Do Beijer Alma's (STO:BEIA B) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Beijer Alma (STO:BEIA B). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Beijer Alma

Beijer Alma's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Beijer Alma managed to grow EPS by 11% per year, over three years. That's a pretty good rate, if the company can sustain it.

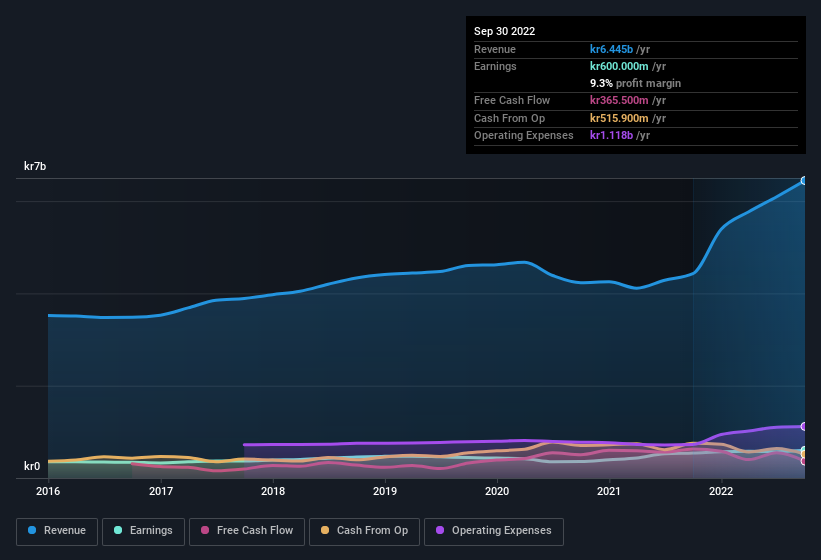

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Beijer Alma's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Beijer Alma's future profits.

Are Beijer Alma Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Beijer Alma insiders walking the walk, by spending kr3.7m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the President & CEO, Henrik Perbeck, who made the biggest single acquisition, paying kr823k for shares at about kr228 each.

The good news, alongside the insider buying, for Beijer Alma bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enviable stake in the company, worth kr1.3b. Coming in at 13% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

Is Beijer Alma Worth Keeping An Eye On?

One positive for Beijer Alma is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. You still need to take note of risks, for example - Beijer Alma has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Beijer Alma, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Alma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BEIA B

Beijer Alma

Engages in component manufacturing and industrial trading businesses in Sweden, rest of Nordic Region, rest of Europe, North America, Asia, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives