Swedbank (OM:SWED A): Assessing Valuation After Steady Returns and Fair Value Debate

Reviewed by Simply Wall St

Swedbank (OM:SWED A) shares have delivered a steady performance this past month, gaining 3% while holding flat over the week. Investors are eyeing the stock’s trajectory after recent market moves, as they consider its place among Swedish bank peers.

See our latest analysis for Swedbank.

Momentum has picked up for Swedbank over the past quarter, with an 11.99% share price return fueling optimism after a series of stable results. Long-term investors have seen substantial rewards, as Swedbank’s total shareholder return has surpassed 50% over the past year. This suggests renewed confidence in its fundamentals and outlook.

If you’re interested in what’s performing beyond the banking sector, this is a great chance to broaden your horizons and discover fast growing stocks with high insider ownership

Yet with Swedbank’s strong run and solid returns, the question remains: does the current share price reflect all that future growth, or could there still be a compelling entry point for investors?

Most Popular Narrative: Fairly Valued

Swedbank’s current share price sits just above the most widely followed narrative’s fair value, suggesting near-perfect alignment between market price and consensus expectations. This setup highlights how closely investors are tracking the company’s prospects, creating a tension that hinges on which assumptions actually play out.

Bullish expectations regarding Swedbank's sustainability positioning and green finance initiatives could be overblown, as increased compliance costs and stricter ESG regulation across Europe have the potential to erode any incremental fee or brand benefits. This could limit the impact on net margins.

Want to peek behind the curtain of this fair price target? The narrative is built on a delicate balance: robust earnings projections, persistent margin pressures, and one surprising profitability assumption that could tip future valuations. Discover what’s really powering this “about right” consensus by reading on for the full breakdown.

Result: Fair Value of $278.33 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating digital adoption or continued strength in Swedbank’s core mortgage franchise could quickly tilt the forecast more positively than current consensus suggests.

Find out about the key risks to this Swedbank narrative.

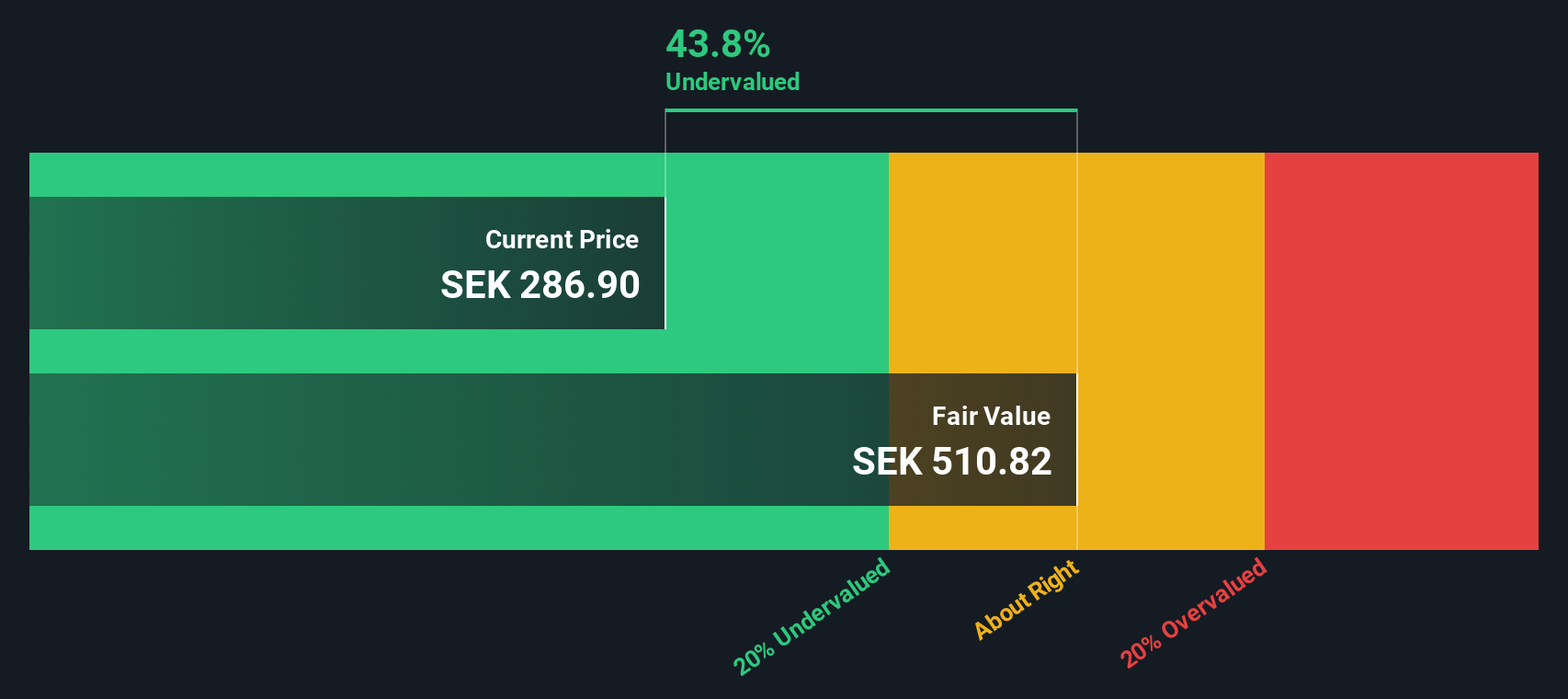

Another View: Discounted Cash Flow Perspective

Looking at Swedbank through the lens of our DCF model paints a very different picture. The SWS DCF model estimates the fair value at SEK504.21, which is much higher than the current price. This suggests the stock could be significantly undervalued if these long-term cash flow assumptions prove accurate. But can Swedbank really deliver on this potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Swedbank Narrative

If you have your own perspective or want to dive deeper into the numbers, it’s easy to craft a personal take on Swedbank’s outlook in just a few minutes. Do it your way.

A great starting point for your Swedbank research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities and take control of your investing future. Don’t settle for the obvious plays when there’s a world of potential waiting just beyond the headlines.

- Capture attractive yields when you target these 17 dividend stocks with yields > 3% that reward shareholders with reliable returns and strong fundamentals.

- Fuel your portfolio growth with these 24 AI penny stocks, surfacing companies at the forefront of artificial intelligence innovation and disruption.

- Capitalize on tomorrow’s trends by scanning these 27 quantum computing stocks. These pioneers are pushing the limits of computing power and scientific progress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SWED A

Swedbank

Provides various banking products and services to private and corporate customers in Sweden, Estonia, Latvia, Lithuania, Norway, the United States, Finland, Denmark, Luxembourg, and China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives