Alfa Laval (OM:ALFA): Examining the Current Valuation After Recent Share Price Stability

Reviewed by Simply Wall St

If you have been keeping an eye on Alfa Laval (OM:ALFA) lately, you might be wondering what is driving investor interest now. While there has not been a specific event making headlines, the recent share price trend could naturally catch investor attention and spark questions about what it means for the company’s value. When a stock moves quietly but steadily, it is worth digging deeper to see if the market is signaling something beneath the surface or if this is just another short-term pause.

This year, Alfa Laval’s performance has been mixed. The shares clawed back some ground over the past month, up 4%, despite being down 7% year-to-date. Over the past three years, the stock has delivered a 55% total return, and an impressive 132% over five years. In this context, momentum appears to be stabilizing after a stretch of strong historic growth and more recent headwinds. Recent company financials showed steady annual increases in both revenue and net income, keeping Alfa Laval on radars in the capital goods sector.

With these moves in mind, the big question is whether Alfa Laval shares are trading at a bargain today or if investors are already pricing in every bit of future growth.

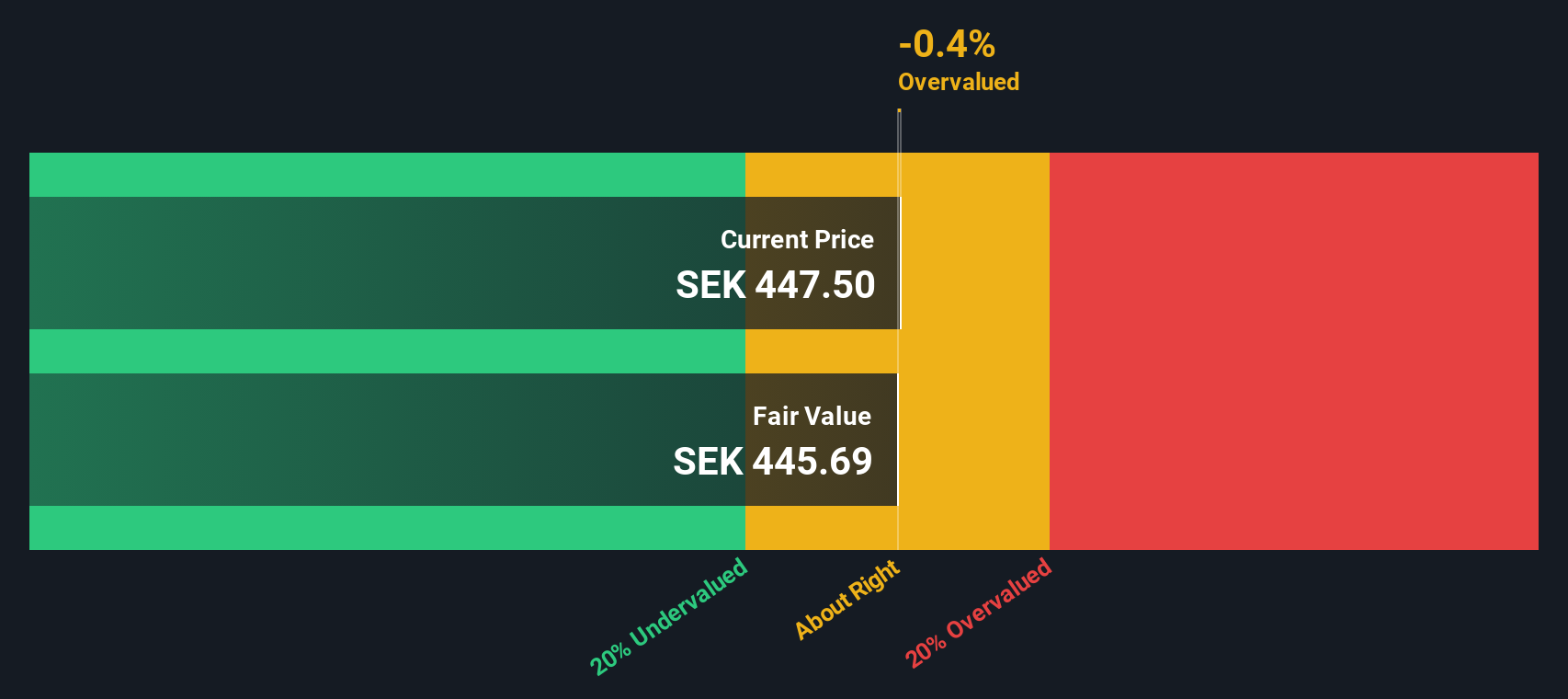

Most Popular Narrative: 0.5% Undervalued

The most widely followed narrative suggests Alfa Laval is trading just below its fair value, with only a slight discount to long-term expectations.

The strategic shift towards service-oriented offerings is delivering all-time-high service order intake. This now accounts for above 30% of group sales and 40% in Marine, which is structurally increasing the stable, high-margin, recurring revenue base. This supports long-term margin expansion and greater earnings resilience.

Curious how analysts justify this near-fair price target? There is a crucial combination of accelerating earnings, ambitious profit multiples, and confidence in service revenues behind the scenes. Want to unlock the full valuation logic and discover what bold projections really set the fair value? Dive into the full narrative for the clear numbers and surprising assumptions that shape this market call.

Result: Fair Value of $440.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected clean energy adoption or heavy exposure to volatile marine and energy markets could quickly shift Alfa Laval’s outlook in a different direction.

Find out about the key risks to this Alfa Laval narrative.Another View: DCF Model Perspective

Looking from a different perspective, our SWS DCF model also suggests Alfa Laval is trading below its estimated fair value. Even though different assumptions are considered, both approaches find value. Which signals will play out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alfa Laval for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alfa Laval Narrative

If you see things differently or want to run the numbers for yourself, you can shape and submit your own Alfa Laval narrative in just a few minutes. Do it your way

A great starting point for your Alfa Laval research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Do not let opportunity pass you by. Expand your watchlist with fresh picks tailored to your strategy. The Simply Wall Street Screener unlocks unique ways to strengthen your portfolio right now.

- Spot high yields that boost your passive income potential by checking out market leaders featured among dividend stocks with yields > 3%.

- Capitalize on innovation and rapid tech adoption by tracking emerging players shaking up the industry with the help of AI penny stocks.

- Find shares trading below their true value by targeting hidden market gems through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:ALFA

Alfa Laval

Provides heat transfer, separation, and fluid handling products and solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives