Assessing ASSA ABLOY (OM:ASSA B) Valuation as Market Consolidation Draws Investor Interest

Reviewed by Kshitija Bhandaru

ASSA ABLOY (OM:ASSA B) might not be making headlines with splashy announcements this week, but recent price movements could still have investors paying closer attention. With the stock drifting slightly lower over the past month, some holders may be wondering whether the market is signaling something beneath the surface or simply reflecting a period of consolidation. When a well-established company like ASSA ABLOY goes through quieter spells, it often opens the door to conversations about intrinsic value rather than daily news flow.

Looking at the broader picture, ASSA ABLOY’s share price momentum has shifted several times through the year. While the stock is basically flat year to date and down modestly from last year, its three-year return delivers significant growth for long-term holders. This is especially notable considering annual revenue and net income have both grown at a decent pace, which points to underlying business strength despite recent softness in the share price. The stock’s trajectory shows renewed gains in the past three months after a choppy start to the year.

With the spotlight off and valuations now front and center, investors may be considering whether this is a chance to get in before momentum builds again or if the market is already anticipating future growth for ASSA ABLOY.

Most Popular Narrative: 7.5% Undervalued

The leading narrative suggests that ASSA ABLOY is trading at a discount to its estimated fair value, with analysts projecting further upside if growth and margin assumptions materialize. A modest gap between the current share price and analyst consensus signals cautious optimism rather than runaway conviction.

The increasing adoption of digital access, smart building solutions, and IoT-driven access control is positively impacting ASSA ABLOY's high-margin Global Technologies and digital product lines. This is evidenced by double-digit growth in the specification business, continued digital hardware rollouts, and strategic partnerships (for example, SKIDATA with Samsung), supporting future revenue mix shift and margin expansion.

Want to know why analysts are pricing in a premium for what looks like an old-world capital goods leader? There is a set of bold forecasts behind this verdict, such as changing industry mix, robust cash generation, and a forward profit multiple that rivals much-hyped sectors. Curious which levers and future numbers make this price target tick? The full narrative doesn’t just hint at steady growth; it unveils the surprisingly optimistic projections that could change minds.

Result: Fair Value of SEK356 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained weakness in residential construction or slower than expected digital adoption could quickly dampen the upbeat outlook that now surrounds ASSA ABLOY’s share price.

Find out about the key risks to this ASSA ABLOY narrative.Another View: Discounted Cash Flow Model Offers a Deeper Insight

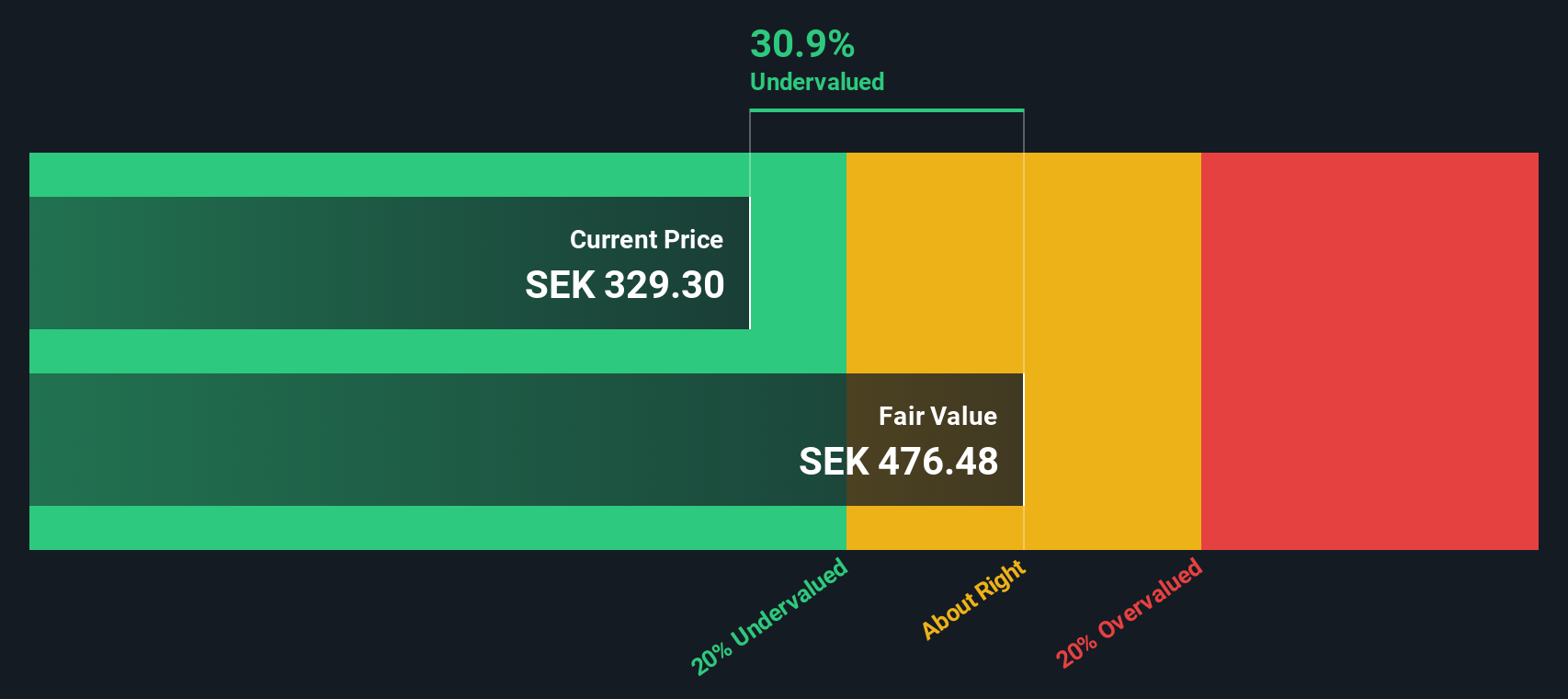

While analyst targets suggest ASSA ABLOY is modestly undervalued, our DCF model paints an even more optimistic picture, indicating the market could be discounting future cash flows more than fundamentals warrant. Does this second method point to a true opportunity, or is the gap simply another market quirk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASSA ABLOY for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASSA ABLOY Narrative

If these views don’t quite align with your own thinking, or if you want to dig into the numbers and tell the story your way, you can assemble your own conclusions in just a few minutes. Do it your way.

A great starting point for your ASSA ABLOY research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t settle for the usual picks when there are countless market movers just waiting for attention. Use these curated strategies to find stocks with exciting potential before the crowd catches on.

- Supercharge your portfolio with steady income by tapping into dividend stocks with yields > 3% that consistently deliver strong yields above 3%.

- Uncover hidden gems showing real value for savvy investors through undervalued stocks based on cash flows that stand out for their compelling cash flow fundamentals.

- Position yourself ahead of major trends by finding AI penny stocks engineered to capitalize on breakthroughs in artificial intelligence and next-generation automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ASSA B

ASSA ABLOY

Provides door opening and access products for the institutional, commercial, and residential markets.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives