- South Korea

- /

- Biotech

- /

- KOSDAQ:A214450

Global Insights Into 3 Stocks Possibly Priced Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by global trade tensions and economic uncertainty, major stock indices across the U.S., Europe, and Asia experienced notable declines. Amidst this volatility, investors often seek opportunities in stocks that may be priced below their intrinsic value, offering potential for long-term growth despite short-term market fluctuations. Identifying such stocks requires careful consideration of fundamental factors like earnings performance and market position, especially in an environment where economic indicators are mixed and geopolitical developments continue to impact investor sentiment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥157.18 | CN¥311.26 | 49.5% |

| Sparebank 68° Nord (OB:SB68) | NOK177.00 | NOK349.92 | 49.4% |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥22.79 | CN¥45.51 | 49.9% |

| Libertas 7 (BME:LIB) | €2.96 | €5.87 | 49.6% |

| Insource (TSE:6200) | ¥916.00 | ¥1816.08 | 49.6% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.80 | NZ$1.59 | 49.7% |

| GEM (SZSE:002340) | CN¥6.53 | CN¥12.93 | 49.5% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.381 | €0.75 | 49.5% |

| Devsisters (KOSDAQ:A194480) | ₩46700.00 | ₩93174.89 | 49.9% |

| ams-OSRAM (SWX:AMS) | CHF10.35 | CHF20.67 | 49.9% |

Let's explore several standout options from the results in the screener.

PharmaResearch (KOSDAQ:A214450)

Overview: PharmaResearch Co., Ltd. is a biopharmaceutical company operating mainly in South Korea, with a market capitalization of approximately ₩5.86 trillion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated approximately ₩392.31 billion.

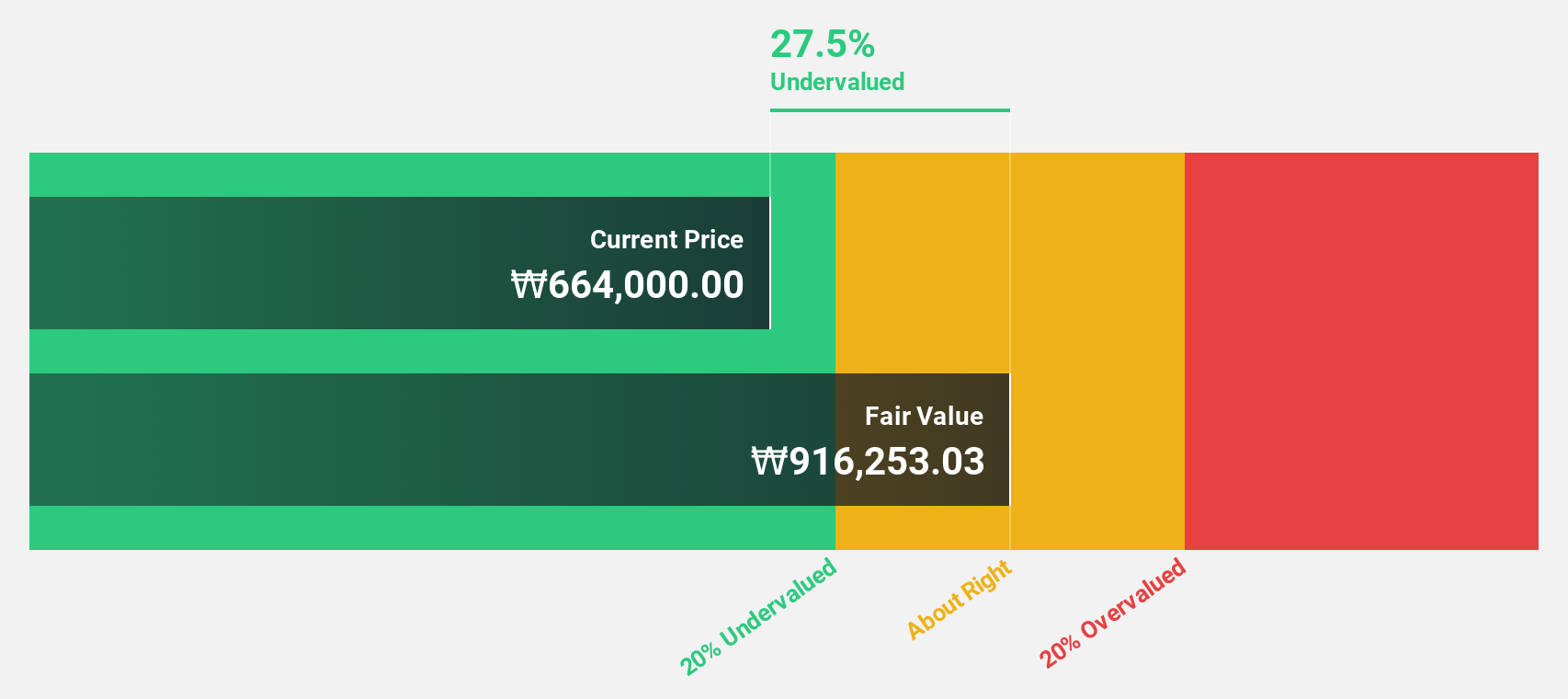

Estimated Discount To Fair Value: 34.7%

PharmaResearch is trading at ₩598,000, significantly below its estimated fair value of ₩916,253.03. The company is forecasted to see robust revenue growth of 27.3% annually and earnings growth of 30.6%, outpacing the KR market's expectations. Despite recent share price volatility, the company's return on equity is projected to be high at 28.3% in three years, supporting its undervaluation based on cash flows and potential for long-term appreciation.

- In light of our recent growth report, it seems possible that PharmaResearch's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of PharmaResearch stock in this financial health report.

ACWA Power (SASE:2082)

Overview: ACWA Power Company, with a market cap of SAR158.16 billion, operates in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants across Saudi Arabia, the Middle East, Asia, and Africa.

Operations: The company's revenue segments include power generation, water desalination, and green hydrogen production across regions such as Saudi Arabia, the Middle East, Asia, and Africa.

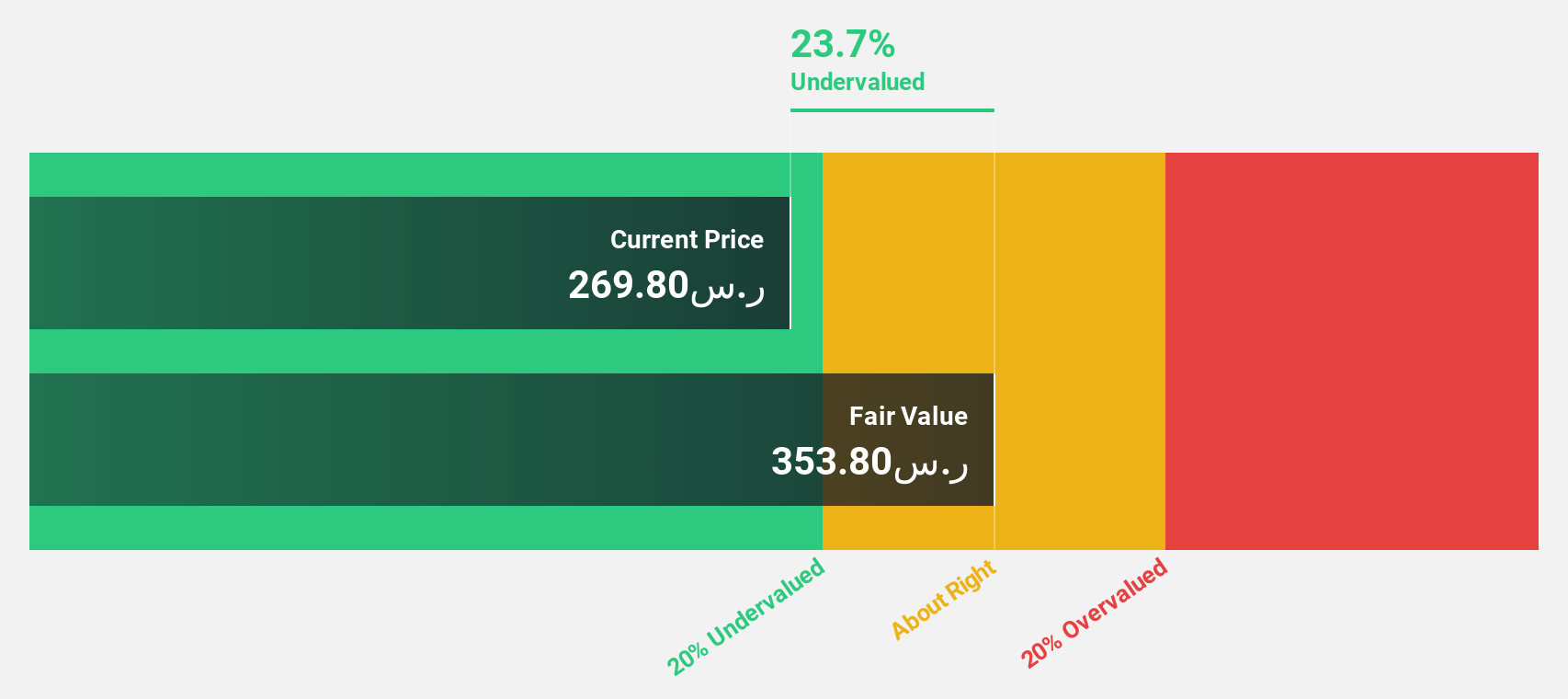

Estimated Discount To Fair Value: 42.7%

ACWA Power's shares, trading at SAR 219, are significantly undervalued compared to the estimated fair value of SAR 382.34. The company is expected to achieve robust revenue growth of 20.3% annually and earnings growth of 24.6%, surpassing the SA market's projections. Despite recent share price volatility and interest payments not being well covered by earnings, strategic alliances in renewable energy projects position ACWA for substantial long-term cash flow potential and expansion in Southeast Asia.

- According our earnings growth report, there's an indication that ACWA Power might be ready to expand.

- Navigate through the intricacies of ACWA Power with our comprehensive financial health report here.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution and utilization systems in China and internationally, with a market cap of CN¥31.93 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd. generates its revenue from the manufacturing and sale of power distribution and utilization systems both domestically in China and internationally.

Estimated Discount To Fair Value: 49.9%

Ningbo Sanxing Medical Electric Ltd. is trading at CN¥22.79, significantly below its estimated fair value of CN¥45.51, indicating it is undervalued based on cash flows. The company forecasts revenue growth of 18% annually, outperforming the Chinese market average. Although earnings growth at 20.1% lags behind the broader market's expectations, its high forecasted return on equity and strong relative value compared to peers highlight potential investment appeal despite a dividend not fully covered by free cash flows.

- Insights from our recent growth report point to a promising forecast for Ningbo Sanxing Medical ElectricLtd's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Ningbo Sanxing Medical ElectricLtd.

Seize The Opportunity

- Unlock our comprehensive list of 486 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214450

PharmaResearch

Operates as a biopharmaceutical company primarily in South Korea.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives