- China

- /

- Food and Staples Retail

- /

- SZSE:301078

3 Global Stocks That Investors Might Be Undervaluing

Reviewed by Simply Wall St

Amidst a landscape of mixed performances across global markets, with U.S. indices fluctuating due to geopolitical tensions and economic uncertainties, investors are keenly observing opportunities that may arise from such volatility. In this context, identifying undervalued stocks becomes crucial as they can offer potential value when broader market conditions remain uncertain.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shanghai OPM Biosciences (SHSE:688293) | CN¥39.38 | CN¥77.60 | 49.3% |

| PFISTERER Holding (XTRA:PFSE) | €39.50 | €78.15 | 49.5% |

| Livero (TSE:9245) | ¥1700.00 | ¥3386.97 | 49.8% |

| Lingotes Especiales (BME:LGT) | €6.00 | €11.87 | 49.4% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.78 | NZ$1.55 | 49.8% |

| GCH Technology (SHSE:688625) | CN¥30.39 | CN¥60.48 | 49.7% |

| Forum Engineering (TSE:7088) | ¥1204.00 | ¥2380.00 | 49.4% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥21.36 | CN¥42.61 | 49.9% |

| Bloks Group (SEHK:325) | HK$139.50 | HK$278.67 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK209.00 | SEK415.74 | 49.7% |

Let's uncover some gems from our specialized screener.

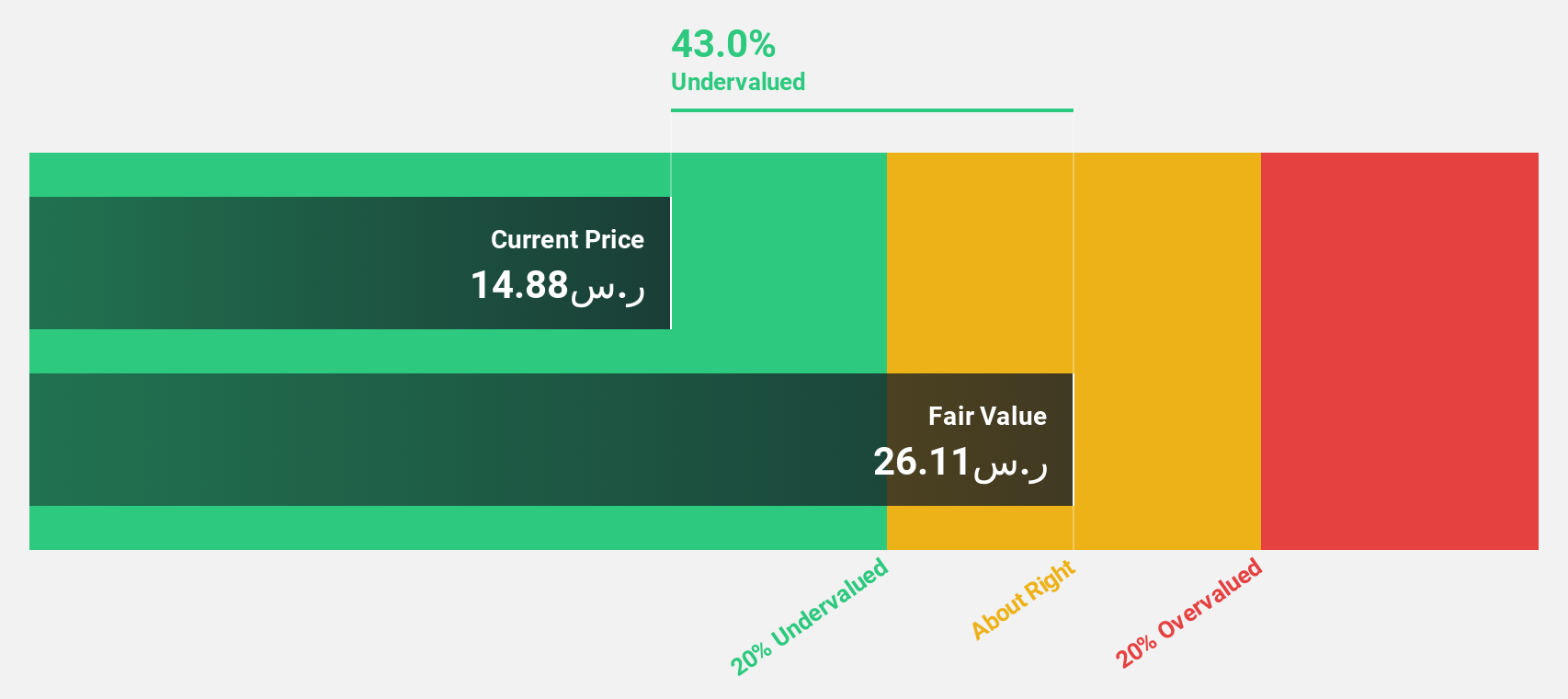

Saudi Electricity (SASE:5110)

Overview: Saudi Electricity Company, along with its subsidiaries, is involved in generating, transmitting, and distributing electricity across the Kingdom of Saudi Arabia and has a market cap of SAR60.25 billion.

Operations: The company's revenue segments include SAR29.01 billion from the National Grid Company, SAR16.51 billion from generation activities, and SAR84.33 billion from distribution and subscriber services in Saudi Arabia.

Estimated Discount To Fair Value: 19.7%

Saudi Electricity Company is trading at SAR 14.46, below its estimated fair value of SAR 18.01, indicating it may be undervalued based on discounted cash flow analysis. Despite high debt levels and a dividend yield of 4.84% not fully covered by earnings or free cash flows, the company reported Q1 sales growth to SAR 19.5 billion and net income of SAR 968 million, reflecting improved financial performance compared to the previous year.

- Our growth report here indicates Saudi Electricity may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Saudi Electricity.

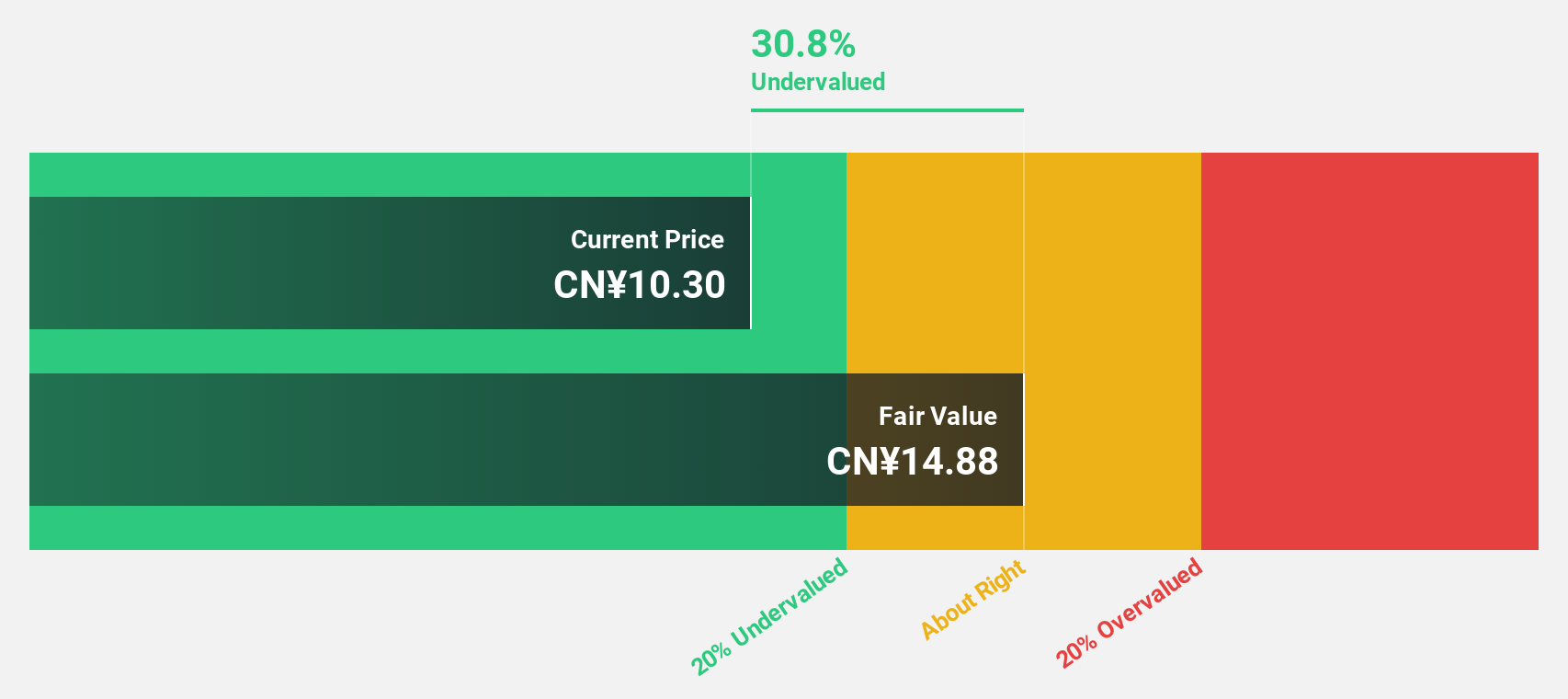

Asian Star Anchor Chain Jiangsu (SHSE:601890)

Overview: Asian Star Anchor Chain Co., Ltd. Jiangsu manufactures and sells anchor chains, marine mooring chains, and related accessories globally, with a market cap of CN¥9.21 billion.

Operations: The company generates revenue primarily from the production and distribution of anchor chains, marine mooring chains, and related accessories on a global scale.

Estimated Discount To Fair Value: 32.1%

Asian Star Anchor Chain Jiangsu, trading at CN¥10.11, is considered undervalued with a fair value estimate of CN¥14.9 based on discounted cash flow analysis. Despite an unstable dividend track record and a recent dividend decrease to CN¥0.10 per share, the company shows promising growth potential with earnings expected to grow significantly at 24.4% annually over the next three years, outpacing market averages in both earnings and revenue growth forecasts.

- Upon reviewing our latest growth report, Asian Star Anchor Chain Jiangsu's projected financial performance appears quite optimistic.

- Take a closer look at Asian Star Anchor Chain Jiangsu's balance sheet health here in our report.

Kidswant Children ProductsLtd (SZSE:301078)

Overview: Kidswant Children Products Co., Ltd. operates in the retail sector, focusing on maternal, infant, and child products in China with a market cap of CN¥16.59 billion.

Operations: The company generates revenue of CN¥9.55 billion from its retail operations in mother and baby products.

Estimated Discount To Fair Value: 24%

Kidswant Children Products Ltd. is trading at CN¥13.44, below its estimated fair value of CN¥17.69, suggesting undervaluation based on discounted cash flow analysis. Despite a volatile share price and an unstable dividend history, the company shows strong growth potential with earnings projected to grow significantly at 36.4% annually over the next three years, surpassing market averages in both revenue and profit growth forecasts. Recent index inclusion may further enhance visibility and investor interest.

- Our comprehensive growth report raises the possibility that Kidswant Children ProductsLtd is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Kidswant Children ProductsLtd stock in this financial health report.

Seize The Opportunity

- Explore the 495 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kidswant Children ProductsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301078

Kidswant Children ProductsLtd

Engages in the retail of maternal, infant, and child products in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives