- Sweden

- /

- Trade Distributors

- /

- OM:ALLIGO B

Alligo (OM:ALLIGO B) Margin Slide Challenges Bull Case Despite Strong Growth Forecasts

Reviewed by Simply Wall St

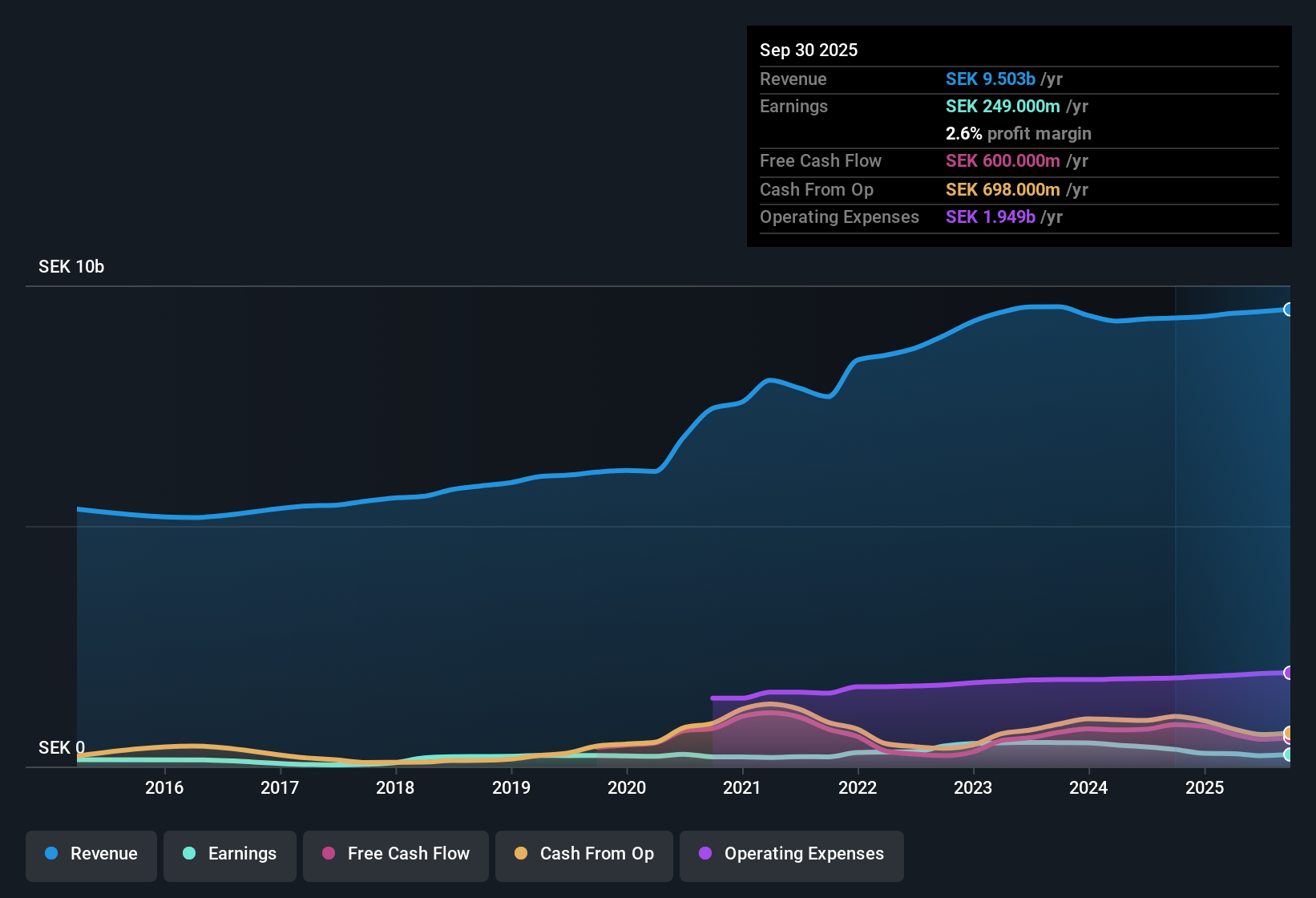

Alligo (OM:ALLIGO B) reported earnings growth of 9.9% per year over the past five years. Most recently, its net profit margin slid to 2.4% from 4.4% last year, signaling a clear margin contraction. Looking ahead, annual earnings are forecast to jump 37.1%, outpacing the Swedish market average of 12.6%, with revenue also expected to grow 5.1% per year. With shares recently trading at SEK121.8, investors are weighing strong growth forecasts against ongoing pressure on profitability and tightening margins.

See our full analysis for Alligo.The next step is comparing these results to the broader narratives driving investor sentiment. We will see where expectations hold up and where reality diverges from the story so far.

See what the community is saying about Alligo

Margin Expansion Hinges on Own-Brand Strategy

- Analysts expect profit margins to climb from the current 2.4% to 8.0% within three years as increased sales of proprietary brands and operational improvements take effect.

- According to the analysts' consensus view, margin improvement is slated to come from expanding own-brand offerings and finalizing cost savings, with annual savings of SEK 100 million projected to start mid-2025.

- This supports expectations for stronger group-level profitability as own-brand penetration rises and integration efforts free up cash flow that can be directed toward efficiency gains.

- However, the durability of margin recovery will depend on the sustainability of these brand initiatives and whether customer adoption translates into higher group margins in a competitive market environment.

- The consensus narrative highlights the company's shift toward proprietary brands and efficiency savings as a key avenue for stronger margins and net earnings, while noting that realizing these impacts at the group level will require consistent adoption and attention to competitive pricing.

- After three years of workflow integration, SEK 100 million in cost savings are forecast to help unlock earnings potential if market and segment-level profitability rebound as anticipated.

See how Alligo is positioning itself for higher margins as own-brand lines expand and cost savings kick in. 📊 Read the full Alligo Consensus Narrative.

Overreliance on Acquisitions Raises Growth Risks

- Long-term organic revenue declined by 4.3% in the most recent quarter, even after normalizing for one-off events, which suggests that acquisition-driven growth may be masking underlying weakness in the core business.

- Bears argue that the group’s substantial focus on M&A and its concentration in Sweden expose it to lower demand and underperformance in important regions like Finland, thereby increasing operational and geographic risk.

- Negative organic growth puts pressure on future earnings, particularly if the integration of acquired businesses does not deliver expected synergies or if market weakness in Sweden persists.

- Rising net debt (SEK 2.1 billion, net debt/EBITDA at 3.2x) and cautious SME customer demand further challenge Alligo’s ability to transition from acquisition-fueled to sustainable, organic growth.

DCF Fair Value vs. Market Price Creates Opportunity

- Alligo’s shares trade at SEK 121.80, significantly below both the analyst price target (SEK 165.00) and the DCF fair value estimate (SEK 413.70), pointing to a notable disconnect between market price, projected earnings power, and analyst expectations.

- The analysts' consensus view notes that while the P/E ratio of 26.9x is above the industry average, the share price reflects considerable skepticism regarding the company’s ability to achieve forecasted growth and margin expansion, which could present upside if earnings and integration benefits are realized.

- The 29.5% gap between the share price and analyst target indicates that the market is waiting for evidence of improvement in organic growth and profitability before adjusting its valuation.

- If Alligo succeeds in margin expansion and own-brand scale, the current valuation discount could begin to narrow, benefiting those willing to look past near-term pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Alligo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data another way, or spot a trend others missed? Share your viewpoint and build your own narrative in just minutes. Do it your way

A great starting point for your Alligo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Alligo’s margin recovery is promising, its reliance on acquisitions and rising debt signal uncertainty about sustainability and underlying growth.

If you want to focus on companies with stronger finances and less balance sheet risk, start your search with solid balance sheet and fundamentals stocks screener (1975 results) and discover businesses built to withstand market stress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALLIGO B

Alligo

Engages in the provision of workwear, personal protective equipment, tools, and consumables in Finland, Sweden, and Norway.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives