- United Kingdom

- /

- Real Estate

- /

- AIM:TPFG

Exploring European Undervalued Small Caps With Insider Buying In June 2025

Reviewed by Simply Wall St

Amidst escalating geopolitical tensions and renewed uncertainty about U.S. trade policy, the European market has experienced a downturn, with the STOXX Europe 600 Index falling by 1.57% as key indices in Germany, Italy, and France also saw declines. Despite these challenges, small-cap companies may present unique opportunities for investors seeking growth potential at a lower valuation level; particularly those with insider buying activity which can signal confidence from within the company itself.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.7x | 0.5x | 35.10% | ★★★★★☆ |

| Science Group | 19.0x | 2.1x | 42.25% | ★★★★★☆ |

| Tristel | 28.8x | 4.1x | 10.65% | ★★★★☆☆ |

| A.G. BARR | 19.1x | 1.8x | 44.38% | ★★★★☆☆ |

| AKVA group | 17.5x | 0.8x | 48.78% | ★★★★☆☆ |

| TT Electronics | NA | 0.4x | 14.22% | ★★★★☆☆ |

| Italmobiliare | 11.2x | 1.5x | -199.68% | ★★★☆☆☆ |

| Fuller Smith & Turner | 11.7x | 0.8x | -30.05% | ★★★☆☆☆ |

| H+H International | 32.7x | 0.8x | 46.12% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.5x | 41.76% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

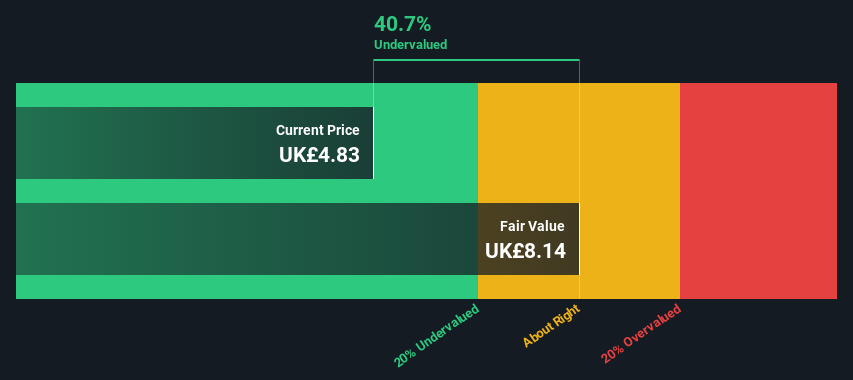

Property Franchise Group (AIM:TPFG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Property Franchise Group operates in the UK, focusing on licensing, financial services, and property franchising, with a market cap of £0.12 billion.

Operations: The company generates revenue primarily from property franchising (£40.90 million), financial services (£19.20 million), and licensing (£7.21 million). Over recent periods, the net income margin has shown a decreasing trend, with the latest figure at 15.14%. Operating expenses have been substantial, impacting profitability as they reached £27.01 million in the latest period recorded.

PE: 34.4x

Property Franchise Group, a smaller player in the European market, has shown significant revenue growth, with sales jumping to £67.31 million for 2024 from £27.28 million the previous year. Despite this impressive increase, profit margins have slipped to 15.1% from 27.1%. Insider confidence is evident as key figures have been actively purchasing shares since early 2025, signaling potential optimism about future performance. The company also increased its dividend payout to shareholders for the upcoming fiscal year.

- Navigate through the intricacies of Property Franchise Group with our comprehensive valuation report here.

Assess Property Franchise Group's past performance with our detailed historical performance reports.

Helical (LSE:HLCL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Helical is a UK-based property investment and development company with operations primarily focused on investment properties and development projects, having a market cap of approximately £0.36 billion.

Operations: The company's revenue primarily comes from its Investment and Developments segments, with recent figures showing £28.94 million and £3.02 million respectively. The gross profit margin has shown a decreasing trend, moving from 73.24% in 2020 to 53.83% by March 2025, indicating changes in cost management or pricing strategies over time.

PE: 9.8x

Helical, a smaller player in the European market, has seen insider confidence with share purchases over recent months. Despite relying solely on external borrowing for funding, the company reported a significant turnaround with net income of £27.95 million for the year ending March 2025, contrasting sharply with last year's loss of £189.81 million. The board's decision to increase dividends by 3.5% further signals optimism about future prospects amidst modest earnings growth projections of 2.73% annually.

- Dive into the specifics of Helical here with our thorough valuation report.

Examine Helical's past performance report to understand how it has performed in the past.

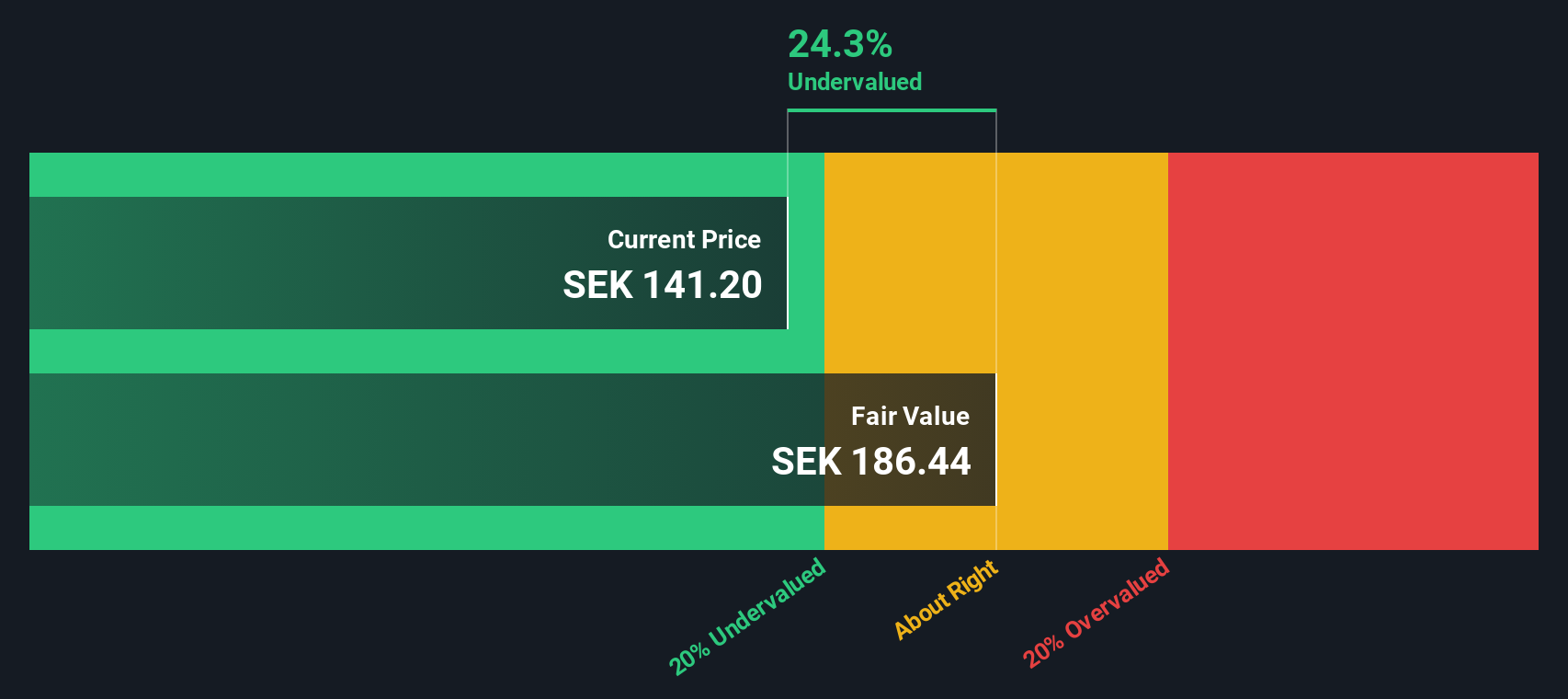

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Alimak Group is a company specializing in vertical access solutions across various sectors including wind, industrial, construction, and facade access, with a market capitalization of approximately SEK 5.52 billion.

Operations: Alimak Group generates revenue primarily from its segments: Facade Access, Construction, Industrial, HS & PS, and Wind. The company has experienced fluctuations in its gross profit margin over the years, with a recent figure of 40.62% as of March 2025. Operating expenses are significant and include costs related to sales and marketing as well as R&D investments.

PE: 22.1x

Alimak Group, a player in the industrial equipment sector, showcases potential as an undervalued stock. Their Q1 2025 earnings revealed a net income of SEK 184 million, up from SEK 131 million the previous year, with basic EPS rising to SEK 1.74. Despite relying solely on external borrowing for funding, insider confidence is evident with Independent Director Sven Törnkvist purchasing 4,000 shares in March for approximately SEK 451K. Earnings are projected to grow by over 10% annually.

- Click to explore a detailed breakdown of our findings in Alimak Group's valuation report.

Explore historical data to track Alimak Group's performance over time in our Past section.

Turning Ideas Into Actions

- Embark on your investment journey to our 73 Undervalued European Small Caps With Insider Buying selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TPFG

Property Franchise Group

Engages in residential property franchise, and licensing and financial services businesses in the United Kingdom.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives