- Sweden

- /

- Auto Components

- /

- OM:DOM

Investors in Dometic Group (STO:DOM) from a year ago are still down 50%, even after 15% gain this past week

This week we saw the Dometic Group AB (publ) (STO:DOM) share price climb by 15%. But that isn't much consolation to those who have suffered through the declines of the last year. Like a receding glacier in a warming world, the share price has melted 52% in that period. Some might say the recent bounce is to be expected after such a bad drop. You could argue that the sell-off was too severe.

The recent uptick of 15% could be a positive sign of things to come, so let's take a look at historical fundamentals.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

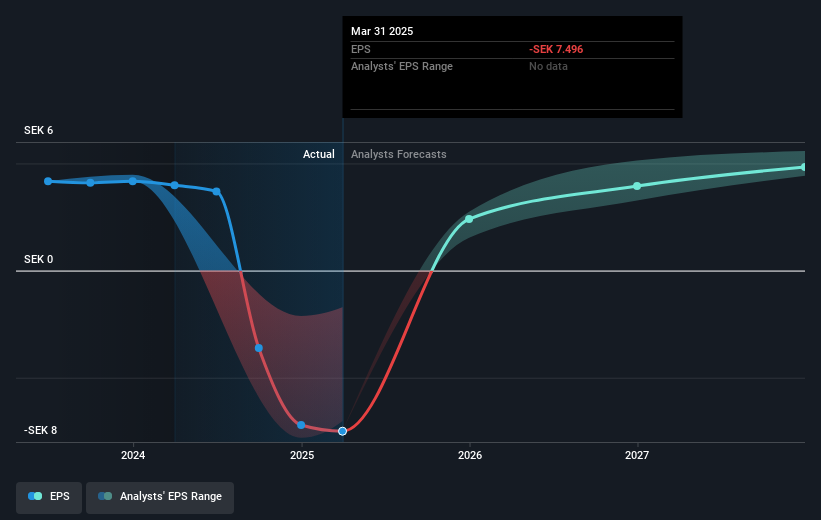

During the last year Dometic Group saw its earnings per share drop below zero. Some investors no doubt dumped the stock as a result. However, there may be an opportunity for investors if the company can recover.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Dometic Group's earnings, revenue and cash flow.

A Different Perspective

Dometic Group shareholders are down 50% for the year (even including dividends), but the market itself is up 0.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Dometic Group has 2 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:DOM

Dometic Group

Provides mobile living solutions for food and beverage, climate, power and control, and other applications in the United States, Germany, Australia, Italy, France, the United Kingdom, Japan, Canada, the Netherlands, Sweden, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives