ASSA ABLOY (OM:ASSA B) Margin Miss Reinforces Investor Caution Despite Strong Growth Forecasts

Reviewed by Simply Wall St

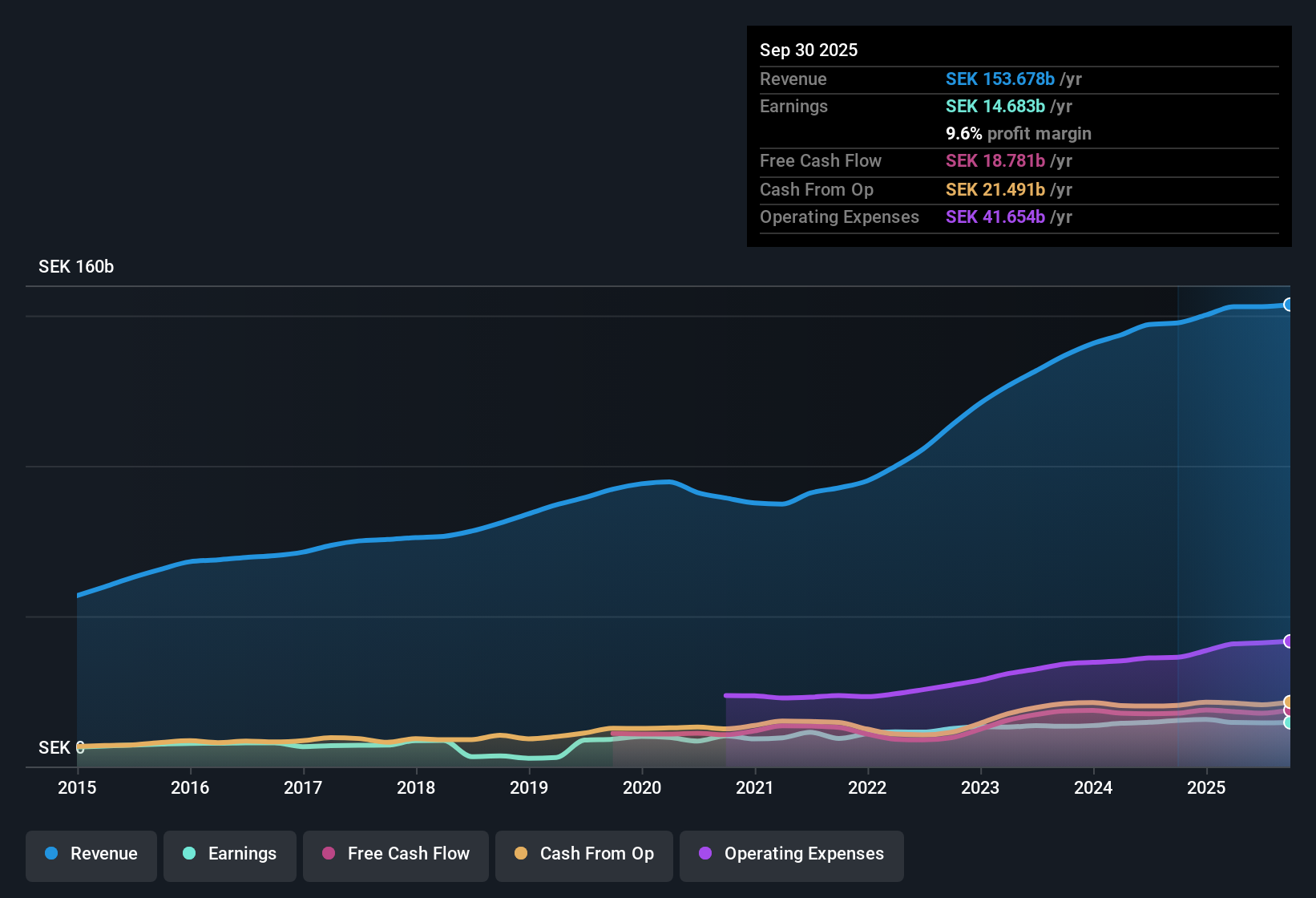

ASSA ABLOY (OM:ASSA B) reported a net profit margin of 9.6%, down from 10.4% a year ago, with annual earnings growing by 9.7% on average over the past five years. While last year's earnings growth was negative and not comparable to the longer-term trend, analysts now expect revenue to climb 6.7% per year and earnings to expand at a solid 12.1% per year moving forward. With the stock trading below fair value estimates and against a backdrop of continued profit and revenue growth, investors will be weighing the company’s ability to sustain these trends against concerns about its financial position as earnings discussions progress.

See our full analysis for ASSA ABLOY.Next, we will compare these headline results with the prevailing narratives around ASSA ABLOY to see which expectations hold up and which might need a second look.

See what the community is saying about ASSA ABLOY

Margins Projected to Bounce Back

- Profit margins are expected to rise from 9.5% now to 11.6% within three years, signaling meaningful improvement after the recent dip.

- Analysts' consensus view argues that operational efficiencies from automation and targeted acquisitions will sustain margins and support higher-quality earnings.

- These efficiency gains, visible in operating leverage of 53% in Q2 and margin resilience in Global Technologies, support the expectation that the company can rebound to the upper end of historical margin ranges even in a tougher environment.

- However, consensus notes that persistent weakness in key geographies and delays in integrating new acquisitions could still create headwinds. This margin expansion remains dependent on effective execution and market recovery.

- Consistent with these margin forecasts, consensus highlights that robust order pipelines, especially in logistics and perimeter security, lend confidence that current margin pressures are temporary rather than permanent.

See how margin and quality debates play out across the full consensus narrative: 📊 Read the full ASSA ABLOY Consensus Narrative.

Revenue Growth Outpacing the Market

- ASSA ABLOY’s revenue is expected to increase at 6.7% per year, comfortably outpacing the Swedish market’s 3.3% forecast for the same period.

- According to the analysts' consensus view, continued growth in non-residential construction, rising demand for digital access, and a steady stream of acquisitions set the stage for revenue momentum above its local market.

- The increasing adoption of smart building solutions has contributed to double-digit growth in Global Technologies, and targeted deals like TeleAlarm are broadening the company’s service offerings and recurring revenue base.

- Yet, the consensus points out that structural soft spots, such as slow residential recovery in China and Europe, could mute portions of the top-line upside unless digital adoption and cross-market demand accelerate as expected.

Trading Below DCF Fair Value

- The current share price is SEK359.90, notably lower than the DCF fair value estimate of SEK484.03 and below the analyst price target of SEK363.33.

- The analysts' consensus view strongly supports the case that ASSA ABLOY is attractively valued compared to both its peer average P/E of 33.2x and its DCF fair value, but cautions that the company still trades at a premium to the broader European Building industry, which averages 26.7x P/E.

- With a modest 7.4% gap between the current share price and the analyst consensus price target, belief in the company’s ability to hit earnings projections and maintain growth justifies the valuation for many. Some skepticism may remain until profit margins recover more convincingly.

- The fair value advantage gives investors a margin of safety, but the consensus notes this cushion is not outsized. This means execution on margin and revenue goals will remain under close watch.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ASSA ABLOY on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures above? Shape those insights into your unique story in just a few minutes. Do it your way.

A great starting point for your ASSA ABLOY research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

ASSA ABLOY’s recent profit margin dip and lingering concerns about execution leave its future growth and financial resilience open to uncertainty.

If dependable results are essential to your approach, use our stable growth stocks screener (2089 results) to find companies with a stronger record of steady earnings and revenue growth through all market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ASSA B

ASSA ABLOY

Provides door opening and access products for the institutional, commercial, and residential markets.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives