How Does Alfa Laval Stack Up After the Recent 5% Recovery in 2025?

Reviewed by Bailey Pemberton

Wondering whether you should buy, sell, or simply hold your Alfa Laval stock right now? You are not alone. With shares recently closing at 446.6, this industrial heavyweight has been keeping investors on their toes. Investors have witnessed some notable short-term recovery, with the stock up 5.2% over the past week and another 3.0% gain in the last 30 days. These movements hint at renewed confidence in the company after a rocky start to the year. Although Alfa Laval is still down 5.2% year-to-date and 5.6% over the past year, long-term holders have seen a 147.1% gain over five years. These shifts often reflect broader moves in global industrial markets and changing investor risk appetites as the sector continues through 2024.

However, price moves are only half the story. Investors are increasingly focused on valuation, and Alfa Laval’s value score comes in at just 1 out of 6 possible checks for being undervalued. This has caught the attention of bargain hunters. Does this mean the stock is expensive, or is there more to consider?

In the next section, we will break down what goes into those valuation checks and how they apply to Alfa Laval. If you are searching for the smartest way to look at value, be sure to read to the end for an even deeper insight beyond the standard metrics.

Alfa Laval scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Alfa Laval Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model attempts to estimate a stock's intrinsic value by forecasting future cash flows and discounting them back to today's value. This approach uses the assumption that money available now is worth more than the same amount in the future. For Alfa Laval, this method uses cash flow projections based on both analyst estimates and further extrapolation beyond five years, all in SEK.

Currently, Alfa Laval's latest twelve-month Free Cash Flow (FCF) stands at approximately SEK 8.2 billion. Analyst forecasts project this figure to grow steadily, with the FCF expected to reach SEK 8.9 billion by 2028. Looking even further, projections suggest FCF could climb above SEK 10.0 billion by 2035. It is important to note that these long-range figures rely on estimated growth rates beyond analyst coverage.

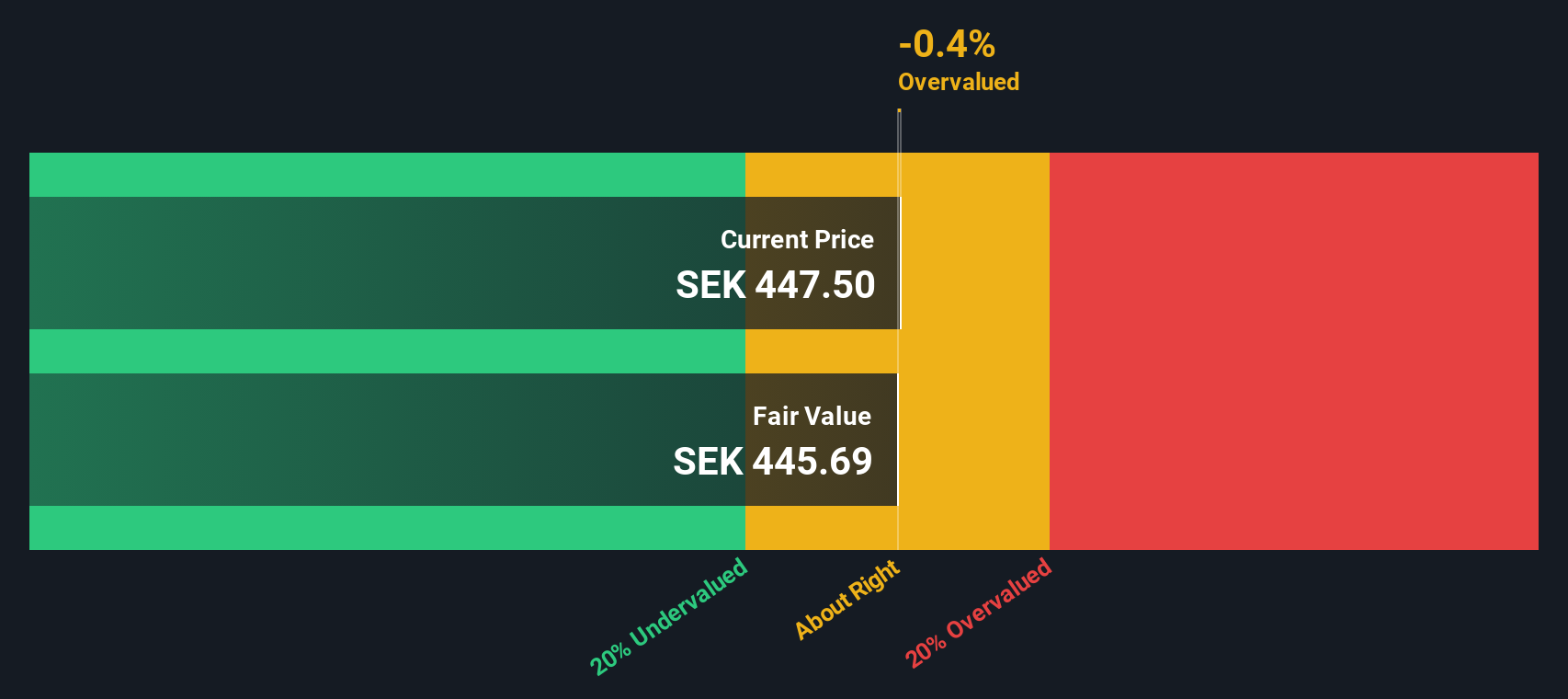

Based on the 2 Stage Free Cash Flow to Equity model, Alfa Laval's estimated intrinsic value comes in at SEK 446.29 per share. The current share price, closing at SEK 446.6, places it just 0.1% above this intrinsic value. This small difference indicates that, according to DCF analysis, the stock is priced almost exactly in line with its fundamental value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Alfa Laval's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Alfa Laval Price vs Earnings (PE) Ratio

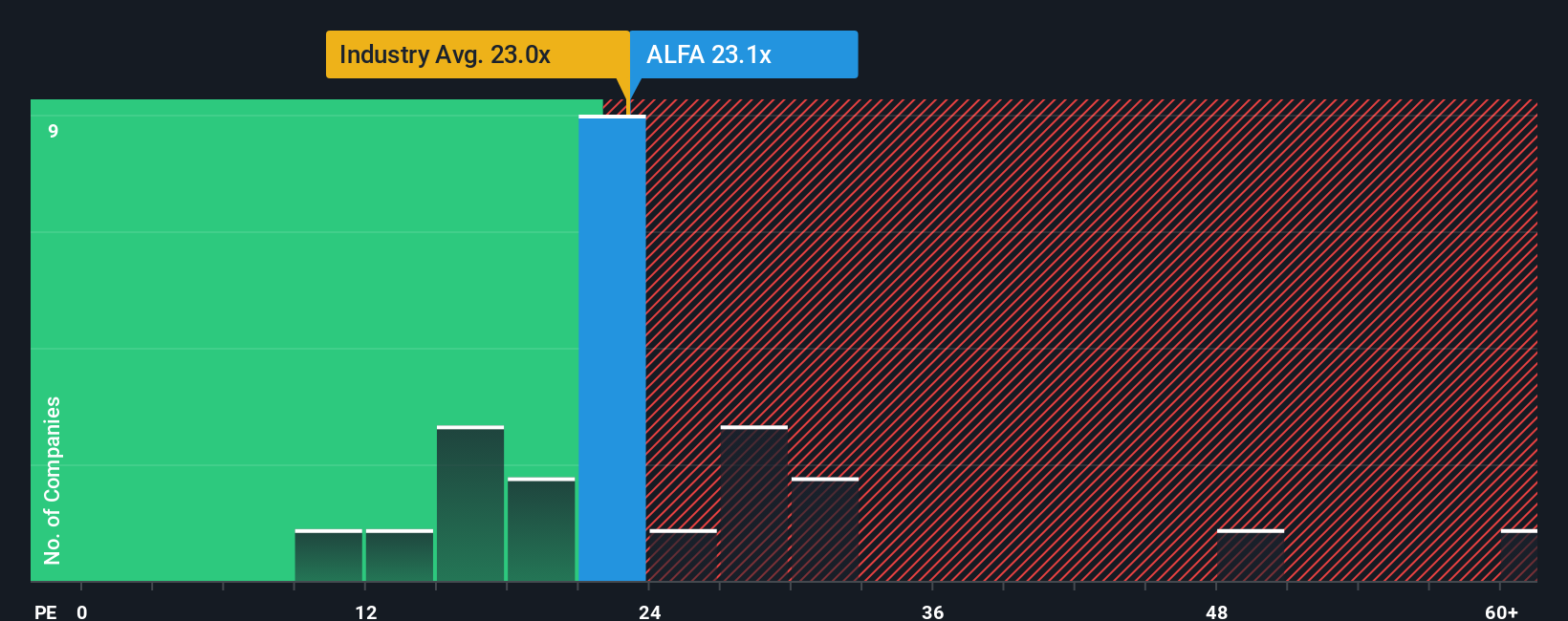

The Price-to-Earnings (PE) ratio is the preferred valuation multiple when assessing established, profitable companies like Alfa Laval. This metric gives investors a straightforward sense of how much they are paying for each unit of earnings, helping to compare valuation across peers and the wider market. Higher growth expectations or lower perceived risk can justify a higher PE ratio. In contrast, slower growth or greater uncertainty might demand a lower one.

Alfa Laval currently trades at a PE of 23x. This is slightly below the Machinery industry average of 24.6x and in line with the average of its closest peers at 24.4x. However, industry and peer comparisons only go so far, as they can overlook important company-specific factors such as growth prospects and risk profile.

This is where the Simply Wall St "Fair Ratio" comes in. This proprietary metric blends in Alfa Laval’s earnings growth, profit margin, industry characteristics, market cap, and risks to calculate what a fair PE should be. For Alfa Laval, the fair ratio is estimated at 21.8x, just a fraction below its current PE. Since this difference is less than 0.10, the stock appears to be valued about right on this basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alfa Laval Narrative

Earlier we mentioned there is an even better way to evaluate a company than traditional valuation metrics, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company: your view of its future potential, grounded in how you forecast things like revenue, earnings, and margins, and what you think the fair value should be.

Unlike standalone numbers, a Narrative connects Alfa Laval's strategy and industry outlook with a tailored financial forecast, seamlessly linking your expectations to an up-to-date fair value estimate. Narratives are user-friendly and available to everyone on Simply Wall St’s Community page, where millions of investors share and discover different perspectives.

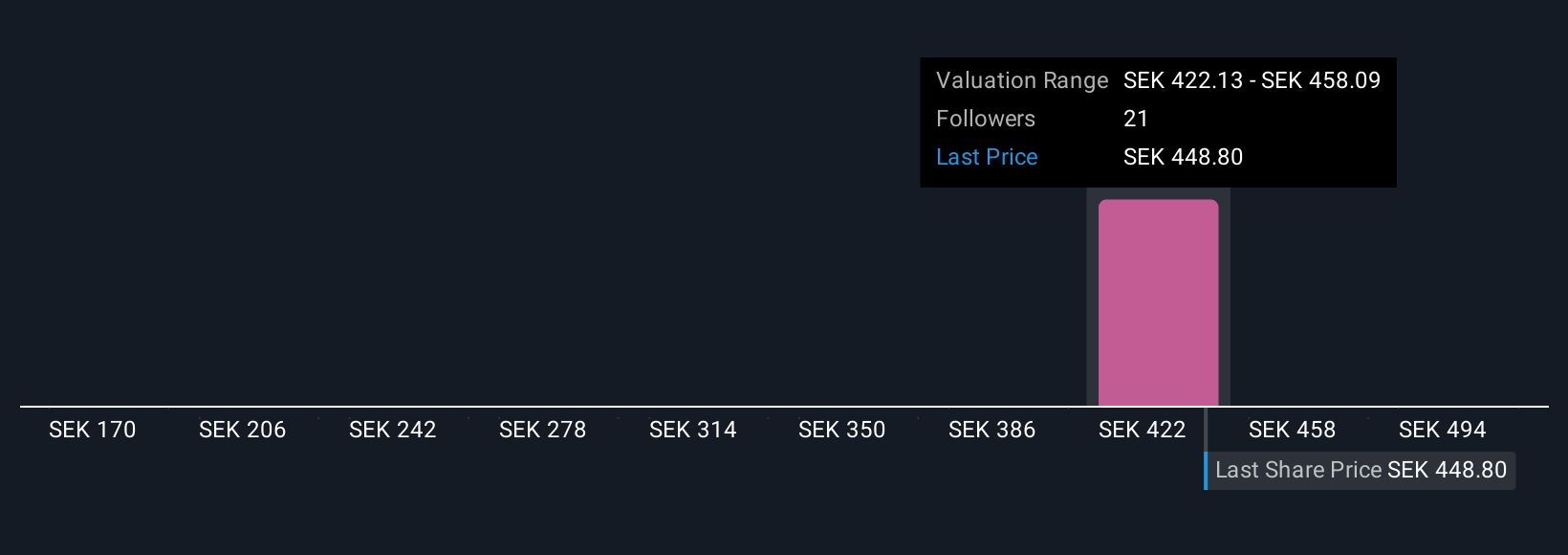

This tool helps you decide when to consider buying, selling, or holding by showing how your estimated Fair Value stacks up against the live market price. It instantly updates as new information, such as earnings or news, comes in. For example, one investor might believe in strong margin expansion and energy transition growth, setting a high fair value near SEK530, while another may be more cautious about risks and set theirs closer to SEK345.

Do you think there's more to the story for Alfa Laval? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALFA

Alfa Laval

Provides heat transfer, separation, and fluid handling products and solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion