- Saudi Arabia

- /

- Water Utilities

- /

- SASE:2081

Does Alkhorayef Water and Power Technologies (TADAWUL:2081) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Alkhorayef Water and Power Technologies (TADAWUL:2081). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Alkhorayef Water and Power Technologies

Alkhorayef Water and Power Technologies' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Alkhorayef Water and Power Technologies has grown EPS by 8.6% per year. That growth rate is fairly good, assuming the company can keep it up.

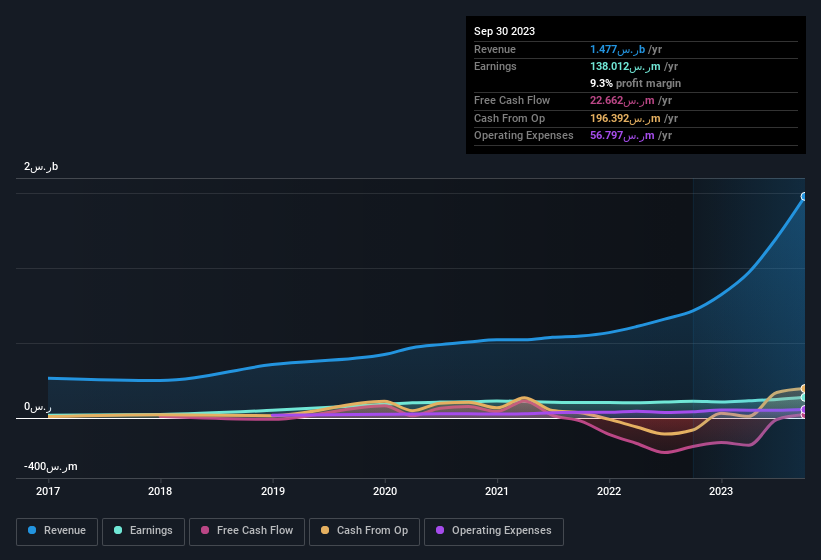

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Alkhorayef Water and Power Technologies has done well over the past year, growing revenue by 107% to ر.س1.5b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Alkhorayef Water and Power Technologies' future profits.

Are Alkhorayef Water and Power Technologies Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Alkhorayef Water and Power Technologies followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Indeed, they hold ر.س167m worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Alkhorayef Water and Power Technologies Deserve A Spot On Your Watchlist?

One important encouraging feature of Alkhorayef Water and Power Technologies is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. You still need to take note of risks, for example - Alkhorayef Water and Power Technologies has 2 warning signs we think you should be aware of.

Although Alkhorayef Water and Power Technologies certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Saudi companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2081

Alkhorayef Water and Power Technologies

Designs, constructs, operates, maintains, and manages water and wastewater projects in Saudi Arabia.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026