- Sweden

- /

- Trade Distributors

- /

- OM:BUFAB

3 Undiscovered European Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As the European market grapples with concerns over inflated AI stock valuations and shifting interest rate expectations, the pan-European STOXX Europe 600 Index recently experienced a notable decline. Amid this backdrop, discovering stocks that offer resilience and potential growth can be crucial for enhancing portfolio diversity.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.27% | 22.67% | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

BASSAC Société anonyme (ENXTPA:BASS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BASSAC Société anonyme is a real estate development company active in France, Belgium, Germany, and Spain with a market cap of €800.55 million.

Operations: Revenue is primarily generated through real estate development activities across France, Belgium, Germany, and Spain. The company focuses on various segments within the real estate market to drive its revenue streams.

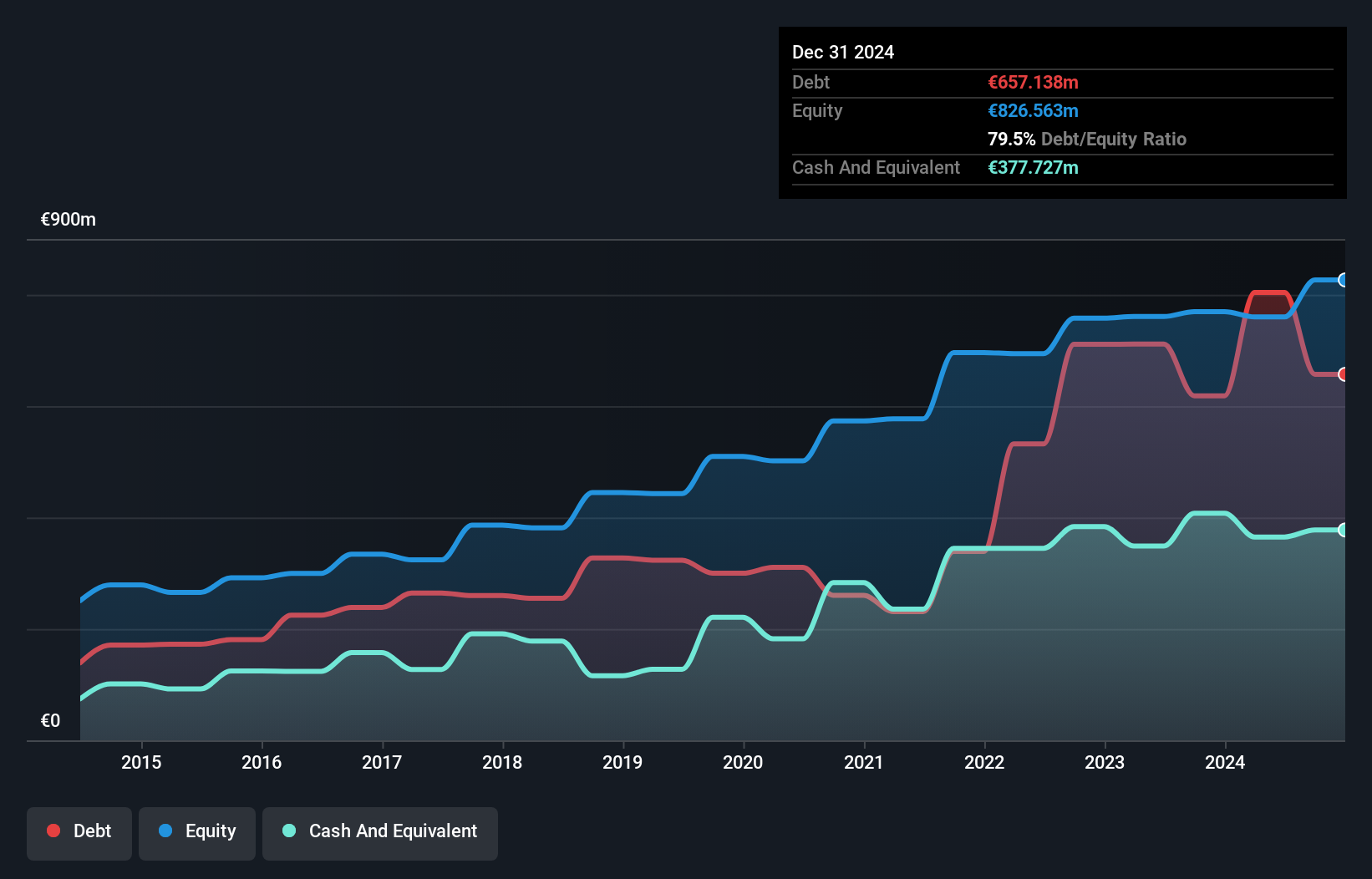

BASSAC Société anonyme has demonstrated impressive earnings growth of 76.7% over the past year, significantly outpacing the Real Estate industry average of 3.8%. Trading at 40.2% below its estimated fair value, it presents a compelling valuation opportunity. The company's net debt to equity ratio stands at a satisfactory 23.4%, with interest payments well covered by EBIT at a ratio of 5.8x, indicating strong financial health despite an increase in debt to equity from 61.9% to 81.2% over five years. While earnings have declined by an average of 9.5% annually over five years, recent performance suggests potential for recovery and growth within the sector.

- Navigate through the intricacies of BASSAC Société anonyme with our comprehensive health report here.

Evaluate BASSAC Société anonyme's historical performance by accessing our past performance report.

Bufab (OM:BUFAB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bufab AB (publ) is a trading company that offers procurement, quality assurance, and logistics solutions for c-parts and technical components globally, with a market cap of SEK18.36 billion.

Operations: Bufab generates revenue primarily from its operations in Europe North & East (SEK2.86 billion) and Europe West (SEK2.15 billion), with additional contributions from the UK/Ireland, Americas, and Asia-Pacific regions. The company's financial performance is influenced by its diverse geographical presence and the varying demand across these markets.

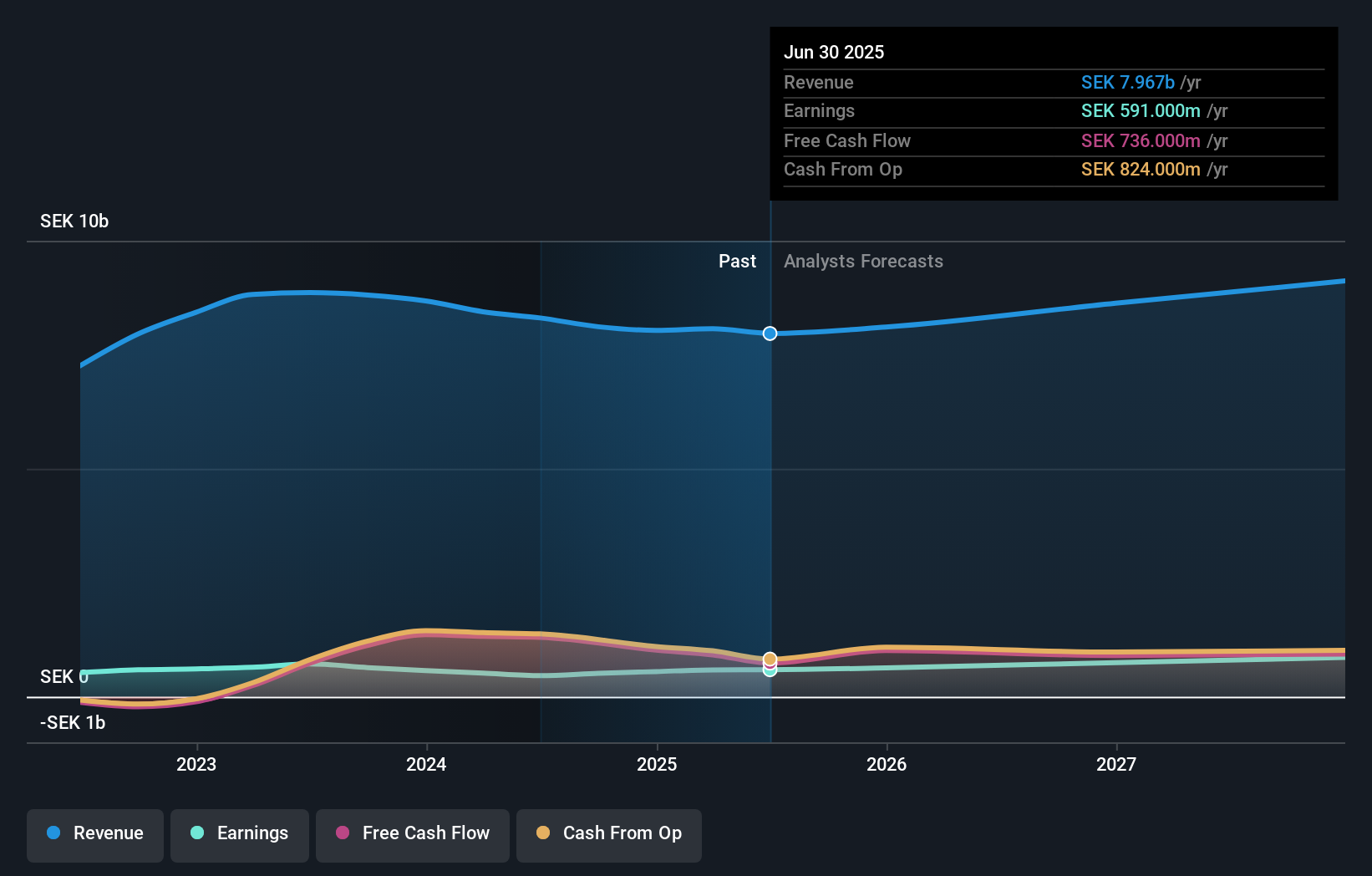

Bufab, a nimble player in the trading sector, has been making waves with its strategic moves and financial performance. The company's earnings grew by 14.9% last year, outpacing the industry average of -3.4%, while trading at 19.7% below its estimated fair value presents a compelling valuation case. Bufab's debt to equity ratio has improved from 88.8% to 64.6% over five years, although its net debt to equity ratio remains high at 59.1%. Recent agreements like the one with Babcock International bolster its growth prospects, alongside robust free cash flow of SEK1,219 million as of September 2025 and well-covered interest payments (5.1x EBIT).

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with communication impairments, with a market capitalization of approximately SEK9.81 billion.

Operations: Dynavox Group generates revenue primarily from its Computer Hardware segment, amounting to SEK2.38 billion.

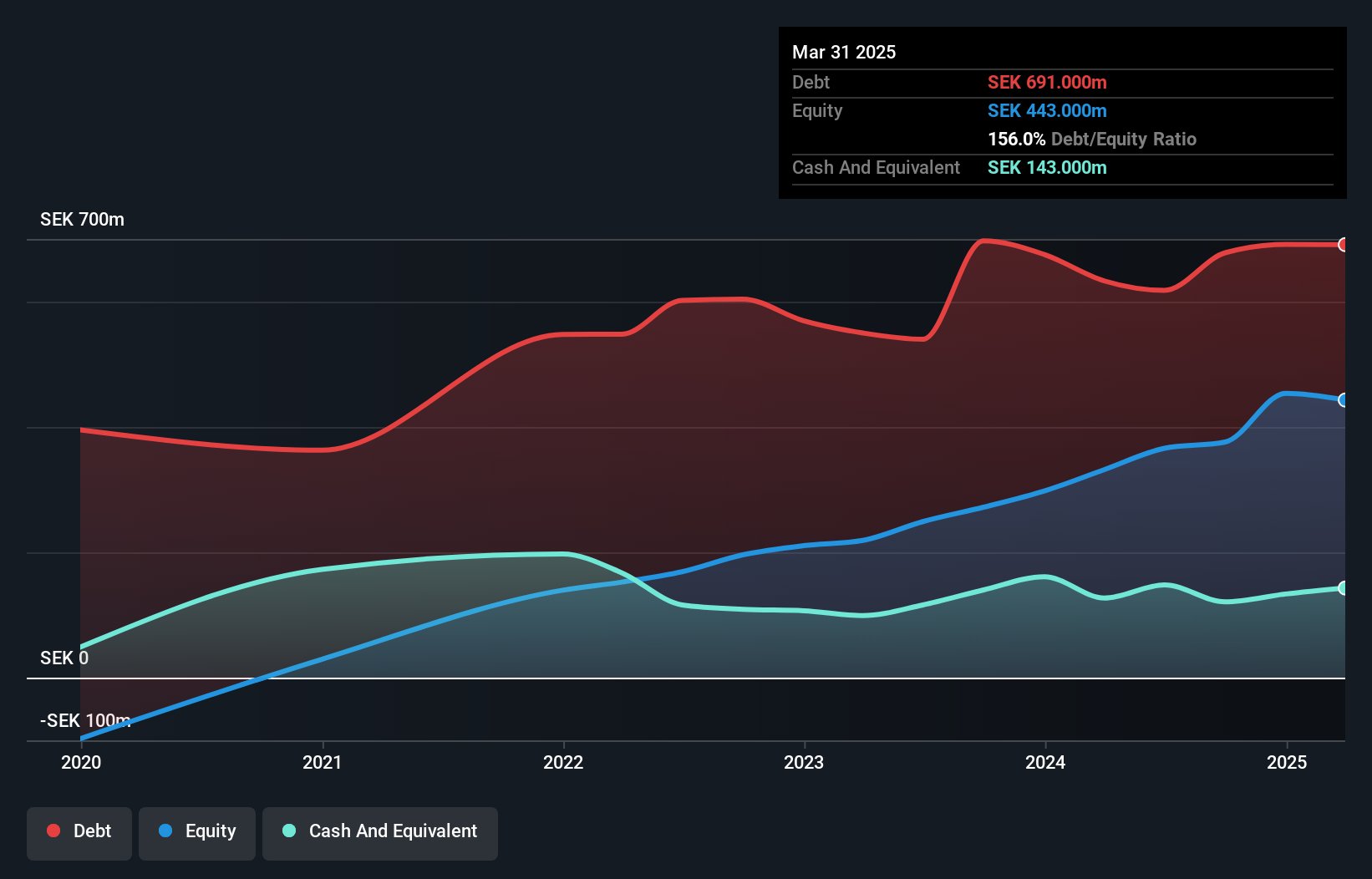

Dynavox Group has been making strides in the tech industry, with its earnings growing by 4.9% over the past year, surpassing the sector's -8.6%. Despite trading at 53.6% below its estimated fair value, it faces challenges like a high net debt to equity ratio of 134.9%. The company reported third-quarter sales of SEK606 million, up from SEK483 million last year, although net income dipped to SEK38 million from SEK45 million. With a forecasted annual earnings growth rate of 38.35%, Dynavox is poised for significant expansion as it taps into international markets and enhances operational efficiencies.

Turning Ideas Into Actions

- Investigate our full lineup of 314 European Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bufab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BUFAB

Bufab

A trading company, provides solutions for procurement, quality assurance, and logistics for c-parts and technical components in Sweden, Denmark, the United States, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success