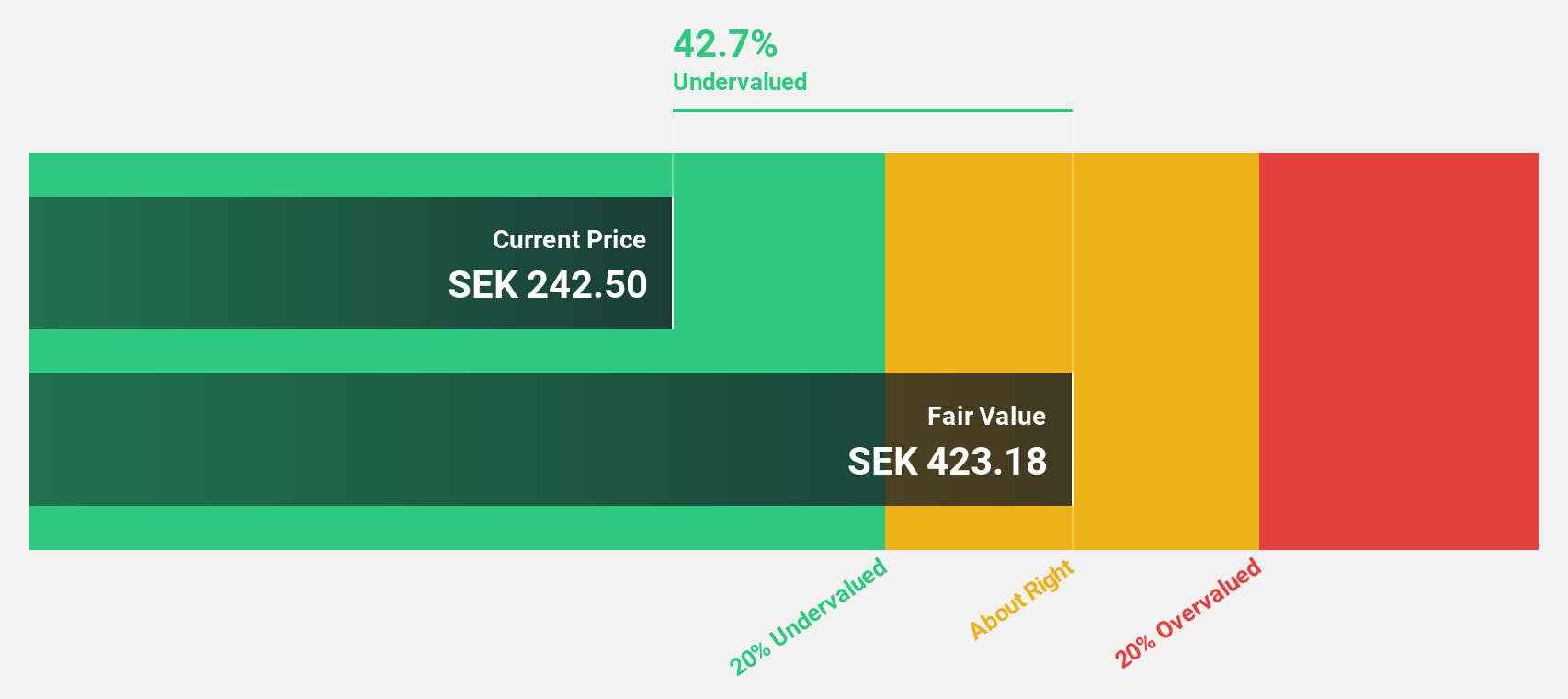

CTT Systems (OM:CTT)

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.48 billion.

Operations: The company generates revenue from its Aerospace & Defense segment, amounting to SEK301.40 million.

Estimated Discount To Fair Value: 19.3%

CTT Systems is trading at SEK278, below its estimated fair value of SEK344.63, suggesting it may be undervalued based on cash flows. Despite recent lowered sales guidance for late 2024 and a drop in Q3 net income to SEK12.2 million from SEK25.3 million a year ago, CTT's revenue and earnings are forecast to grow significantly faster than the Swedish market, with expected annual profit growth of 33.3% and high projected return on equity at 44.1%.

- The analysis detailed in our CTT Systems growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of CTT Systems stock in this financial health report.

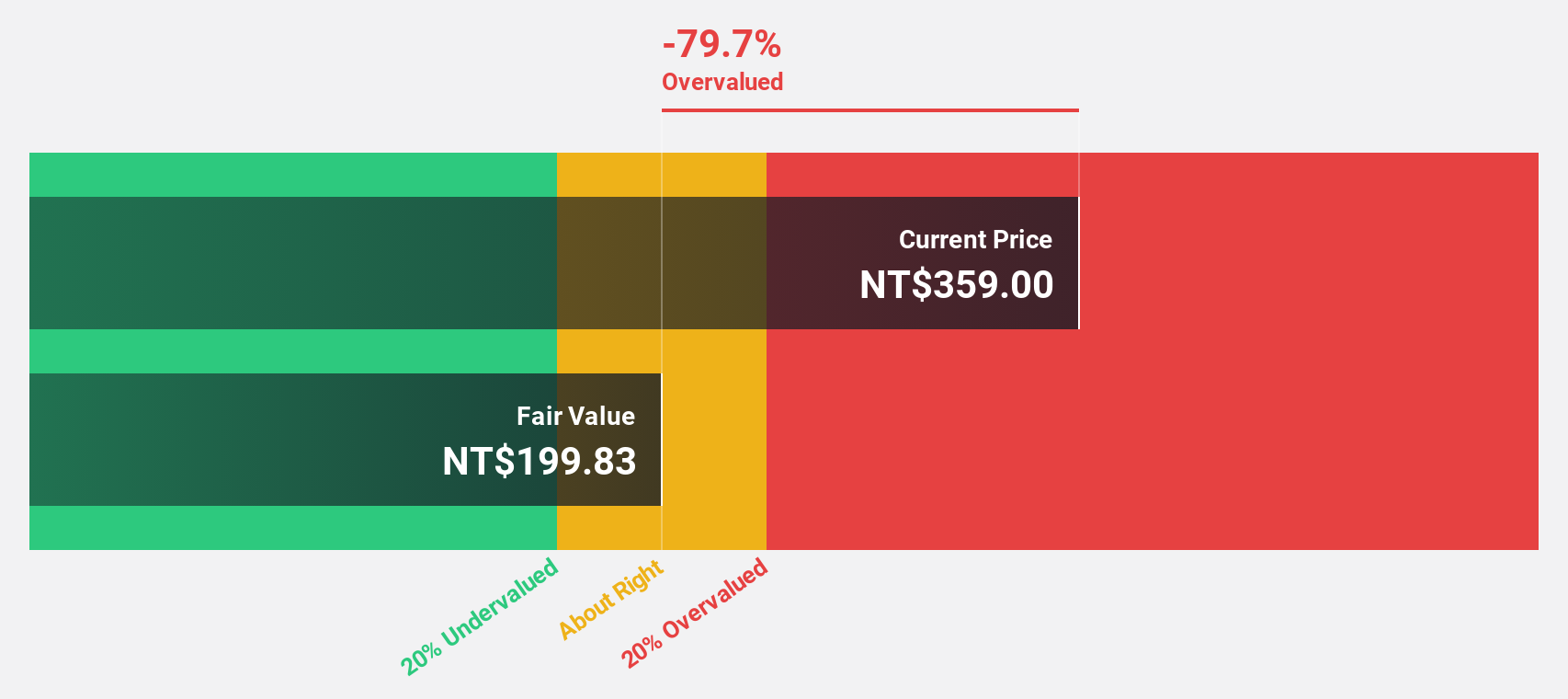

All Ring Tech (TPEX:6187)

Overview: All Ring Tech Co., Ltd. designs, manufactures, and assembles automation machines in Taiwan and China, with a market cap of NT$43.28 billion.

Operations: The company's revenue segments include NT$684.53 million from WAN Run Jing Ji Co., Ltd. and NT$4.40 billion from All Ring Technology Co., Ltd.

Estimated Discount To Fair Value: 39.7%

All Ring Tech is trading at NT$453, below its estimated fair value of NT$751.66, reflecting potential undervaluation based on cash flows. The company reported a significant increase in earnings, with net income rising to TWD 452.23 million from TWD 28.76 million year-on-year in Q3 2024. Despite recent shareholder dilution and high share price volatility, its revenue and earnings are expected to grow significantly faster than the Taiwanese market over the next three years.

- Our growth report here indicates All Ring Tech may be poised for an improving outlook.

- Navigate through the intricacies of All Ring Tech with our comprehensive financial health report here.

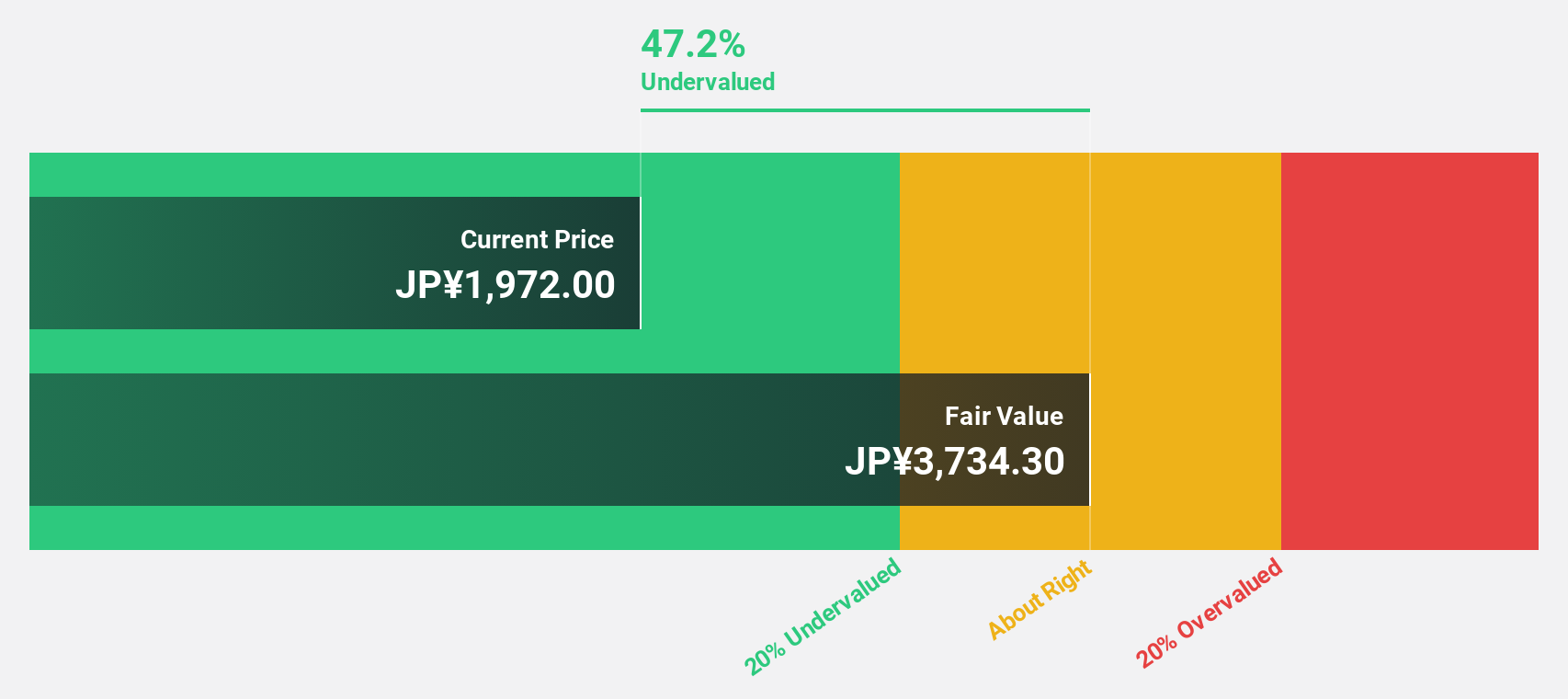

Japan Eyewear Holdings (TSE:5889)

Overview: Japan Eyewear Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on the planning, designing, manufacturing, wholesaling, and retailing of eyewear products with a market cap of ¥69.22 billion.

Operations: The company's revenue segments include Four Nines, contributing ¥5.50 billion, and Kaneko Glasses, contributing ¥9.93 billion.

Estimated Discount To Fair Value: 27.7%

Japan Eyewear Holdings is trading at ¥2,878, below its estimated fair value of ¥3,978.88, indicating potential undervaluation based on cash flows. Despite a high level of debt and recent share price volatility, the company shows promising growth prospects with earnings expected to increase by 13.8% annually—outpacing the Japanese market's growth rate. Additionally, its inclusion in the S&P Global BMI Index highlights its growing recognition in global markets.

- Insights from our recent growth report point to a promising forecast for Japan Eyewear Holdings' business outlook.

- Take a closer look at Japan Eyewear Holdings' balance sheet health here in our report.

Next Steps

- Delve into our full catalog of 888 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5889

Japan Eyewear Holdings

Through its subsidiaries, engages in the planning, designing, manufacturing, wholesaling, and retailing of eyewear products in Japan.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives