Will S&P Global BMI Index Inclusion Change TF Bank's (OM:TFBANK) Investment Narrative?

Reviewed by Sasha Jovanovic

- TF Bank AB was recently added to the S&P Global BMI Index, marking a significant milestone in its recognition among global investment benchmarks.

- This type of index inclusion can enhance the company's international visibility and potentially increase interest from a wide range of institutional investors.

- With this new exposure to index-tracking funds, we’ll examine how it may influence TF Bank’s broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is TF Bank's Investment Narrative?

For anyone considering TF Bank as a long-term holding, the big picture often revolves around its ability to deliver strong and sustained profit growth in a competitive banking sector, while managing credit quality and maintaining resilience through economic cycles. The recent addition of TF Bank to the S&P Global BMI Index could shape near-term catalysts, potentially increasing international flows into the stock as it enters the radar of index-tracking funds. However, whether this translates into a significant and lasting re-rating of the shares remains to be seen, as recent price moves suggest much of the positive outlook may already be in the price. Meanwhile, the biggest risks, high bad loan ratios, relatively high valuation compared to European peers, and a still-inexperienced management team, remain relevant. The main narrative now includes heightened visibility, but not necessarily reduced operational risk.

Yet, risk around asset quality isn’t going away and deserves your attention.

Exploring Other Perspectives

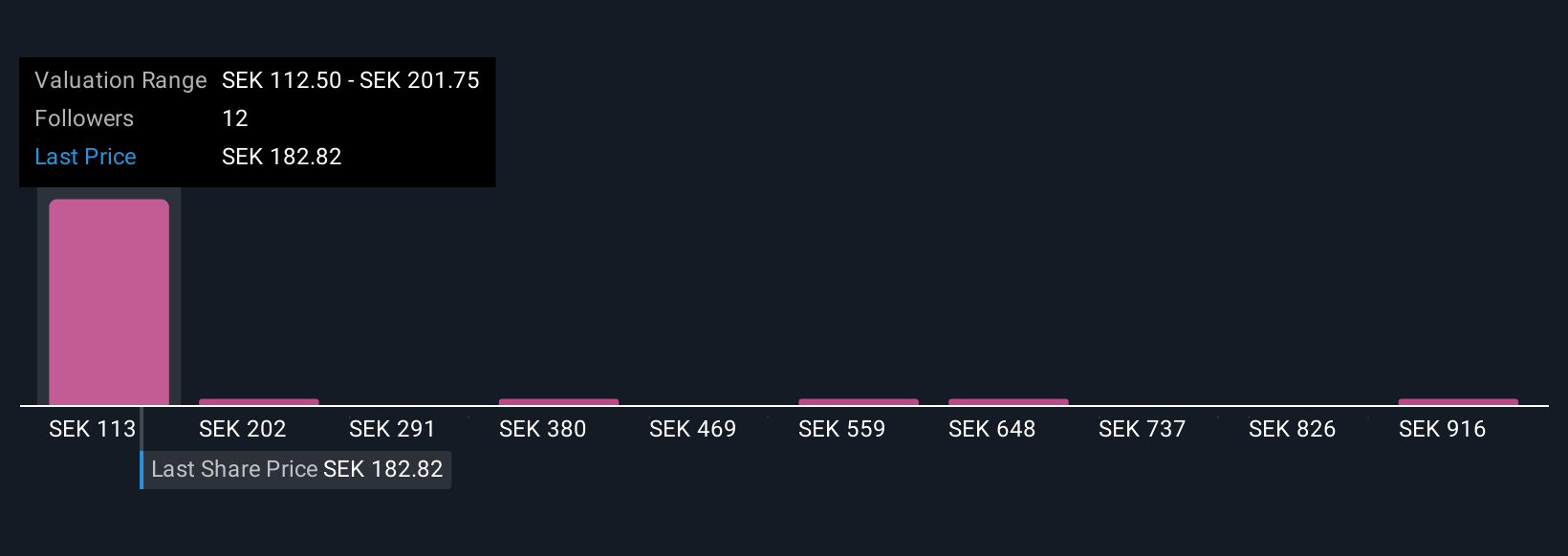

Explore 9 other fair value estimates on TF Bank - why the stock might be worth over 5x more than the current price!

Build Your Own TF Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TF Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TF Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TF Bank's overall financial health at a glance.

No Opportunity In TF Bank?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives