The Bull Case For Norion Bank (OM:NORION) Could Change Following Share Buyback and Strong Q3 Earnings

Reviewed by Sasha Jovanovic

- Norion Bank AB recently completed the repurchase of 8,000,000 shares for NOK 500 million and reported improved financial results for the third quarter and nine months ended September 30, 2025, with higher net income and earnings per share compared to the previous year.

- This combination of share repurchase and profitability growth underscores the bank's focus on both capital return and operational performance.

- We'll explore how Norion Bank's solid third-quarter earnings growth supports its broader investment narrative and ongoing capital management approach.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Norion Bank's Investment Narrative?

To get behind Norion Bank as a shareholder, you really need to believe in its ability to balance capital returns for investors with healthy, sustainable business performance. The recent completion of a substantial share buyback program, paired with growing earnings and rising net income, sends a direct signal about management’s commitment to returning value and supporting the share price. This may help counter any near-term uncertainties and adds momentum ahead of upcoming earnings releases, which could continue to be a catalyst if profitability remains robust. However, sizable bad loans still present a risk: with a high ratio of non-performing loans and a relatively low bad loan allowance, Norion’s fundamentals will be closely watched by the market. While the buyback and earnings beat keep the investment case on track, this risk hasn’t disappeared.

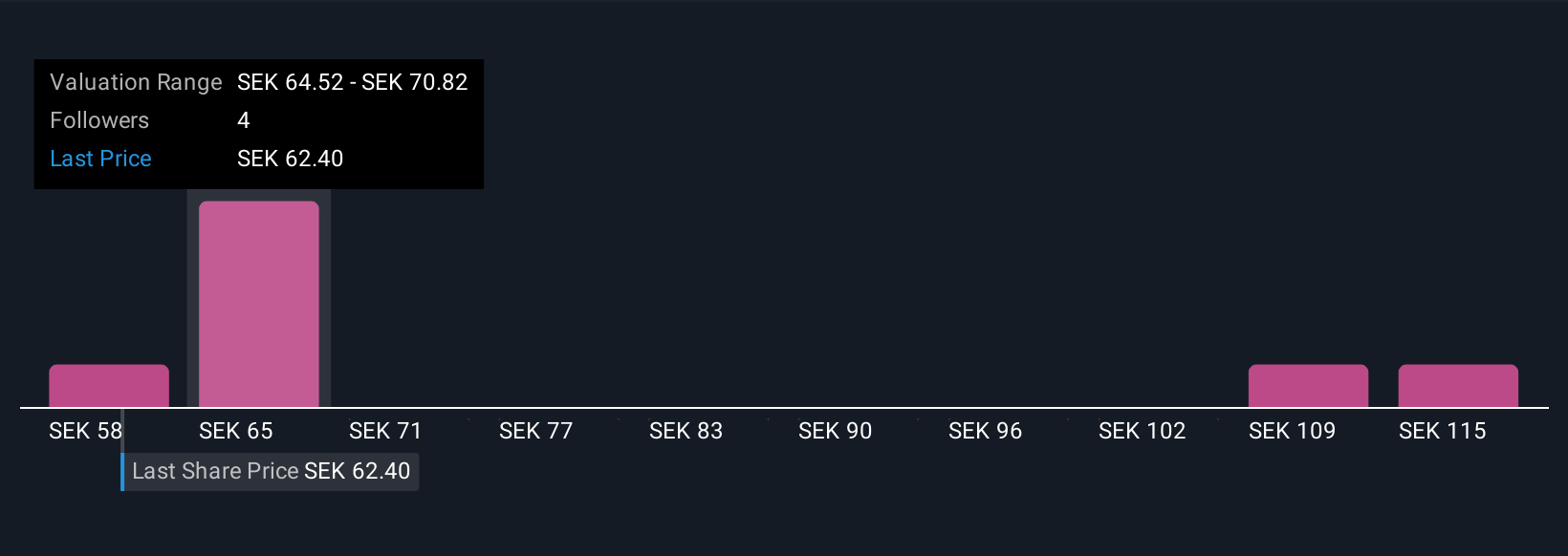

Yet, the high level of bad loans is a concern that can't be ignored. Norion Bank's shares have been on the rise but are still potentially undervalued by 46%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on Norion Bank - why the stock might be worth as much as 86% more than the current price!

Build Your Own Norion Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Norion Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Norion Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Norion Bank's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORION

Norion Bank

Provides financial solutions for medium-sized corporates and real estate companies, merchants, and private individuals in Sweden, Germany, Norway, Denmark, Finland, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives