Norion Bank (OM:NORION): Assessing Valuation After Q3 Earnings Beat and New Share Buyback Announcement

Reviewed by Kshitija Bhandaru

Norion Bank (OM:NORION) wrapped up its third quarter by posting stronger earnings and confirming the completion of a substantial share buyback as well as plans for a new program. This signals ongoing financial momentum and a continued focus on shareholders.

See our latest analysis for Norion Bank.

Norion Bank’s share price has powered ahead this year, up more than 62% year-to-date, though it recently pulled back with a 1-month share price return of -10.5%. This highlights how quickly sentiment can shift after a strong run. While recent earnings strength and bold buybacks have lifted longer-term confidence, the short-term dip reflects both broader market jitters and natural consolidation after impressive gains. Overall, total shareholder returns are still stellar with a 53% gain over the past year and an eye-catching 132% in three years.

If Norion’s momentum makes you curious about where else smart money is headed, now is the perfect time to discover fast growing stocks with high insider ownership

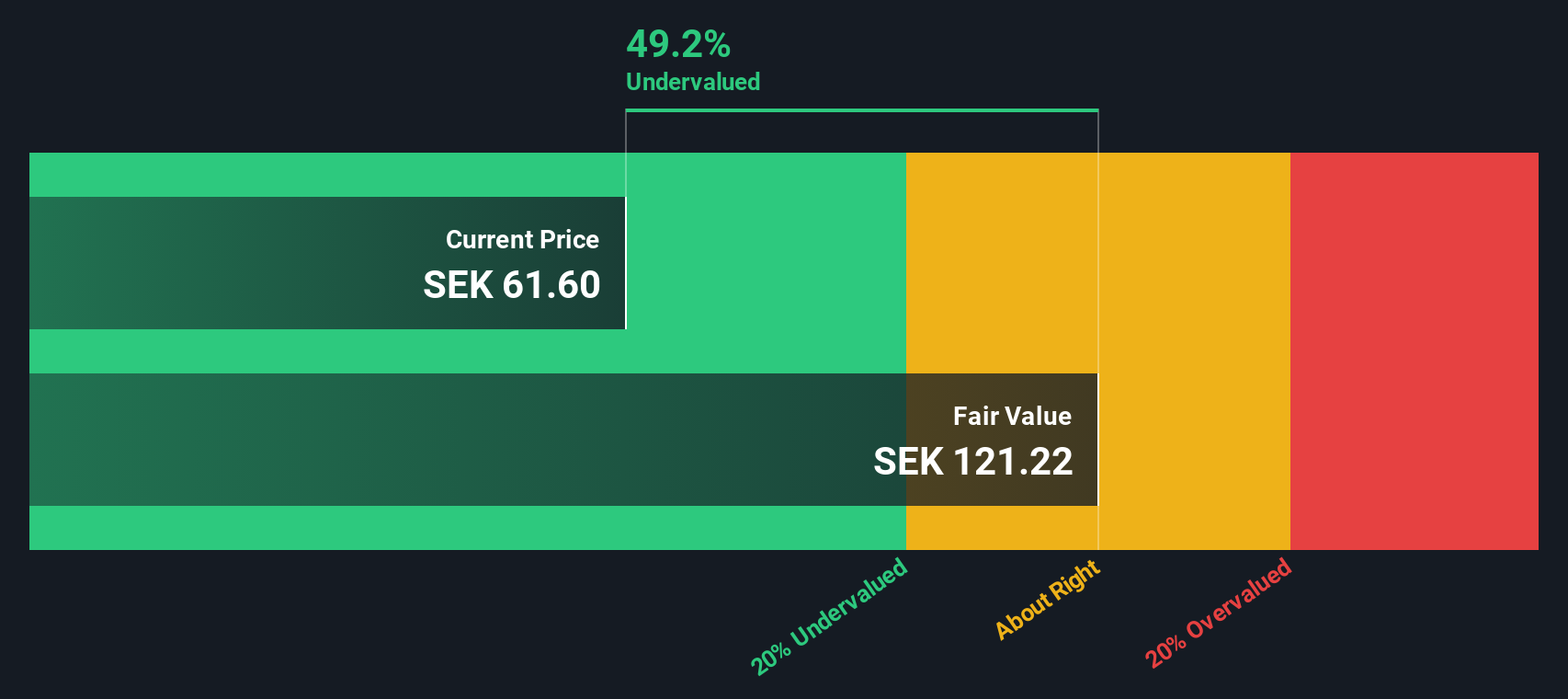

With Norion’s shares still trading at a notable discount to analyst targets despite robust performance, investors have to wonder if there is more upside left or if all the future growth is already priced in.

Price-to-Earnings of 8.7x: Is it justified?

Norion Bank’s shares are trading at a price-to-earnings (P/E) ratio of 8.7x, which suggests the market values its recent earnings lower than many of its listed peers.

The P/E ratio compares a company's current share price to its per-share earnings, providing a snapshot of how much investors are willing to pay for each unit of profit. For banks like Norion, this multiple can reflect both recent performance and future expectations for stability, returns, and growth.

At 8.7x, Norion’s P/E is below the European Banks industry average of 9.7x. It is also noticeably lower than its peer group’s average of 13.2x. This sizeable discount could indicate the market is undervaluing the company’s profit potential, especially considering its earnings growth outpaced the broader industry and market over the last year.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 8.7x (UNDERVALUED)

However, rapid share gains and short-term price swings remind investors that shifting market sentiment or weaker-than-expected fundamentals could quickly change the story.

Find out about the key risks to this Norion Bank narrative.

Another View: Discounted Cash Flow

Stepping back from earnings multiples, our SWS DCF model suggests an even wider margin of safety. According to this approach, Norion Bank’s fair value is SEK123.85, almost double its current price of SEK61.6. This indicates a much deeper undervaluation. But can the fundamentals eventually close this gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Norion Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Norion Bank Narrative

If you see the numbers differently, or want to dive in and craft your own view of Norion Bank, you can shape a narrative in just minutes. Do it your way

A great starting point for your Norion Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. Smart investors always keep their eyes open for new trends and promising stocks. Make your next move count with these handpicked ideas.

- Uncover high-growth potential by tracking these 24 AI penny stocks as they reshape industries with artificial intelligence and advanced machine learning.

- Boost your income with these 18 dividend stocks with yields > 3% that consistently deliver attractive yields, helping you grow your wealth through dependable returns.

- Ride the digitalassets wave and spot tomorrow’s leaders with these 79 cryptocurrency and blockchain stocks at the forefront of blockchain innovation and emerging technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORION

Norion Bank

Provides financial solutions for medium-sized corporates and real estate companies, merchants, and private individuals in Sweden, Germany, Norway, Denmark, Finland, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives