Are Shifting Regional EV Trends Shaping Volvo Car (OM:VOLCAR B)’s Long-Term Market Mix?

Reviewed by Sasha Jovanovic

- Volvo Car Group recently announced global sales of 63,212 vehicles for September 2025, a 1 percent increase compared to the same month last year, while year-to-date sales stood at 514,294 cars, which is lower than the previous year.

- Sales of electrified Volvo models rose sharply in China but declined in Europe, underlining shifting regional demand patterns that are reshaping the company's market mix.

- We will explore how China’s rising appetite for Volvo’s electrified vehicles might impact the company’s future prospects and earnings narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Volvo Car AB (publ.) Investment Narrative Recap

To be a Volvo Car AB (publ.) shareholder, you need to believe in the company’s ability to grow electrified vehicle sales faster than industry peers, optimize costs, and shift its regional sales mix in response to changing demand. The modest September sales increase amid sharply declining European electrified sales and softer year-to-date volumes signals that the immediate catalyst, the success of Volvo’s electrified lineup, particularly in China, remains in play, while revenue pressure from Europe poses a key risk. The impact of the latest sales figures appears moderate, but sustained weakness in core regions could become more material if trends continue.

Among recent announcements, Volvo’s expanded investment in U.S. manufacturing to produce the XC60 mid-size SUV and introduce a next-generation hybrid for the U.S. market stands out. This move is particularly relevant as it supports Volvo’s strategy to address tariff risks, localize production, and tap into U.S. consumer demand, potentially mitigating the impact of trade barriers on its global volume ambitions.

Yet, in contrast, investors should also be aware that weaker sales recovery in Europe could delay the turnaround in earnings and cash flow...

Read the full narrative on Volvo Car AB (publ.) (it's free!)

Volvo Car AB (publ.) is projected to reach SEK 413.0 billion in revenue and SEK 17.7 billion in earnings by 2028. This outlook assumes a 2.7% annual revenue growth rate and an increase in earnings of SEK 17.3 billion from the current SEK 403.0 million.

Uncover how Volvo Car AB (publ.)'s forecasts yield a SEK17.76 fair value, a 17% downside to its current price.

Exploring Other Perspectives

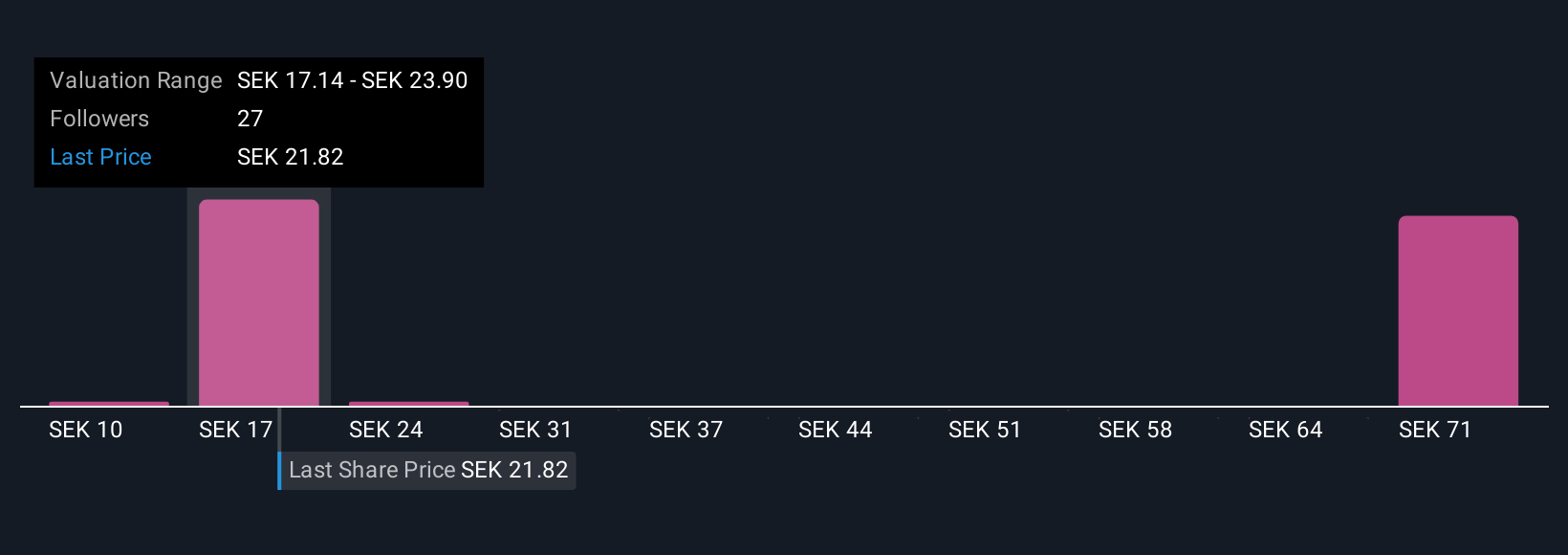

The Simply Wall St Community’s 13 fair value estimates for Volvo Car AB span from SEK10.38 to SEK61.67, showing opinions from deep value to high growth. However, the recent pressure from slower European electrified demand could weigh on market performance even if optimism holds in other regions.

Explore 13 other fair value estimates on Volvo Car AB (publ.) - why the stock might be worth over 2x more than the current price!

Build Your Own Volvo Car AB (publ.) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Volvo Car AB (publ.) research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Volvo Car AB (publ.) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Volvo Car AB (publ.)'s overall financial health at a glance.

No Opportunity In Volvo Car AB (publ.)?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, markets, and sells cars in Sweden and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives