Can SEB’s Impressive 28% Rally in 2025 Continue After Nordic Bank Resilience Headlines?

Reviewed by Bailey Pemberton

- Curious if Skandinaviska Enskilda Banken is really a bargain or just looks like one? You are not alone, and we are about to dive into what the numbers reveal.

- The stock has climbed an impressive 28.3% over the past year and risen 18.4% year-to-date, despite some short-term ups and downs like a 2.3% dip this past month.

- Recent headlines have focused on the Nordic banking sector’s resilience, with investors weighing up the impact of shifting interest rates and regulatory updates across European financial stocks. For SEB, steady demand for financial services and strategic growth moves have kept it in the spotlight. At the same time, market sentiment seems to grow more optimistic.

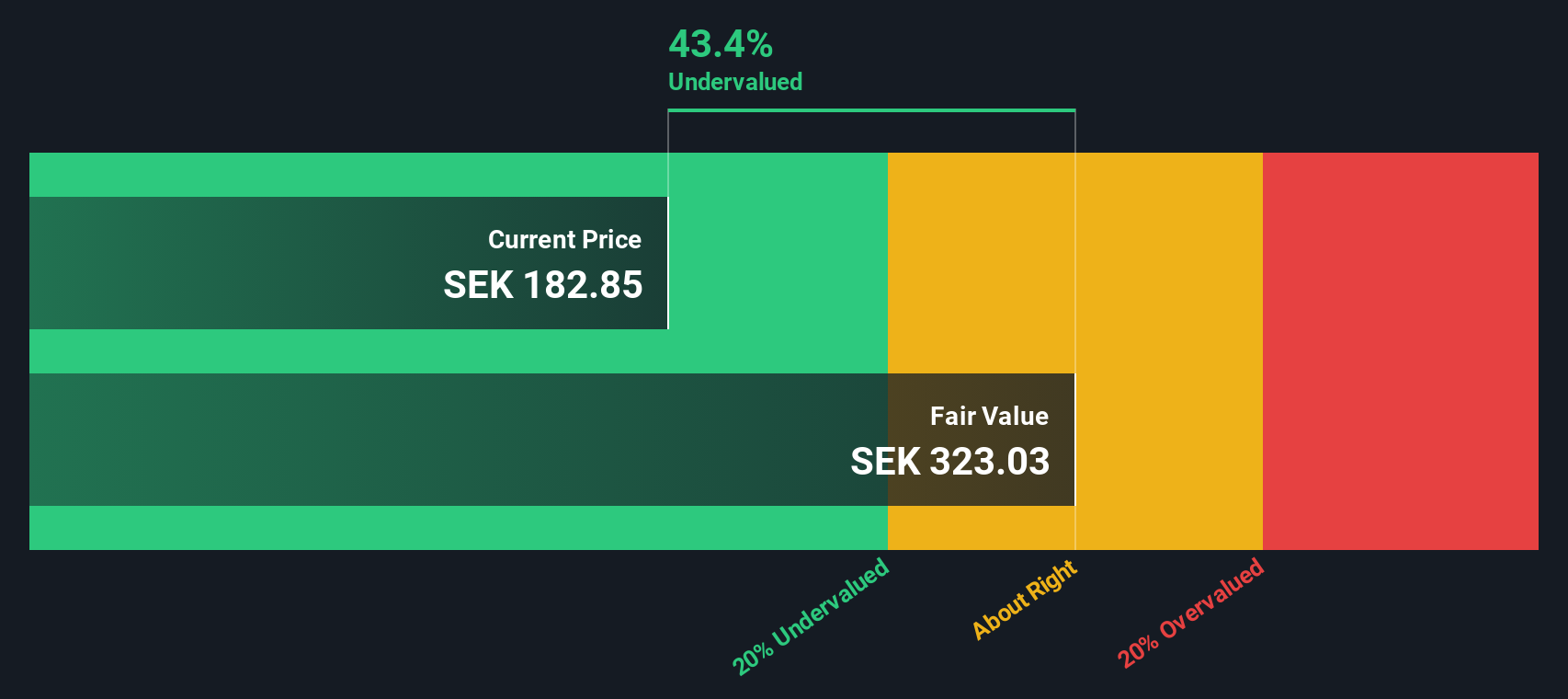

- Looking at our Valuation Scorecard, Skandinaviska Enskilda Banken scores 2 out of 6 for being undervalued on key checks. As you will see, there are a few ways to slice valuation, and we will cover a method at the end that puts the whole picture together.

Skandinaviska Enskilda Banken scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Skandinaviska Enskilda Banken Excess Returns Analysis

The Excess Returns valuation model evaluates a company by comparing the returns it generates on its capital to the minimum required by investors. In essence, it estimates whether Skandinaviska Enskilda Banken is delivering profits beyond the cost of its equity and projects these surpluses into the future.

For Skandinaviska Enskilda Banken, the current Book Value is SEK112.88 per share. Analyst consensus calls for a Stable EPS of SEK17.20 per share. This forecast is based on weighted future Return on Equity estimates from 12 analysts, with an average expected Return on Equity of 13.95%.

The estimated Cost of Equity is SEK7.68 per share. This means that every year SKB generates an Excess Return of SEK9.51 per share beyond what investors require. Looking ahead, the estimated Stable Book Value stands at SEK123.24 per share, reflecting future expectations tracked by 10 analysts.

Based on these fundamentals, the Excess Returns model calculates that Skandinaviska Enskilda Banken is trading at a 44.6% discount to its intrinsic value. This suggests a significant undervaluation compared to where the share price could be if the company continues performing as projected.

Result: UNDERVALUED

Our Excess Returns analysis suggests Skandinaviska Enskilda Banken is undervalued by 44.6%. Track this in your watchlist or portfolio, or discover 853 more undervalued stocks based on cash flows.

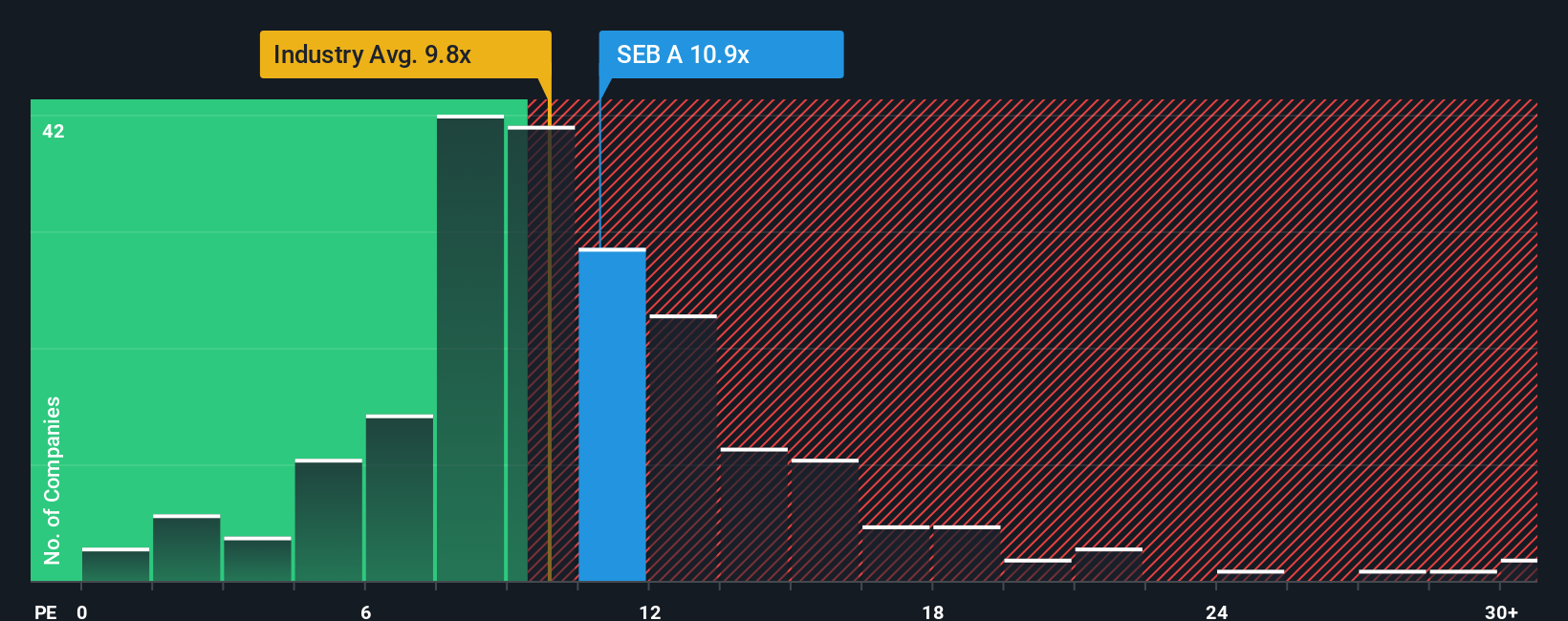

Approach 2: Skandinaviska Enskilda Banken Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies, as it measures how much investors are willing to pay for each krona of earnings. For well-established banks like Skandinaviska Enskilda Banken, the PE ratio provides a straightforward snapshot of market expectations about future profitability, stability, and growth potential.

It's important to note that growth forecasts and perceived risk both affect what a “normal” PE ratio should be. Companies with higher growth prospects or lower risk profiles typically deserve a higher PE, while the opposite holds true for slower growers or riskier firms.

Currently, Skandinaviska Enskilda Banken trades at a PE of 11.43x. This is just a touch above the industry average PE of 10.20x for banks, and closely aligns with the peer group average of 11.12x. However, Simply Wall St’s proprietary Fair Ratio model sets a fair PE for SEB at 11.28x. The Fair Ratio goes beyond simple peer or industry comparisons by factoring in SEB’s unique fundamentals such as growth outlook, risk, profitability, industry dynamics, and its position in the market.

This context means the Fair Ratio is a more precise guide for investors. SEB’s current PE of 11.43x is nearly identical to its Fair Ratio, suggesting the market has priced in its prospects quite efficiently.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Skandinaviska Enskilda Banken Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear story behind the numbers. It lets you connect your personal view about a company’s future (including your expectations for earnings, revenue, and margins) directly to a forward-looking financial forecast and, ultimately, an estimated fair value.

This approach goes beyond static ratios or consensus estimates. Narratives empower you to articulate what you think will shape Skandinaviska Enskilda Banken’s journey, grounding your conclusions in actual data. On Simply Wall St’s platform, millions of investors use Narratives through the Community page where it is easy to build and adjust your own scenarios using up-to-date inputs. Narratives are dynamic and automatically update when new news or company results are released, so your investment thesis is always current.

Comparing your Narrative’s fair value with the latest share price quickly shows whether you see opportunity to buy, hold, or sell. For example, some investors believe SEB’s push into AI and fee-based growth will improve operational efficiency and drive the price to SEK190. More cautious investors, factoring in regulatory concerns and market risks, think SEK151 is justified. Narratives help you decide for yourself with numbers and story in sync.

Do you think there's more to the story for Skandinaviska Enskilda Banken? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion