- Sweden

- /

- Electrical

- /

- NGM:TOPR

Investors Still Aren't Entirely Convinced By TopRight Nordic AB (publ)'s (NGM:TOPR) Revenues Despite 44% Price Jump

TopRight Nordic AB (publ) (NGM:TOPR) shareholders are no doubt pleased to see that the share price has bounced 44% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 73% share price decline over the last year.

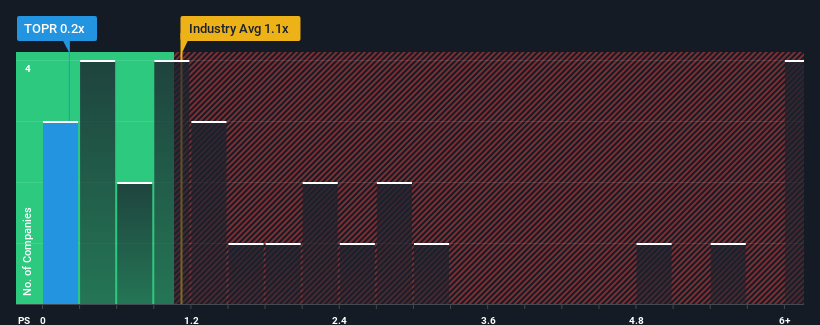

In spite of the firm bounce in price, considering around half the companies operating in Sweden's Electrical industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider TopRight Nordic as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for TopRight Nordic

How TopRight Nordic Has Been Performing

For example, consider that TopRight Nordic's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on TopRight Nordic will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TopRight Nordic will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, TopRight Nordic would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 42%. Even so, admirably revenue has lifted 105% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 16% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that TopRight Nordic's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From TopRight Nordic's P/S?

TopRight Nordic's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We're very surprised to see TopRight Nordic currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 5 warning signs for TopRight Nordic that you need to take into consideration.

If you're unsure about the strength of TopRight Nordic's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TopRight Nordic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:TOPR

TopRight Nordic

Engages in the lighting technology, digital glass, and construction businesses.

Good value slight.

Market Insights

Community Narratives