- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A033240

Discover Jahwa Electronics And 2 Other Leading Growth Stocks With Insider Ownership

Reviewed by Simply Wall St

In the midst of a busy earnings season, global markets have experienced some volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before pulling back. Despite this turbulence, growth stocks have generally lagged behind value shares due to cautious earnings reports from key tech giants. In such an environment, identifying growth companies with high insider ownership can be particularly appealing as it often signals confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Jahwa Electronics (KOSE:A033240)

Simply Wall St Growth Rating: ★★★★☆☆

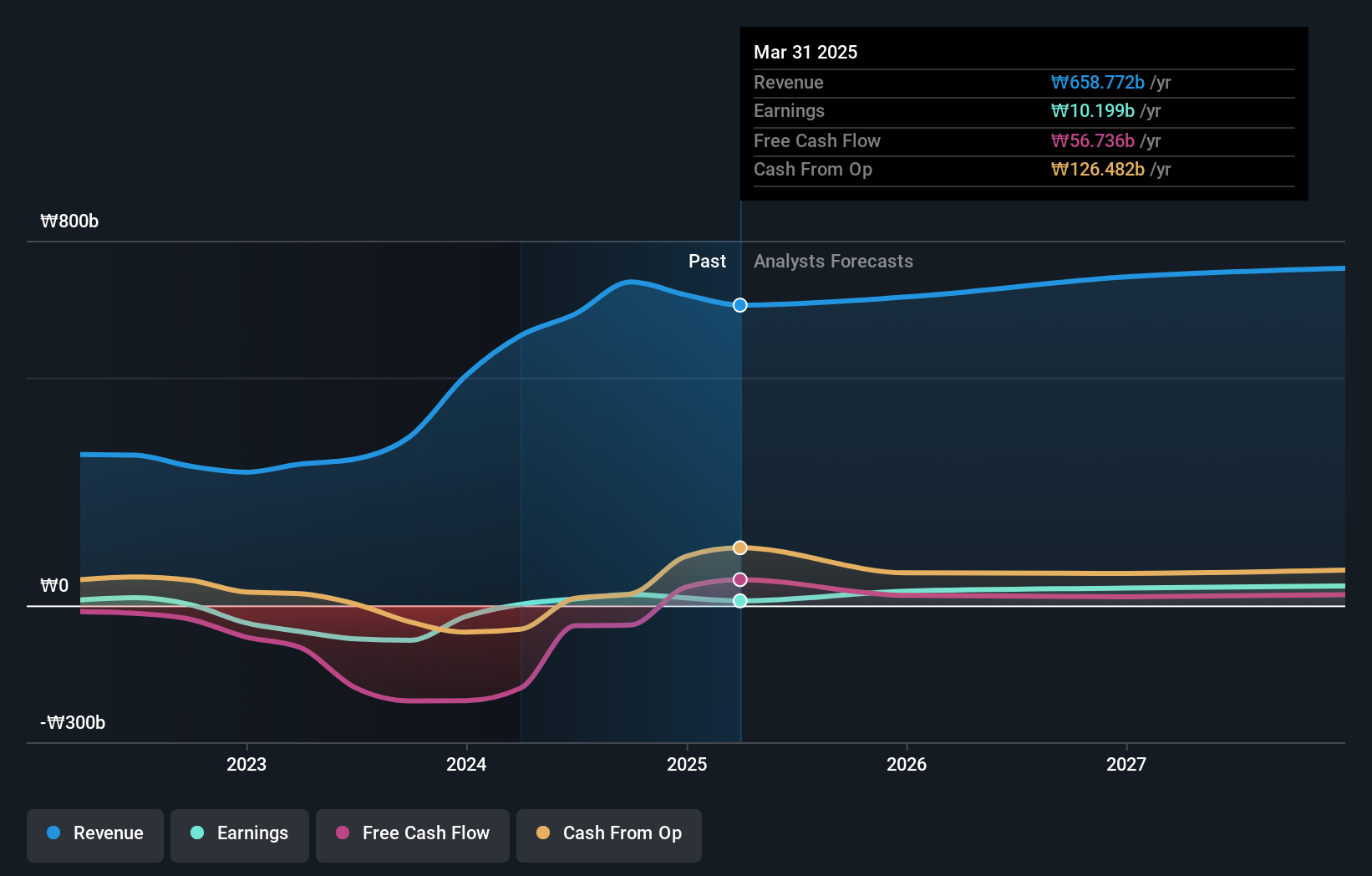

Overview: Jahwa Electronics Co., Ltd is a company that manufactures and sells precision electronic components both in South Korea and internationally, with a market cap of ₩344.55 billion.

Operations: The company generates revenue of ₩639.33 billion from the manufacturing and sales of mobile phone parts and other electronic components.

Insider Ownership: 22.4%

Jahwa Electronics is experiencing significant earnings growth, with forecasts of 39.1% annually, outpacing the KR market's 29.5%. Although revenue growth at 15.6% annually is slower than some high-growth peers, it surpasses the market average of 10%. The company recently became profitable and shows no substantial insider trading activity over the past three months. However, its return on equity is projected to remain low at 12.3% in three years.

- Click to explore a detailed breakdown of our findings in Jahwa Electronics' earnings growth report.

- According our valuation report, there's an indication that Jahwa Electronics' share price might be on the expensive side.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

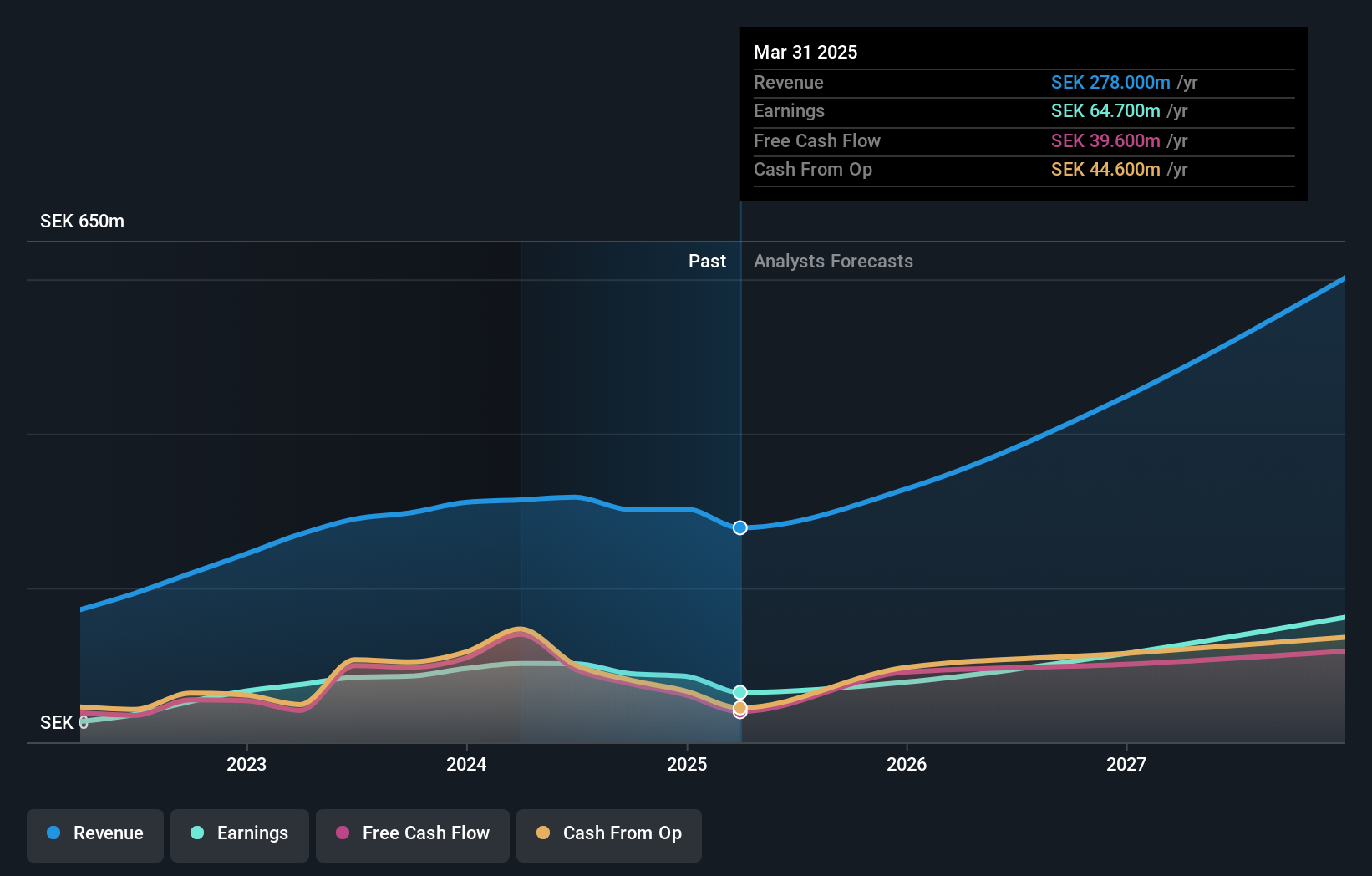

Overview: CTT Systems AB (publ) specializes in designing, manufacturing, and selling humidity control systems for aircraft across Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.12 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling SEK301.40 million.

Insider Ownership: 16.9%

CTT Systems is poised for substantial growth, with earnings projected to increase by 33.3% annually, outpacing the Swedish market's 15.6%. Revenue is expected to grow at 24.2% per year, significantly above the market average of 0.03%. Despite trading at a discount of 30.6% below its estimated fair value, recent guidance adjustments indicate challenges, as net sales forecasts were lowered for late 2024. No significant insider trading was reported recently.

- Click here to discover the nuances of CTT Systems with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, CTT Systems' share price might be too pessimistic.

Qingmu Tec (SZSE:301110)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Qingmu Tec Co., Ltd. specializes in providing brand retail solutions and has a market cap of CN¥3.69 billion.

Operations: Revenue Segments (in millions of CN¥):

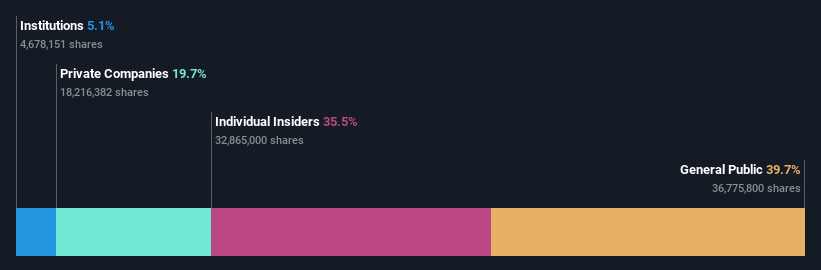

Insider Ownership: 35.5%

Qingmu Tec demonstrates strong growth potential, with earnings projected to rise 46.19% annually, surpassing the Chinese market's 26.1%. Revenue is forecasted to grow at 28.8% per year, significantly above the market average of 14%. Recent earnings for nine months ended September 2024 showed sales of CNY 807.96 million and net income of CNY 72.23 million, reflecting substantial improvement from the previous year. No significant insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of Qingmu Tec stock in this growth report.

- Upon reviewing our latest valuation report, Qingmu Tec's share price might be too optimistic.

Turning Ideas Into Actions

- Click here to access our complete index of 1527 Fast Growing Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Jahwa Electronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A033240

Jahwa Electronics

Manufactures and sells precision electronic components in South Korea and internationally.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives