Market Might Still Lack Some Conviction On Nilsson Special Vehicles AB (publ) (STO:NILS) Even After 38% Share Price Boost

Nilsson Special Vehicles AB (publ) (STO:NILS) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 82%.

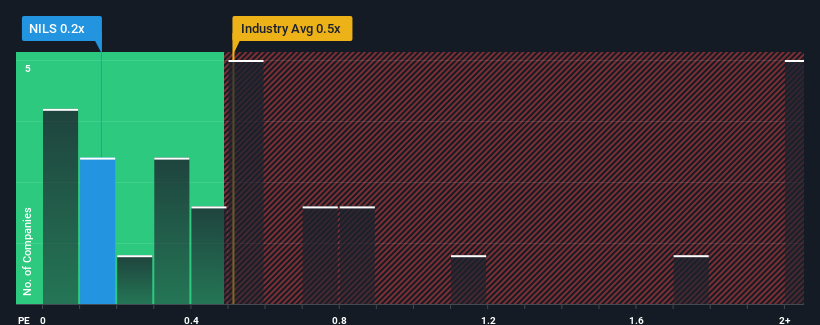

Although its price has surged higher, there still wouldn't be many who think Nilsson Special Vehicles' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Sweden's Auto industry is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Nilsson Special Vehicles

What Does Nilsson Special Vehicles' Recent Performance Look Like?

Revenue has risen firmly for Nilsson Special Vehicles recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nilsson Special Vehicles will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Nilsson Special Vehicles?

The only time you'd be comfortable seeing a P/S like Nilsson Special Vehicles' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 52% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 0.9% shows it's noticeably more attractive.

With this information, we find it interesting that Nilsson Special Vehicles is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Nilsson Special Vehicles' P/S?

Nilsson Special Vehicles appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We didn't quite envision Nilsson Special Vehicles' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Having said that, be aware Nilsson Special Vehicles is showing 2 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If these risks are making you reconsider your opinion on Nilsson Special Vehicles, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nilsson Special Vehicles might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:NILS

Nilsson Special Vehicles

Produces and sells ambulances, limousines, hearses, and other vehicles.

Low and slightly overvalued.

Market Insights

Community Narratives