The ASSA ABLOY (STO:ASSA B) Share Price Is Up 74% And Shareholders Are Holding On

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the ASSA ABLOY share price has climbed 74% in five years, easily topping the market return of 18% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 7.7%, including dividends.

See our latest analysis for ASSA ABLOY

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, ASSA ABLOY actually saw its EPS drop 10% per year. Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

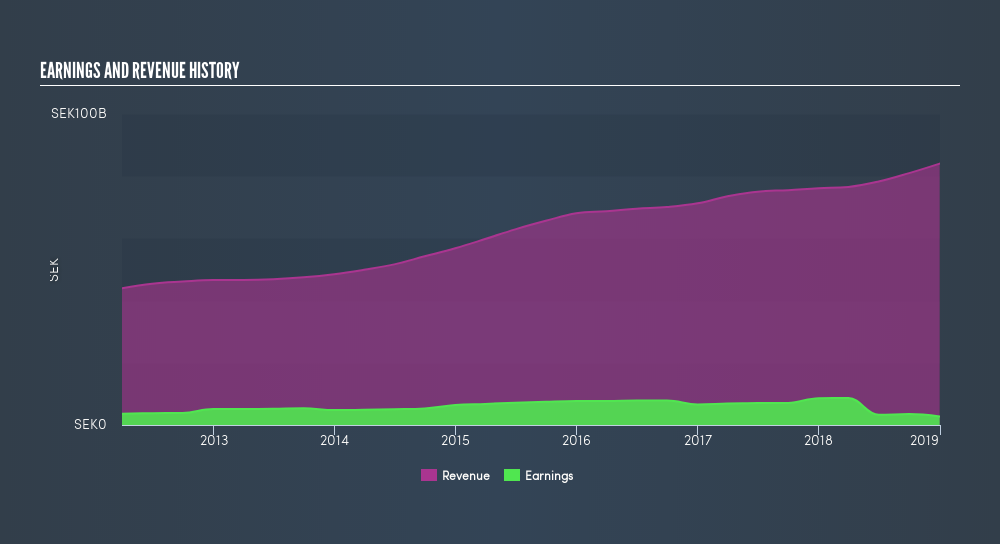

The modest 1.8% dividend yield is unlikely to be propping up the share price. In contrast revenue growth of 9.8% per year is probably viewed as evidence that ASSA ABLOY is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This freereport showing analyst forecasts should help you form a view on ASSA ABLOY

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for ASSA ABLOY the TSR over the last 5 years was 88%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that ASSA ABLOY shareholders have received a total shareholder return of 7.7% over the last year. And that does include the dividend. However, that falls short of the 13% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

ASSA ABLOY is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OM:ASSA B

ASSA ABLOY

Provides door opening and access products for the institutional, commercial, and residential markets.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives