- Sweden

- /

- Specialty Stores

- /

- OM:HM B

Swedish Value Stocks Trading Below Estimated Worth In October 2024

Reviewed by Simply Wall St

As global markets grapple with escalating Middle East tensions and fluctuating oil prices, European indices have experienced notable declines, including Sweden's market. Amid this uncertainty, identifying stocks trading below their estimated worth can present potential opportunities for investors seeking value in a volatile environment.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CTT Systems (OM:CTT) | SEK268.00 | SEK492.60 | 45.6% |

| Concentric (OM:COIC) | SEK215.50 | SEK405.91 | 46.9% |

| Lindab International (OM:LIAB) | SEK276.80 | SEK528.70 | 47.6% |

| Nolato (OM:NOLA B) | SEK51.80 | SEK98.82 | 47.6% |

| Dometic Group (OM:DOM) | SEK58.50 | SEK106.83 | 45.2% |

| Tourn International (OM:TOURN) | SEK8.40 | SEK16.46 | 49% |

| Mentice (OM:MNTC) | SEK27.00 | SEK50.97 | 47% |

| Nexam Chemical Holding (OM:NEXAM) | SEK4.12 | SEK7.93 | 48% |

| MilDef Group (OM:MILDEF) | SEK85.00 | SEK160.40 | 47% |

| Lyko Group (OM:LYKO A) | SEK119.20 | SEK217.51 | 45.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Dometic Group (OM:DOM)

Overview: Dometic Group AB (publ) offers mobile living solutions focusing on food and beverage, climate, power and control, among other applications, with a market cap of approximately SEK18.69 billion.

Operations: Dometic Group's revenue segments are comprised of Marine (SEK6.25 billion), Global Ventures (SEK5.88 billion), Land Vehicles APAC (SEK4.52 billion), Land Vehicles EMEA (SEK8.11 billion), and Land Vehicles Americas (SEK5 billion).

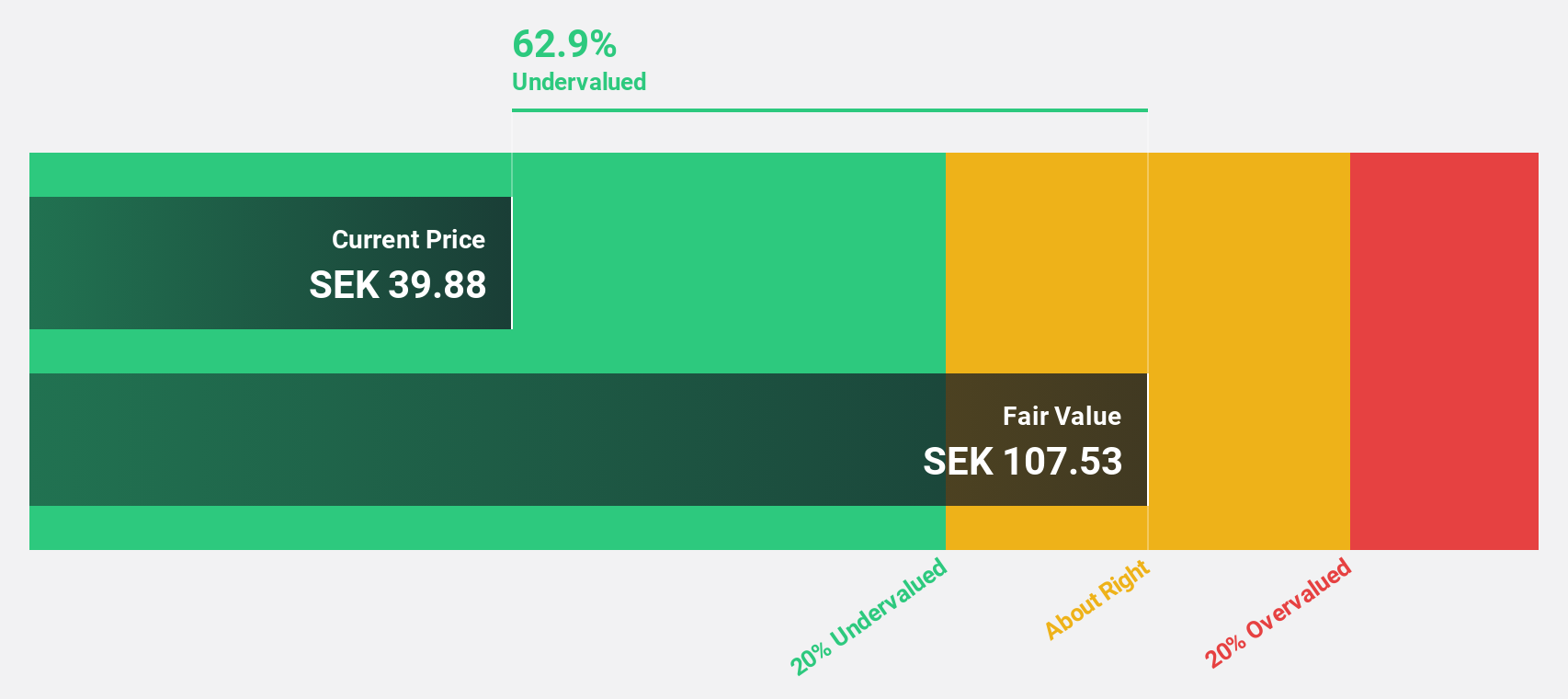

Estimated Discount To Fair Value: 45.2%

Dometic Group appears undervalued, trading at SEK 58.5, significantly below its estimated fair value of SEK 106.83. Despite recent declines in sales and net income for the second quarter of 2024, with sales at SEK 7.66 billion and net income at SEK 443 million, earnings are forecasted to grow by over 25% annually in the coming years. However, high debt levels and an unstable dividend track record may pose risks.

- According our earnings growth report, there's an indication that Dometic Group might be ready to expand.

- Dive into the specifics of Dometic Group here with our thorough financial health report.

H & M Hennes & Mauritz (OM:HM B)

Overview: H & M Hennes & Mauritz AB (publ) is a global retailer offering clothing, accessories, footwear, cosmetics, and homeware for all genders and ages with a market cap of approximately SEK279.83 billion.

Operations: The company's revenue primarily comes from its apparel segment, generating SEK234.94 billion.

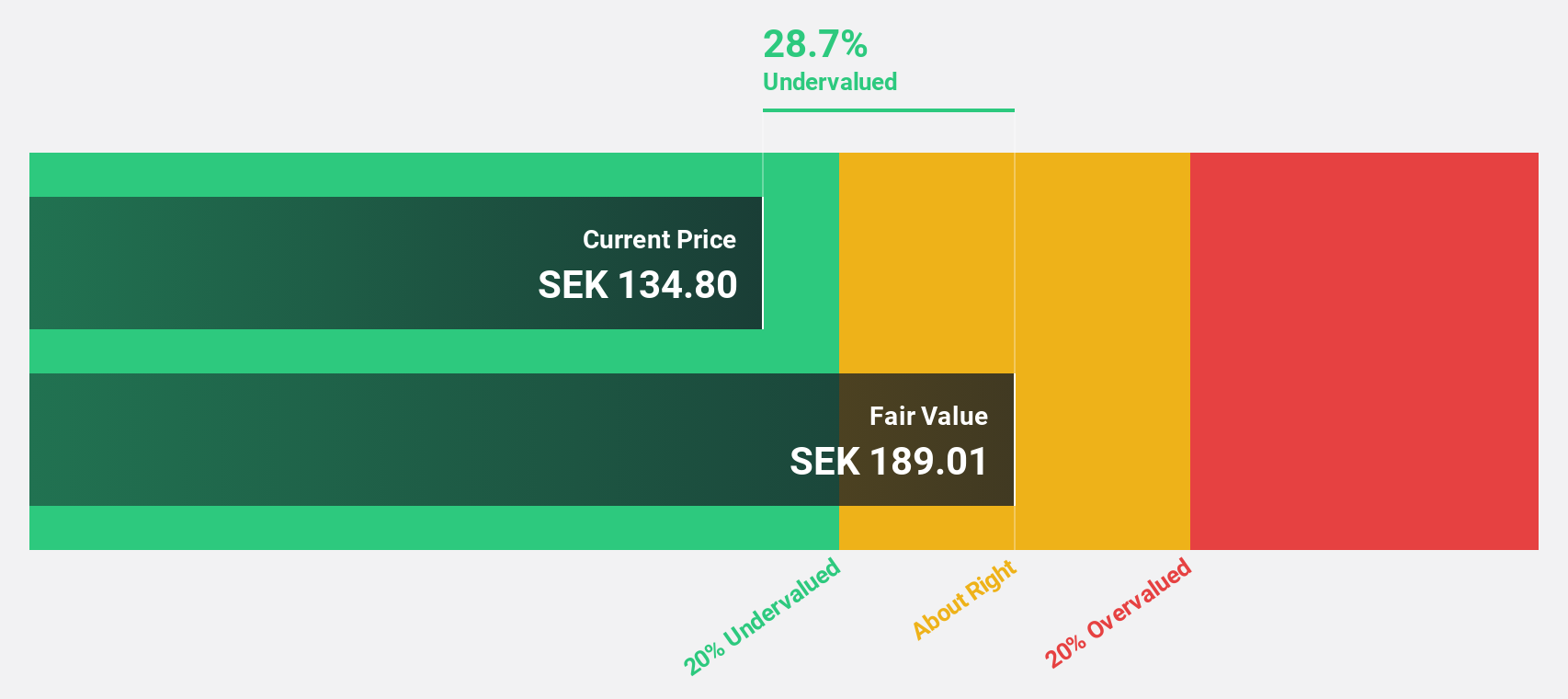

Estimated Discount To Fair Value: 14.7%

H&M is trading at SEK 173.85, below its estimated fair value of SEK 203.92, suggesting potential undervaluation based on cash flows. Despite a recent dip in quarterly sales and net income, H&M's earnings grew by 60.7% over the past year and are forecast to grow annually by 17%, outpacing the Swedish market average of 15.2%. However, its dividend yield of 3.74% is not well covered by earnings, indicating some financial caution is warranted.

- Our growth report here indicates H & M Hennes & Mauritz may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in H & M Hennes & Mauritz's balance sheet health report.

Troax Group (OM:TROAX)

Overview: Troax Group AB (publ) is a company that produces and sells mesh panels across the Nordic region, the United Kingdom, North America, Continental Europe, and internationally, with a market cap of SEK12.57 billion.

Operations: The company's revenue segment consists of mesh panels, generating €270.77 million.

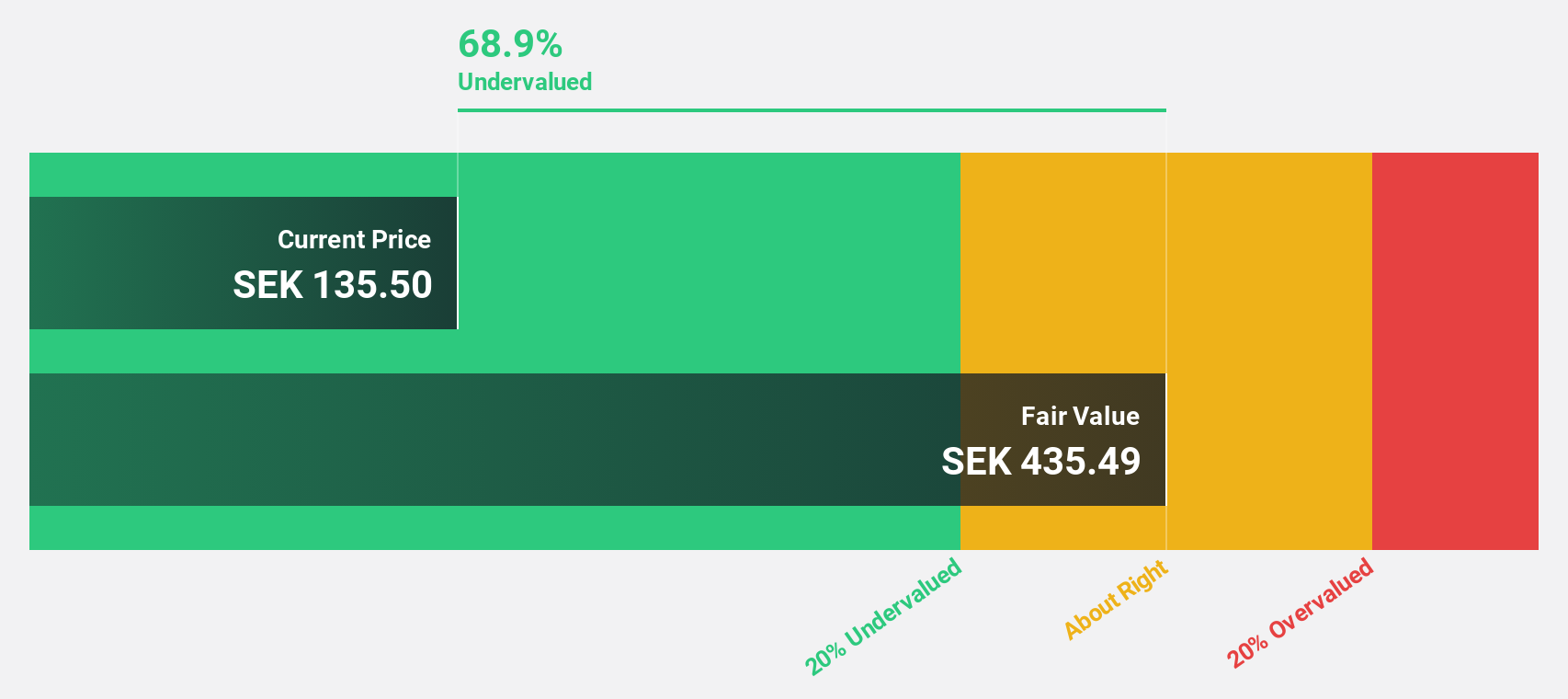

Estimated Discount To Fair Value: 11%

Troax Group is trading at SEK 210, slightly below its estimated fair value of SEK 235.97, indicating potential undervaluation. Earnings are projected to grow significantly at 21.9% annually, outpacing the Swedish market's average growth rate. Recent earnings reports show a decline in net income from EUR 9.1 million to EUR 7.5 million year-over-year for Q2, despite an increase in sales from EUR 68.5 million to EUR 71.9 million, highlighting operational challenges amidst growth prospects.

- Our earnings growth report unveils the potential for significant increases in Troax Group's future results.

- Unlock comprehensive insights into our analysis of Troax Group stock in this financial health report.

Where To Now?

- Explore the 40 names from our Undervalued Swedish Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with solid track record.