- Saudi Arabia

- /

- Renewable Energy

- /

- SASE:2082

ACWA Power Company (TADAWUL:2082) Shares Slammed 28% But Getting In Cheap Might Be Difficult Regardless

ACWA Power Company (TADAWUL:2082) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 114%.

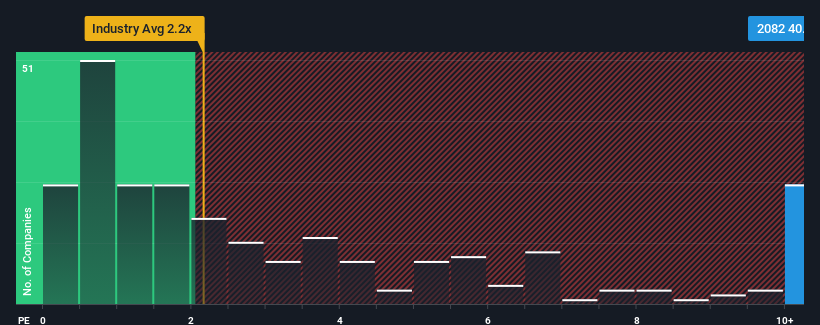

Even after such a large drop in price, when almost half of the companies in Saudi Arabia's Renewable Energy industry have price-to-sales ratios (or "P/S") below 2.2x, you may still consider ACWA Power as a stock not worth researching with its 40.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for ACWA Power

What Does ACWA Power's P/S Mean For Shareholders?

ACWA Power could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ACWA Power.What Are Revenue Growth Metrics Telling Us About The High P/S?

ACWA Power's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. The solid recent performance means it was also able to grow revenue by 20% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 27% as estimated by the five analysts watching the company. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this information, we can see why ACWA Power is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

ACWA Power's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of ACWA Power's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with ACWA Power.

If you're unsure about the strength of ACWA Power's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2082

ACWA Power

Engages in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants in the Kingdom of Saudi Arabia, the Middle East, Asia, and Africa.

High growth potential low.

Similar Companies

Market Insights

Community Narratives